Major external factors influencing risk management in the financial year just ended

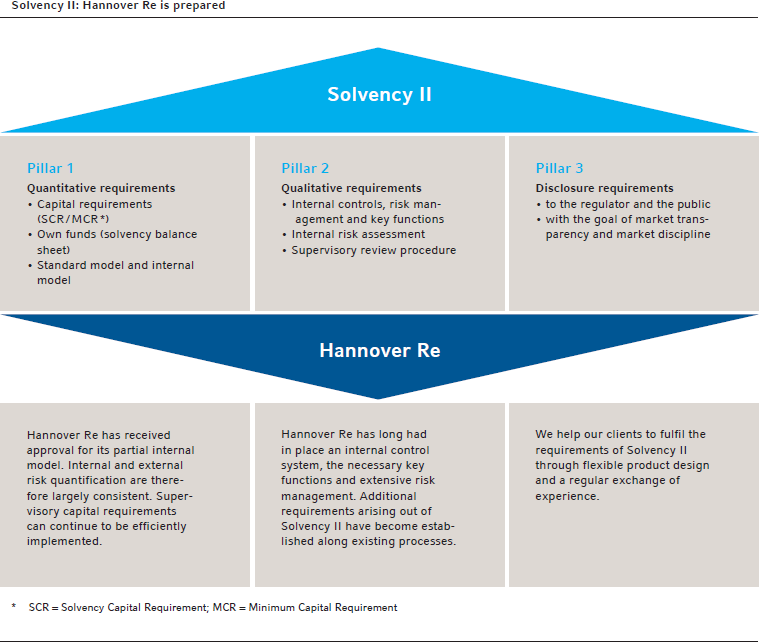

Regulatory developments: Further more concrete aspects of Solvency II were defined in the 2015 financial year, including the decision by lawmakers to adopt a revised version of the Insurance Supervision Act with effect from 1 January 2016 and thereby translate European standards into national law. The Hannover Re Group has systematically implemented all requirements to date. Following intensive preparations the Hannover Re Group received approval to calculate its solvency requirements using its internal model when Solvency II comes into effect. The approved model covers the underwriting, market and counterparty default risks that are most relevant to enterprise management. Our internal model enables us to optimally map the risk structure of our reinsurance business and our investments, which would not be possible using a standard model. Regulatory approval also means that the risks can be better reflected when determining the regulatory capital requirements. Our internal target capitalisation with a confidence level of 99.97% comfortably exceeds the target level of 99.5% under Solvency II, thereby ensuring a comfortable level of capital adequacy under Solvency II if the internal target is achieved.

The core functions of Solvency II – the risk management function, the actuarial function, the compliance function and the internal audit function – have been implemented. In fulfilling the new supervisory requirements for core functions, we were able to build on existing processes and organisational structures. In 2015 we comprehensively fulfilled the supervisory reporting requirements during the preparatory phase for Solvency II, inter alia by compiling a Regular Supervisory Report (RSR) and a report on the Own Risk and Solvency Assessment (ORSA) for Hannover Rück SE and other European insurance companies within the Group.

Parallel to the regulatory developments in Europe, we are seeing adjustments worldwide to the regulation of (re)insurance undertakings. It is often the case that various local supervisory authorities take their lead from the principles of Solvency II or the requirements set out by the International Association of Insurance Supervisors (IAIS).

Capital market environment: Another major external influencing factor is the protracted low level of interest rates, especially with an eye to the return on our investments. For further information please see the “Investments” section of the management report.

More Information

Topic related links within the report:

Topic related links outside the report: