Life & Health reinsurance

| Key figures for Life & Health reinsurance | ||||||

| in EUR million | 2015 | +/ - previous year | 2014 | 2013 | 20121 | 2011 |

|---|---|---|---|---|---|---|

| Gross written premium | 7,730.9 | +19.7% | 6,458.7 | 6,145.4 | 6,057.9 | 5,270.1 |

| Net premium earned | 6,492.4 | +20.0% | 5,411.4 | 5,359.8 | 5,425.6 | 4,788.9 |

| Investment income | 709.2 | +15.5% | 614.2 | 611.5 | 685.1 | 512.6 |

| Claims and claims expenses | 5,459.0 | +17.7% | 4,636.2 | 4,305.7 | 4,023.5 | 3,328.6 |

| Change in benefit reserve | 101.1 | 28.6 | 146.5 | 529.4 | 619.7 | |

| Commissions | 1,075.1 | +13.6% | 946.4 | 1,169.0 | 1,098.0 | 985.8 |

| Own administrative expenses | 197.3 | +12.3% | 175.7 | 156.7 | 144.1 | 130.6 |

| Other income/expenses | 35.9 | +43.1% | 25.1 | (42.9) | (36.7) | (19.2) |

| Operating result (EBIT) | 405.1 | +53.6% | 263.8 | 150.5 | 279.0 | 217.6 |

| Net income after tax | 289.6 | +41.3% | 205.0 | 164.2 | 222.5 | 182.3 |

| Earnings per share in EUR | 2.40 | +41.3% | 1.70 | 1.36 | 1.84 | 1.51 |

| Retention | 84.2% | 83.9% | 87.7% | 89.3% | 91.0% | |

| EBIT margin2 | 6.2% | 4.9% | 2.8% | 5.1% | 4.5% | |

| 1 Adjusted pursuant to IAS 8 2 Operating result (EBIT)/net premium earned |

||||||

Life and health reinsurance accounted for 45% of Group gross premium in the financial year just ended. It has evolved into a core strategic business group of the Hannover Re Group and thus plays a key part in the company’s success. On the basis of our long-standing, partnership-based business relationships with our customers, our expertise and our worldwide presence, we operate directly in the international arena – not only identifying but also actively helping to shape trends and new markets. In so doing, we never lose our focus on profitability.

Total business

The performance of life and health reinsurance was at times volatile in the individual quarters of the financial year just ended. This was due to, among other things, differing developments in the various markets.

Preparations for the implementation of Solvency II at the beginning of the 2016 financial year dominated the insurance industry in Europe. Insurance companies were heavily preoccupied with the future capital and reporting requirements. In this connection, working together with our primary insurance customers, we have already identified various means of bringing about an optimal capital and solvency situation. Another significant move in the reporting period just ended was the entry into the Canadian life reinsurance market with the establishment of a branch in that country. Along with opening up new business opportunities, this will help to further diversify our portfolio. Asian as well as Central and Eastern European markets are exhibiting stronger interest in automated underwriting systems and innovative life insurance concepts.

Overall, the development of the year under review was thoroughly satisfactory. We booked gross premium income for the financial year just ended of EUR 7,730.9 million (previous year: EUR 6,458.7 million). This represents an increase of 19.7%. Adjusted for exchange rate fluctuations, growth came in at 9.5%. We thus comfortably beat the comparable growth target for gross premium of 5% to 7%. The level of retained premium also developed as planned and amounted to 84.2% (83.9%). Net premium totalled EUR 6,492.4 million (EUR 5,411.4 million). Adjusted for exchange rate effects, growth would have reached 10.0%.

Investment income in life and health reinsurance amounted to EUR 709.2 million (EUR 614.2 million). The investment income derives, on the one hand, from our assets under own management and, secondly, from securities deposited with ceding companies. In the financial year just ended income of EUR 334.3 million (EUR 258.5 million) was generated from the assets under own management, while income from securities deposited with ceding companies came in at EUR 374.9 million (EUR 355.7 million). The modest increase in the investment income should be viewed particularly favourably in light of the unchanged low level of interest rates and is a testament to a solid investment strategy.

The operating result (EBIT) in life and health reinsurance reached a very pleasing level of EUR 405.1 million (EUR 263.8 million). The increased result was boosted by the gratifying development of financial solutions business. Overall, the very good underlying profitability was influenced on the one hand by positive special effects, including for example the early termination of a contract in the first quarter of 2015 in an amount of EUR 39.0 million. Negative one-off effects also played a part, however, as was the case at our branch in France. Against this backdrop, Group net income for life and health reinsurance increased by 41.3% to EUR 289.6 million (EUR 205.0 million)

In the following sections we discuss developments in life and health reinsurance in greater detail on the basis of our reporting categories. We split our business and the associated reporting into the categories of financial solutions and risk solutions. For the purposes of differentiation by biometric risks, the category of risk solutions is further divided into longevity, mortality and morbidity. This also corresponds to the breakdown used within our internal risk management system.

Financial solutions

Our financial solutions reporting category encompasses reinsurance solutions that focus on the management of our clients’ balance sheets and thereby support them in – among other things – financing new business and optimising their capital or solvency structure. A crucial criterion for allocation to this category is that there is less emphasis on biometric risks with this form of reinsurance, even though they are always present.

Financial solutions business has been a central pillar of our activities for many years. We are equipped with long-standing expertise and current surveys rank us as the leading provider in a number of markets, including for example the United States. A special hallmark of our business philosophy is that we do not fall back on standardised reinsurance solutions. We offer our clients financing solutions and customised concepts designed to provide relief for capital and reserves that are individually tailored to their needs. This approach has stood the test of time and resulted in another exceptionally pleasing profit contribution in the year under review.

US financial solutions business, in particular, again fared thoroughly profitably in the financial year just ended and delivered a positive profit contribution. Along with solutions for capital relief and optimising the solvency situation of our customers in the life insurance market, we extended our business activities in the year under review to the emergent longevity and health reinsurance market and have already completed the first transactions. The underlying profitability of the financial solutions business generated in the United States developed superbly. As a further factor, the investment income was positively influenced on a one-off basis by the cancellation of a financial solutions contract in an amount running into the mid-double-digit millions of US dollars. Australia similarly developed well in the financial year just ended, especially in the area of new business financing, and thereby laid the foundation for the future.

In China the new supervisory regime C-ROSS (China Risk Oriented Solvency System), which was officially adopted on 1 January 2016, left its mark on the (re)insurance market in the financial year just ended. This was because companies were already applying the regulations on a test basis in 2015, hence generating stronger demand for reinsurance concepts to fit the new framework conditions.

In South Africa, too, new supervisory requirements for the (re) insurance industry are on the verge of implementation. Generally speaking, financial solutions business in South Africa and Asia developed positively overall with a pleasing share of new business.

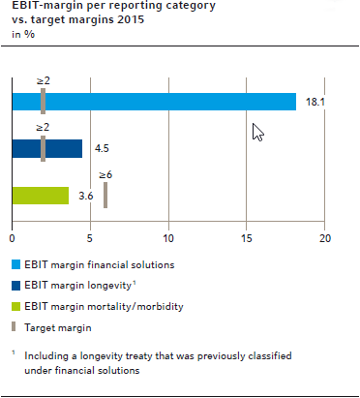

Our activities in the area of financial solutions produced gross premium of EUR 1,271.3 million (EUR 1,295.2 million). This is equivalent to 16.4% of the total gross premium income booked in life and health reinsurance. The operating result (EBIT) amounted to EUR 203.2 million (EUR 74.6 million), a gratifying performance after the comparatively low EBIT reported in 2014. The EBIT margin stood at 18.1% (6.5%).

Longevity

The longevity reporting category encompasses our entire annuity and pension reinsurance business, insofar as the material risk here is the longevity risk. The policies in our portfolio are for the most part already in the pay-out phase.

Our portfolio consists to a large extent of enhanced annuities. These guarantee individuals with a reduced life expectancy a higher regular income for the remainder of their shorter lifespan. The United Kingdom continued to be our largest longevity market by premium volume in the year under review. Although the reform of the UK Pensions Act in April 2015 had a particularly adverse effect on enhanced annuities business, the implications for our premium volume have proven to be considerably less marked than previously anticipated.

The longevity sector throughout the rest of the European market saw unusually brisk activity prompted by the impending implementation of Solvency II. This opened up a broad array of attractive business opportunities for our company, and in volume terms the financial year just ended proved to be the most successful in Hannover Re’s history. This positive development was also crucially reinforced by stronger worldwide demand for longevity solutions. The global demographic trend played a part here, generating further demand around the world for the transfer of longevity portfolios.

The gross premium for worldwide longevity business totalled EUR 1,482.1 million (EUR 1,012.0 million) in the year under review. The operating result (EBIT) amounted to EUR 54.0 million (EUR 23.7 million), while the EBIT margin stood at 4.5% (2.9%).

Mortality and morbidity

In the following section we report on our mortality and morbidity business. In the international (re)insurance markets these two risk types frequently occur together in business relationships and sometimes they are even covered under the same reinsurance treaties. It therefore makes sense to consider the results of both reporting categories on a consolidated basis and merely to give a separate account of the business development.

Mortality

Mortality-exposed business traditionally constitutes the core business of life and health reinsurance. The mortality reporting category accounts for the largest share of our total life and health reinsurance portfolio. The risk that we assume as a reinsurer is that the actually observed mortality may diverge negatively from the expected mortality.

With our subsidiary Hannover Life Reassurance Company of America we have grown into an established and sought-after business partner in our important US mortality market. Business there fell short of our expectations in the year under review. This can be attributed principally to the one-time payout of a very lucrative life insurance policy. In view of the risk experiences observed in a partial portfolio, we stepped up our portfolio maintenance activities with a view to further optimising the development of business going forward. In addition, by restructuring our collateral instruments in September of 2015 we were able to achieve a future annual saving – starting in 2016 – in the low double-digit million euros for this business. The effects of this restructuring were felt pro rata in the year under review. Moreover, working in cooperation with a primary insurance partner, we launched a holistic lifestyle concept in the US market that combines traditional life insurance policies with benefits and rewards in the area of health and wellness.

Looking at the year under review as a whole, our mortality-exposed business in Europe experienced volatility. In Continental Europe stronger demand could be discerned for unit-linked and risk-oriented products. The difficult situation on capital markets, especially when it comes to the protracted low level of interest rates, is driving this trend. In Central European markets and some parts of Northern Europe we similarly observed increased interest in risk-oriented insurance products as well as stronger demand for automated underwriting systems and alternative sales channels in general. This demand was also evident in Asia. In Russia we were able to successfully roll out our proprietary automated underwriting system for the first time on a joint basis with one of our customers. Not only that, in Malaysia we established a sales company for the exclusive online selling of insurance policies.

We were able to further increase the gross premium in the mortality reporting category to EUR 3,561.6 million (EUR 2,949.5 million) in the year under review. At 46.1%, mortality business therefore once again contributed the lion’s share of our total gross premium income from life and health reinsurance (EUR 7.7 billion).

Morbidity

Morbidity business encompasses all business relating to the risk of deterioration in a person’s state of health due to disease, injury or infirmity. The morbidity reporting category is notable for extensive product diversity, ranging from strict (any occupation) disability and occupational disability to numerous varieties of long-term care insurance. We are active in this area as a robust business partner, supporting our customers with our know-how and through risk transfer.

The development of group and health business in the Middle East gave grounds for satisfaction in the year under review. In the United Kingdom, too, our business fared well despite an extremely competitive environment. In Asian markets we noted stronger demand for critical illness covers.

The Australian market recovered appreciably in the financial year just ended, enabling us to slightly enlarge our portfolio in this area. The run-off of Australian disability business was in line with our expectations. Results in the US market were slightly poorer than we had anticipated owing to increased losses. The reform of the health sector there is nevertheless injecting fresh impetus into the market. We expect this to have positive implications for the development of business going forward.

From a global perspective, however, we observed lively demand in the financial year just ended – above all with respect to products for long-term care insurance. Particularly in mature insurance markets with progressively ageing demographics, demand for protection in retirement and in case of illness is growing. Consequently, we were able to boost our premium for worldwide morbidity business by 17.8% to EUR 1,415.9 million (EUR 1,202.1 million).

Taken together, we generated an operating result (EBIT) of EUR 147.8 million (EUR 165.5 million) for the reporting categories of mortality and morbidity in the financial year just ended. This is equivalent to an EBIT margin of 3.6% (4.8%).

Our goal in life and health reinsurance is to offer our customers a broad and individually tailored range of solutions and – in addition to pure risk assumption – to successfully support them in the service sector. In the field of medical underwriting, we strive to highlight – inter alia through our “ReCent” newsletter – current and relevant topics in health and medicine. When it comes to our electronic underwriting manual “Ascent” – which provides our customers with integrated support for individual risk assessment –, we similarly focus on continuous updating and enhancement of the contents in order to adequately reflect the latest market developments and trends at all times. Furthermore, thanks to our international network we are able to quickly and directly transfer novel and innovative reinsurance solutions to other markets.

More Information

Topic related links within the report:

Topic related links outside the report: