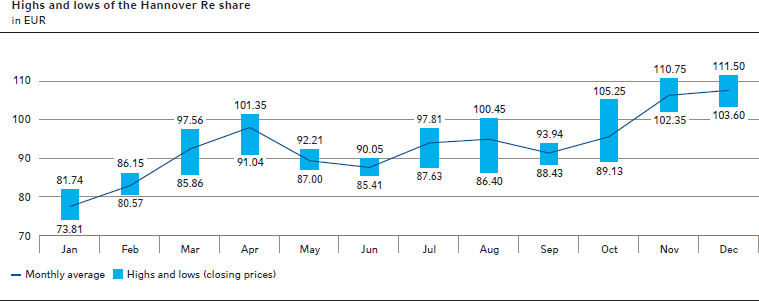

Hannover Re share reaches new all-time high of EUR 111.50

The Hannover Re share had started 2015 at a price of EUR 74.97 and was to slip to its lowest point of the year after just five days at EUR 73.81. In the spring, supported by broadly positive market sentiment and the unveiling of another record result for the financial year just ended, the share posted steady price gains and passed the EUR 100 mark for the first time on 10 April 2015. In the course of the following summer months until autumn the share was unable to divorce itself from the general sense of uncertainty prevailing on the markets, leading to a volatile performance with a number of setbacks. The sustained competitive intensity on reinsurance markets and the associated news on the renewals in property and casualty reinsurance – with corresponding rate erosion – had a detrimental impact on the share valuation. At the same time, a major loss experience that remained well below expectations and pleasing Group net income for the first half-year generated positive demand on the stock market. In times of low capital market rates investors increasingly looked at the Hannover Re share – and especially its attractive dividend yield – in 2015. In the fourth quarter the share moved higher, touching its highest point of the year – and new all-time high – of EUR 111.50 on 2 December 2015. This performance was supported primarily by the expectation that Hannover Re would post another very favourable Group result for 2015. This assumption was based on the insight that thanks to its comfortable capital resources, prudently calculated loss reserves and very good market position as a broadly diversified reinsurer, Hannover Re should be able to deliver good results even in the prevailing competitive market climate and hence again set a higher payout ratio for the dividend distribution in the year under review. The Hannover Re share closed the financial year with a gain of 40.9% at EUR 105.65 and thus recorded a performance of 47.8% including reinvested dividends. Over the year the Hannover Re share comfortably outperformed its benchmark indices, namely the DAX (+9.6%), MDAX (+22.7%) and the Global Reinsurance (Performance) Index (+22.5%). The Global Reinsurance Index tracks the share performance and dividend payments of the world’s 20 largest reinsurers. Hannover Re measures its performance by this benchmark index.

In a three-year comparison the Hannover Re share delivered a performance (including reinvested dividends) of 106.4%. It therefore once again clearly outperformed the DAX (41.1%) and MDAX (74.4%) and the Global Reinsurance Index (92.6%) benchmark indices.

Based on the year-end closing price of EUR 105.65, the market capitalisation of the Hannover Re Group totalled EUR 12.7 billion at the end of the 2015 financial year, an increase of EUR 3.7 billion or 40.9% compared to the previous year’s figure of EUR 9.0 billion. According to the rankings drawn up by Deutsche Börse AG, the company placed seventh in the MDAX at the end of December with a free float market capitalisation of EUR 6,484.2 million and a trading volume of EUR 4,748.7 million over the past twelve months. All in all, the Hannover Re Group thus continues to rank among the 40 largest listed companies in Germany.

With a book value per share of EUR 66.90 the Hannover Re share showed a price-to-book (P/B) ratio of 1.58 at the end of the year under review; compared to the average MDAX P/B ratio of 2.44 as at year-end the share thus continues to be very moderately valued.

More Information

Topic related links within the report:

- Share data

- Figures

- Statement of changes in shareholders’ equity

- 8.5 Earnings per share and dividend proposal

Topic related links outside the report: