Life & Health reinsurance

| Key figures for Life & Health reinsurance | ||||||

| in EUR million | 2014 | +/ - previous year | 2013 | 20121 | 2011 | 2010 |

|---|---|---|---|---|---|---|

| Gross written premium | 6,458.7 | +5.1% | 6,145.4 | 6,057.9 | 5,270.1 | 5,090.1 |

| Net premium earned | 5,411.4 | +1.0% | 5,359.8 | 5,425.6 | 4,788.9 | 4,653.9 |

| Investment income | 614.2 | +0.4% | 611.5 | 685.1 | 512.6 | 508.2 |

| Claims and claims expenses | 4,636.2 | +7.7% | 4,305.7 | 4,023.5 | 3,328.6 | 3,135.8 |

| Change in benefit reserve | 28.6 | –80.5% | 146.5 | 529.4 | 619.7 | 653.5 |

| Commissions | 946.4 | –19.0% | 1,169.0 | 1,098.0 | 985.8 | 1,022.8 |

| Own administrative expenses | 175.7 | +12.1% | 156.7 | 144.1 | 130.6 | 118.7 |

| Other income/expenses | 25.1 | (42.9) | (36.7) | (19.2) | 53.0 | |

| Operating result (EBIT) | 263.8 | +75.3% | 150.5 | 279.0 | 217.6 | 284.4 |

| Net income after tax | 205.0 | +24.8% | 164.2 | 222.5 | 182.3 | 219.6 |

| Earnings per share in EUR | 1.70 | +24.8% | 1.36 | 1.84 | 1.51 | 1.82 |

| Retention | 83.9% | 87.7% | 89.3% | 91.0% | 91.7% | |

| EBIT margin 2 | 4.9% | 2.8% | 5.1% | 4.5% | 6.1% | |

| 1 Adjusted pursuant to IAS 8 2 Operating result (EBIT) / net premium earned |

||||||

Our strategic business group of Life & Health reinsurance accounted for 45% (previous year: 44%) of Group gross premium in the financial year just ended. This clearly shows the significant role played by these lines in Hannover Re’s overall portfolio. Thanks to partnership-based business relationships with our customers, our expertise and our worldwide presence, we not only identify trends and new markets; we also shape them and generate sustained, profitable growth.

Total business

The international market climate in life and health reinsurance was influenced by a number of different effects in the reporting period just ended. In mature insurance markets such as the United States, Germany, the United Kingdom, France and Scandinavia the pressure on companies to consolidate increased. The strained state of capital and financial markets was also a factor in the generally moderate development of routine business in these regions. Turning to the major emerging and growth markets, the implementation of regulatory measures has been – and continues to be – stepped up, thereby increasingly opening up fresh business opportunities. This is especially evident in Asia. The growing prevalence of regulatory changes consistently poses new challenges for the entire international insurance sector. In many instances established product solutions have to be reworked or even entirely redesigned in order to satisfy the new requirements for all parties concerned. With this in mind, the development of Hannover Re’s life and health reinsurance business was very pleasing.

Our gross premium income for the year under review totalled EUR 6,458.7 million (EUR 6,145.4 million). This represents an increase of 5.1%. With growth of 4.9% adjusted for exchange rate fluctuations, we almost achieved the anticipated currency-adjusted gross premium growth of 5% to 7%. The level of retained premium developed as planned in the financial year just ended to stand at 83.9% (87.7%). Net premium improved slightly by 1.0% to EUR 5,411.4 million (EUR 5,359.8 million). Adjusted for exchange rate effects, the change in net premium would have been 0.7%.

Investment income in life and health reinsurance consists of two earnings components: on the one hand, from our assets under own management and, secondly, from securities deposited with ceding companies. In the financial year just ended income of EUR 258.5 million (EUR 269.1 million) was generated from the assets under own management, while the income from securities deposited with ceding companies came in at EUR 355.7 million (EUR 342.4 million). Taken together, the investment income in life and health reinsurance climbed by a modest 0.4% to EUR 614.2 million (EUR 611.5 million). This performance is especially gratifying in view of the protracted low level of interest rates and the correspondingly strained state of capital markets.

The development of the operating result (EBIT) was highly pleasing. Compared to the previous year – which had been substantially impacted by losses in Australian disability business – EBIT surged by a significant 75.3% and has now normalised relative to 2013 at EUR 263.8 million (EUR 150.5 million).

In the following section we discuss in detail developments in life and health reinsurance. Our business is split into the reporting categories of financial solutions and risk solutions. Reflecting the differentiation by biometric risks, risk solutions is further divided into longevity, mortality and morbidity and hence corresponds to the breakdown used within our internal risk management system.

Financial solutions

We categorise reinsurance solutions that focus on our clients’ capital and liquidity management and thereby assist them with – among other things – new business financing and / or help to optimise their capital or solvency structure as financial solutions. There is less emphasis on the transfer of biometric risks with this form of reinsurance, although it is always present.

Hannover Re is equipped with long-standing expertise in the financial solutions business segment and ranks as one of the leading providers in a number of markets, including the United States. A special hallmark of our business philosophy is that we make virtually no use of standardised reinsurance solutions. Particularly when it comes to financial solutions transactions, we offer financing solutions as well as concepts designed to provide relief for capital and reserves that are individually tailored to our customers’ needs. This has enabled us to further enlarge our portfolio and generate a pleasing profit contribution. The rigorous and complex supervisory requirements in the US insurance market, which is one of the most highly developed in the world, are the key factor driving the stable strong demand for financial solutions and the pleasing development of this business segment. In addition, we again significantly expanded our financial solutions business in Asia – most notably in Japan and China. Not only that, we are also enjoying successes on the African continent, where we assumed a substantial portfolio of life insurance policies from a leading South African client. Traditional new business financing arrangements in Europe – including Southern and Eastern Europe – were another key driver of this segment in the reporting period just ended. We benefited here from lively demand for individual, innovative financing solutions.

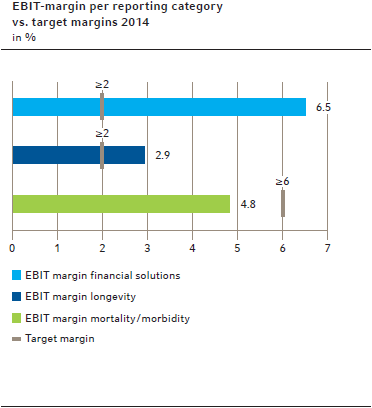

All in all, against the backdrop of the developments described above, gross premium contracted by 16.7% owing to a strictly profit-oriented underwriting policy. We deliberately relinquished premium volume in cases where we were unable to fully satisfy our margin requirements. The gross premium for the year under review amounted to EUR 1,295.2 million (EUR 1,554.3 million), equivalent to 20.1% of the total gross premium income booked in life and health reinsurance. The operating result (EBIT) of EUR 74.6 million fell well short of the previous year’s figure (EUR 128.5 million).

Longevity

Our longevity reporting category encompasses all annuity and pension reinsurance business, insofar as the material risks here are longevity risks. With few exceptions we predominantly cover policies in the pay-out phase.

Our portfolio consists principally of enhanced annuities on a single premium basis as well as large-volume annuity blocks with regular premium payments, in return for which we take over the annuity payments that will become due in the future. In the United Kingdom, which continues to be our largest longevity market by premium volume, demand has become more selective and competition more intense. Thanks to our market leadership, our decades of experience and our extensive database, we are well positioned and were able to act on profitable business opportunities despite growing competition. In the financial year just ended, reflecting the global demographic trend, we received an increased number of specific inquiries concerning the transfer of longevity portfolios outside the United Kingdom. Our international know-how was evidenced by our closing of the first reinsurance treaty for longevity risks in France. Under this transaction we assumed pension liabilities in the order of EUR 750 million from a leading French insurer.

In the European market Solvency II-oriented covers are a particular focus of interest. In the US market new, far more conservative assumptions relating to mortality improvement have been published, adding impetus to the local longevity market. Notwithstanding the general demand for longevity products in various regions of the world, we have observed increased demand for reinsurance solutions in which the cash flows are geared to the performance of a contractually defined index. In view of this broad range of favourable developments, we were able to boost our gross premium for international longevity business to a pleasing EUR 1,012.0 million (EUR 884.7 million). This increase was carried over in a corresponding profit contribution (EBIT) of EUR 23.7 million (-EUR 17.2 million).

Mortality and morbidity

In the following section we present a consolidated account of the mortality and morbidity reporting categories. In view of the fact that in the international (re)insurance markets these two risk types are frequently covered as part of the same business relationship or even under the same reinsurance treaty, it makes sense to consider them together.

Mortality

The mortality reporting category encompasses our mortality-exposed business, which traditionally constitutes the core business of life and health reinsurance and accounts for the largest share of our total life and health reinsurance portfolio. The risk that we assume as a reinsurer is that the actually observed mortality may diverge negatively from the expected mortality. The US mortality market ranks as one of our most important markets. We are present here with our subsidiary and have been an established and sought-after business partner for more than 30 years.

Our new business in the US developed broadly as we had anticipated. The positive performance of large parts of our existing business was cancelled out by elevated risk experiences in the in-force portfolio covering policies from before 2005. On balance, this business fell somewhat short of our expectations.

In the European market the appeal of traditional, fixed-income risk-oriented products such as life insurance has further diminished owing to the low interest rate environment. Particularly for the German reinsurance market, growth in the area of mortality-exposed risk solutions remains limited. The development in Southern Europe, where mortality business has remained on a consistently high level despite the generally strained economic situation, should therefore be viewed in a correspondingly favourable light. The high quality of bancassurance and credit life business in Italy goes hand in hand with the prudent approach to lending adopted by banks since the outbreak of the financial crisis. Sharia-compliant retakaful reinsurance, an area in which we have further expanded our portfolio and our market leadership, also continued to fare well. Similarly, in Eastern Europe and Asia we achieved a pleasing enlargement of our mortality business in the reporting period just ended. Particularly in certain Latin American countries, the basic conditions for writing reinsurance business have become more challenging due to the exertion of political influence. Nevertheless, we succeeded in boosting our business to a gratifying extent and maintained our leading position in most countries. We were thus able to increase the gross premium for our worldwide mortality business to EUR 2,949.5 million (EUR 2,833.5 million). At 45.7%, the mortality portfolio consequently contributes the lion’s share of our total gross premium income from life and health reinsurance (EUR 6.5 billion).

Morbidity

Morbidity business refers to the risk of deterioration in a person’s state of health due to disease, injury or infirmity. This reporting category is notable for extensive product diversity, ranging from strict (any occupation) disability and occupational disability to long-term care insurance.

On the whole, morbidity business normalised in 2014 after the adverse impacts of Australian disability risks in the previous year. The intensive efforts undertaken market-wide to counteract the elevated risk experiences brought about the first positive movements: it will, however, likely taken further time before the underlying treaties deliver consistently profitable results. It is nevertheless gratifying to note the reversal of the unfavourable trend, which suggests the onset of an encouraging upswing in results going forward. Other regions of the world, for the most part, are meanwhile playing a positive part in the growth of morbidity business. In the Netherlands, for example, we have assumed appreciable premium volumes under disability risk coverage. Demand for disability policies was similarly strong in Asian markets. In Korea we recorded poorer than anticipated risk experiences for our assumed morbidity business. The general rise in demand for long-term rate guarantees for such risks therefore necessitates a more selective underwriting policy. In the Indian market the growth of microinsurance business in the health insurance sector was very pleasing. These developments are reflected in highly gratifying premium growth of 37.7%. Gross premium income in the financial year surged sharply to EUR 1,202.1 million (EUR 872.9 million).

Taken together, we generated significant growth in the operating result for the reporting categories of mortality and morbidity: EBIT rose to EUR 165.5 million (EUR 39.2 million).

Quite aside from the development of business in the various reporting categories of our Life & Health reinsurance business group, there were further pleasing developments to note: the service component – as in many other sectors too – is taking on ever greater importance. We are actively responding to this trend and successfully supported our customers in the year under review with, among other things, our expertise in the field of automated underwriting. When it comes to medical underwriting, our newly launched newsletter “ReCent” puts the spotlight on current and relevant topics in health and medicine. In addition, our customers are benefiting from a revision of our underwriting manual, which assists primary insurers with risk assessment. We have also made promising progress in the development of alternative, Web-based sales channels in life insurance, the first positive effects of which on our business should be felt in the next few years. Issues such as “big data”, the use of information and technological advances continue to be of growing interest to the (re)insurance industry.

More Information

Topic related links within the report:

Topic related links outside the report: