Corporate Governance Report

An Overview of Corporate Governance

The Company strives to maintain a high level of corporate governance and has inherited an excellent, prudent and efficient corporate governance style and continuously improves its corporate governance methodology, regulates its operations, improves its internal control mechanism, implements sound corporate governance and disclosure measures, and ensures that the Company’s operations are in line with the longterm interests of the Company and its shareholders as a whole. In 2013, the Shareholders’ General Meeting, the Board and the Supervisory Committee maintained efficient operations in accordance with the operating specifications, and the Company continued to optimise the organisation structure and has achieved a breakthrough in its mechanism innovation, which well supported the Company’s strategic transformation to the Three New Roles – “a Leader of Intelligent Pipeline, a Provider of Integrated Platforms, and a Participant of Content and Application Development”. The Company further optimised its internal control and integrated comprehensive risk management into its operational practice. The sustained enhancement of the Company’s corporate governance ensured alignment with the longterm best interest of shareholders and firmly protected the interests of shareholders.

As a company incorporated in the PRC, the Company adopts the Company Law of the People’s Republic of China, the Securities Law of the People’s Republic of China and other related laws and regulations as the basic guidelines for the Company’s corporate governance. As a company dual-listed in Hong Kong and the United States, the current Articles of Association are in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (“the Listing Rules”) and the regulatory requirements for non-US companies listed in the United States, and these rules serve as guidances for the Company to improve the foundation of its corporate governance. The Company has regularly published statements relating to its internal control in accordance with the US Sarbanes-Oxley Act and the regulatory requirements of the U.S. Securities and Exchange Commission (SEC) and the New York Stock Exchange to confirm its compliance with related financial reporting, information disclosure and corporate internal control requirements.

For the financial year ended 31 December 2013, save that the roles of Chairman and Chief Executive Officer of the Company were performed by the same individual, the Company has been in compliance with all the code provisions under the Corporate Governance Code as set out in Appendix 14 to the Listing Rules. In the Company’s opinion, through supervision by the Board and the Independent Non-executive Directors, and effective control of the Company’s internal check and balance mechanism, the same individual performing the roles of Chairman and Chief Executive Officer can achieve the goal of improving the Company’s efficiency in decision-making and execution and effectively capturing business opportunities. Many leading international corporations also have similar arrangements.

In 2013, the Company’s continuous efforts in corporate governance gained wide recognition from the capital markets and the Company was accredited with a number of awards. The Company was voted the “Overall Best Managed Company in Asia” by Euromoney for five consecutive years, while at the same time being ranked as the “No. 1 Best Corporate Governance in Asia”, the “No. 1 Most Convincing and Coherent Strategy in Asia” and the “No. 1 Most Transparent Accounts in Asia” in the individual categories. The Company was accredited by the investors as the “No. 1 Best Managed Company in Asia”, the “No. 1 Best Managed Company in China” and the “No. 1 Best Investor Relations in China” for three consecutive years in the Asia’s Best Companies Poll 2013 organised by FinanceAsia. The Company was voted by investors as the “No.1 Most Honored Company in Asia” and “Asia’s Best Investor Relations Company in telecommunications sector” in 2013 All-Asia-Executive- Team ranking organised by Institutional Investor. In addition, Mr. Wang Xiaochu, Chairman and CEO, was voted as “Asia’s Best CEO in telecommunications sector” and Madam Wu Andi, Executive Vice President and CFO was voted as “Asia’s Best CFO in telecommunications sector”. The Company swept several top awards including the “Grand Prix for Best Overall Investor Relations for Large-cap Companies” and the “Best Investor Relations by a mainland Chinese company” for two consecutive years at the IR Magazine Awards – Greater China 2013. In addition, based on IR Magazine’s annual surveys of investors and analysts for its awards in the US, Canada, Europe, Greater China, South East Asia and Brazil, the Company was ranked No.5 in The Global Top 50 and was the only Asian company among the top 10 companies. The Company was accredited the “Platinum Award for All- Round Excellence” in the poll of Corporate Awards 2013 by the Asset for five consecutive years. In addition, the Company was awarded the “The Best of Asia – Icon on Corporate Governance” by Corporate Governance Asia and Mr. Wang Xiaochu, Chairman and CEO of the Company, was awarded “Asian Corporate Director Recognition Awards 2013” by Corporate Governance Asia for four consecutive years.

-

Overall Structure of the Corporate Governance

A double-tier structure has been adopted as the overall structure for corporate governance: the Board and the Supervisory Committee are established under the Shareholders’ General Meeting. The Audit Committee, Remuneration Committee and Nomination Committee were established under the Board. The Board is authorised by the Articles of Association to make major decisions on the Company’s operation and to oversee the daily management and operations of the senior management. The Supervisory Committee is mainly responsible for the supervision of the performance of duties by the Board and the senior management. Each of the Board and the Supervisory Committee is independently accountable to the Shareholders’ General Meeting.

Shareholders’ General Meeting

In 2013, the Company convened one Shareholders’ General Meeting, the Annual General Meeting (“AGM”) for the year 2012. The AGM held on 29 May 2013 reviewed and approved numerous resolutions such as the financial statements for the year 2012, Report of the Independent International Auditor, proposal for profit and dividends distribution, authorisation to the Board for the formulation of a budget for 2013, appointment and remuneration of auditors, authorisation to the Board to issue debentures and appointment of a director.

Since the Company’s listing in 2002, at each of the Shareholders’ General Meetings a separate shareholders’ resolution was proposed by the Company in respect of each independent item. The circulars to shareholders also provided details about the resolutions. All votes on resolutions tabled at the Shareholders’ General Meetings of the Company were already conducted by poll and all voting results were published on the websites of the Company and The Stock Exchange of Hong Kong Limited. The Company attaches great importance to the Shareholders’ General Meetings and the communication between Directors and shareholders. The Directors provided detailed and complete answers to the questions raised by shareholders at the Shareholders’ General Meetings. The Board adopted the shareholders communication policy to ensure that the shareholders are provided with comprehensive, equal, understandable and publicised information of the Company on a timely basis and to strengthen the communication between the Company, and the shareholders and investors.

Board of Directors

As at 31 December 2013, the Board comprises 13 Directors with seven Executive Directors, one Non-executive Director and five Independent Non-executive Directors. The Audit Committee, Remuneration Committee and Nomination Committee under the Board all consist solely of Independent Non-executive Directors, which ensure that the committees are able to provide sufficient review and check and balance and make effective judgments to protect the interests of shareholders and the Company as a whole. The number of Independent Non-executive Directors constitutes more than one-third of the members of the Board. Mr. Tse Hau Yin, Aloysius, the Chairman of the Audit Committee, is an internationally renowned financial expert with expertise in accounting and financial management. The term of office for the fourth session of the Board lasts for three years, starting from May 2011 until the day of the Company’s Annual General Meeting in 2014, upon which the fifth session of the Board will be elected.

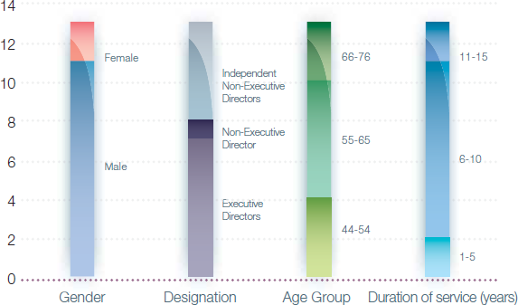

In August 2013, the Company adopted the Board diversity policy. The Company believes that Board diversity will contribute significantly to the enhancement of the level of performance of the Company. In order to achieve a sustainable and balanced development, the Company views the increasing Board diversity as a key element for supporting its strategic goals and maintaining sustainable development. In determining the composition of the Board, the Company takes into account diversity of the Board from a number of perspectives, including but not limited to gender, age, education background or professional experience, skills, knowledge, duration of service, etc. All appointments made or to be made by the Board are merit-based, and candidates are selected based on objective criteria, giving full consideration to the benefits in terms of Board diversity. Final decisions are based on each candidate’s attributes and the contributions to be made to the Board. The Nomination Committee oversees the implementation of policies, reviews existing policies as and when appropriate, and recommends proposals for revisions for the Board’s approval. Biographical details of existing Directors are set out in the “Directors, Supervisors and Senior Management” section of this Annual Report. The Company believes that the Board currently comprises experts from diversified professions such as telecommunications, finance, economics, law and management, and is diversified in terms of gender, age, duration of service, etc., which contributes to the enhanced management standard and more regulated operation of corporate governance of the Company, and results in a more comprehensive and balanced Board structure and decision-making process.

The Company strictly complies with the Corporate Governance Code under the Listing Rules to rigorously regulate the operating procedures of the Board and its committees, and to ensure that the procedures of Board meetings are in compliance with related rules in terms of organisation, regulations and personnel. The Board responsibly and effectively supervises the preparation of financial statements for each financial period, so that such financial statements truly and fairly reflect the operational condition, the operating results and cash flows of the Company for such period. In preparing the financial statements for the year ended 31 December 2013, the Directors adopted appropriate accounting policies and made prudent, fair and reasonable judgments and estimates, and prepared the financial statements on a going concern basis.

The Articles of Association of the Company provide that the Board is accountable to the Shareholders’ General Meetings, and its duties mainly include the execution of resolutions, formulation of major operational decisions, financial proposals and policies, formulation of the Company’s basic management system, and the appointment of managers and other senior management personnel of the Company. The Articles of Association also clearly define the respective duties of the Board and the management. The management is responsible for the operation and management of the Company, the implementation of the Board resolutions and the annual operation plans and investment proposals of the Company, formulating the proposal of the Company’s internal administrative organisations and sub-organisations, and performing other duties as authorised by the Articles of Association and the Board. In order to maintain highly efficient operations, as well as flexibility and swiftness in operational decision-making, the Board may delegate its management and administrative powers to the management when necessary, and shall provide clear guidance regarding such delegation so as to avoid seriously impeding or undermining the capabilities of the Board when exercising its powers as a whole.

All members of the Board/Committees are informed of the meeting schedule for the Board/Committees for the year at the beginning of each year. In addition, all Directors will receive a meeting notification at least 14 days prior to the meeting under normal circumstances. The Company Secretary is responsible for ensuring that the Board meetings comply with all procedures, related rules and regulations while all Directors can make inquiries to the Company Secretary for details to ensure that they have received sufficient information on various matters set out in the meeting agenda.

The Board meets at least four times a year. Additional Board meetings will be held as necessary. In 2013, the Board played a pivotal role in the Company’s operation, budgeting, decision-making, supervision, internal control, organisational restructuring and corporate governance. The Company convened four Board meetings, four Audit Committee meetings, one Nomination Committee meeting and several board and committee written resolutions were passed in this year.

At the Board meetings, the Board reviewed significant matters including the Company’s annual, interim and quarterly financial statements, annual operational, financial and investment budgets, internal control implementation and assessment report, annual proposal for profit distribution, annual report, interim report and quarterly reports, connected transactions, continuing connected transactions and the annual caps applicable thereto and appointment and remuneration of auditors. All directors performed their fiduciary duties and devoted sufficient time and attention to the affairs of the Company.

The Company determines the Directors’ remuneration with reference to factors such as their respective responsibilities and duties in the Company, as well as their experiences and market conditions at the relevant time.

The Board should develop and review the Company’s policies and practices on corporate governance; review and monitor the training and continuous professional development of directors and senior management; review and monitor the Company’s policies and practices on compliance with legal and regulatory requirements; develop, review and monitor the code of conducts for employees; review the Company’s compliance with the Corporate Governance Code and disclosure in the Corporate Governance Report.

Directors’ training and continuous professional development

The Company also arranges induction activities including the duties and continuing obligations of directors, relevant laws and regulations, the operation and business of the Company, so that all newly appointed Directors are provided with updated data on industry development. To ensure that the Directors are familiar with the Company’s latest operations for decisionmaking, the Company arranges for key financial data and operational data to be provided to the Directors on a monthly basis since 2009. Through regular Board meetings and reports from management, the Directors are able to clearly understand the operations, business strategy and latest development of the Company and the industry. In addition, the Company reminds the Directors of their functions and responsibilities by continuously providing them with information about the latest development of the Listing Rules and other applicable regulations. The Directors also pay regular visits to our provincial branches to exchange ideas and to study so as to achieve a better understanding of the latest business developments and to share their valuable experiences. The Directors actively participate in training and continuous professional development to develop and refresh their knowledge and skills to ensure their contribution to the Company.

In 2013, the Directors have participated in training and continuous professional development activities and the summary is as follows:

Directors Training categories Executive Directors Wang Xiaochu A, B Yang Jie A, B Wu Andi A, B Zhang Jiping A, B Yang Xiaowei A, B Sun Kangmin A, B Ke Ruiwen A, B Non-Executive Director Chen Liangxian (resigned on 20 March 2013) B Xie Liang (appointed on 29 May 2013) A, B Independent Non-executive Directors Wu Jichuan A, B Qin Xiao A, B Tse Hau Yin, Aloysius A, B Cha May Lung, Laura A, B Xu Erming A, B A: attending relevant seminars and/or conferences and/or forums; delivering speeches at relevant seminars and/or conferences and/or forums

B: reading or writing relevant newspapers, journals and articles relating to general economy, general business, telecommunications, corporate

governance or directors' dutiesCompliance with the Model Code for Securities Transactions by Directors and Supervisors

The Company has adopted the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix 10 to the Listing Rules to govern securities transactions by the Directors and Supervisors. Based on the written confirmation from the Directors and Supervisors, all of the Company’s Directors and Supervisors have strictly complied with the Model Code for Securities Transactions by Directors of Listed Issuers in Appendix 10 to the Listing Rules regarding the requirements in conducting securities transactions. The Company has received annual independence confirmations from each of the Independent Non-executive Directors, and considers them to be independent.

Audit Committee

The Audit Committee comprises four Independent Non-executive Directors, Mr. Tse Hau Yin, Aloysius as the chairman and Mr. Wu Jichuan, Dr. Qin Xiao and Mr. Xu Erming as the members. The Charter of the Audit Committee clearly defines the status, qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Audit Committee. The Audit Committee’s principal duties include the supervision of the truthfulness and completeness of the Company’s financial statements, the effectiveness and completeness of the Company’s internal control and risk management systems as well as the work of the Company’s internal audit department. It is also responsible for the supervision and review of the qualifications, selection and appointment, independence and services of external independent auditors. The Audit Committee ensures that the management has discharged its duty to establish and maintain an effective internal control system including the adequacy of resources, qualifications and experience of staff fulfilling the accounting and financial reporting function of the Company together with the adequacy of the staff’s training programmes and the related budget. The Audit Committee also has the authority to set up a reporting system to receive and handle cases of complaints or complaints made on an anonymous basis regarding the Company’s accounting, internal control and audit matters. The Audit Committee is responsible to and regularly reports its work to the Board.

In 2013, pursuant to the requirements of the governing laws and regulations of the places of listing and the Charter of the Audit Committee, the Audit Committee fully assumed its responsibilities within the scope of the clear mandate from the Board. The Audit Committee proposed a number of practical and professional recommendations for improvement based on the Company’s actual circumstances in order to promote the continuous improvement and perfection of corporate management. The Audit Committee has provided important support to the Board and played a significant role in protecting the interests of independent shareholders.

In 2013, the Audit Committee convened four meetings, in which it reviewed important matters related to the Company’s annual, interim and quarterly financial statements, assessment of the qualifications, independence and performance of the external auditors and their appointments, effectiveness of internal control, internal audit and connected transactions. The Audit Committee received quarterly reports in relation to the internal audit and connected transactions and provided guidance to the internal audit department. Additionally, the Audit Committee reviewed the internal control assessment report and the attestation report, followed up with the implementation procedures of the recommendations proposed by the external auditors, reviewed the U.S. annual report, and communicated independently with the auditors twice a year.

Remuneration Committee

The Remuneration Committee comprises four Independent Non-executive Directors. Mr. Xu Erming as the chairman and Mr. Wu Jichuan, Dr. Qin Xiao and Mr. Tse Hau Yin, Aloysius as the members. The Charter of the Remuneration Committee clearly defines the status, qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Remuneration Committee. The Remuneration Committee assists the Company’s Board to formulate overall remuneration policy and structure for the Company’s Directors and senior management personnel, and to establish related procedures that are standardised and transparent. The Remuneration Committee’s principal duties include supervising the compliance of the Company’s remuneration system with legal requirements, presenting the evaluation report on the Company’s remuneration system to the Board, giving recommendations to the Board in respect of the overall remuneration policy and structure for the Company’s Directors and senior management personnel and the establishment of a formal and transparent procedure for developing remuneration policy, and determining, with delegated responsibility by the Board, the remuneration packages of individual Executive Directors and senior management including benefits in kind, pension rights and compensation payments (including any compensation payable for loss or termination of their office or appointment). Its responsibilities comply with the requirements of the Corporate Governance Code. The Remuneration Committee is responsible to and regularly reports its work to the Board. No meeting was held by the Remuneration Committee in year 2013.

Nomination Committee

The Company’s Nomination Committee comprises four Independent Non-executive Directors, Mr. Wu Jichuan as the chairman and Mr. Tse Hau Yin, Aloysius, Madam Cha May Lung, Laura and Mr. Xu Erming as the members.

The Charter of the Nomination Committee clearly defines the status, qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Nomination Committee, and it specifically requires that the Nomination Committee members shall have no significant connection to the Company, and comply with the regulatory requirements related to “independence”. The Nomination Committee assists the Board to formulate standardised, prudent and transparent procedures for the appointment and succession plans of Directors, and to further optimise the composition of the Board. The principal duties of the Nomination Committee include regularly reviewing the structure, number of members, composition and diversity of the Board; identifying candidates and advising the Board with the appropriate qualifications for the position of Directors; reviewing the Board Diversity Policy as appropriate to ensure its effectiveness; evaluating the independence of Independent Non-executive Directors; advising the Board on matters regarding the appointment or reappointment of Directors and succession plans for the Directors. The Nomination Committee is accountable to and regularly reports its work to the Board. One meeting was held by the Nomination Committee in 2013, and it performed a review of the structure and operations of the Board and discussed the appointment of the Non-executive Director.

The Company will identify suitable candidates through multiple channels such as internal recruitment and recruiting from the labour market. The criteria of identifying candidates include, but are not limited to, their gender, age, educational background or professional experience, skills, knowledge and length of service and capability to commit to the affairs of the Company and, in case of Independent Non-executive Director, the candidates should fulfill the independence requirements set out in the Listing Rules from time to time. Upon the Nomination Committee and the Board reviewed and resolved to appoint the appropriate candidate, the relevant proposal will be put forward to the Shareholders’ General Meeting in writing for approval.

Directors shall be elected at the Shareholders’ General Meeting for a term of three years. At the expiry of a Director’s term, the Director May stand for re-election and re-appointment. According to the Articles of Association, before the convening of the Annual General Meeting, shareholders holding 5% or more of the total voting shares of the Company shall have the right to propose new motions (such as election of directors) in writing, and the Company shall place such proposed motions on the agenda for such Annual General Meeting if there are matters falling within the functions and powers of shareholders in general meetings. According to the Articles of Association, shareholders can also request for the convening of extraordinary general meeting provided that the shareholders holding in aggregate 10% or more of the shares carrying the right to vote at the meeting sought to be held and they shall sign one or more written requisitions in the same format and with the same content, requiring the Board to convene an extraordinary general meeting and stating the resolutions of meeting (such as election of directors). The Board shall convene an extraordinary general meeting within two months. The minimum period during which written notice given to the Company of the intention to propose a person for election as a director, and during which written notice to the Company by such person of his willingness to be elected May be given, will be at least seven days. Such period will commence no earlier than the day after the despatch of the notice of the meeting for the purpose of considering such election and shall end no later than seven days prior to the date of such meeting. The ordinary resolution to approve the appointment of Directors shall be passed by votes representing more than one-half of the voting rights represented by the shareholders (including proxies) present at the meeting.

The number of attendance/meetings of the members of the Board and committees in year 2013

Board Audit

CommitteeNomination

CommitteeAnnual

General

MeetingExecutive Directors Wang Xiaochu (Chairman) 4/4 N/A N/A 1/1 Yang Jie 4/4 N/A N/A 0/1 Wu Andi 4/4 N/A N/A 1/1 Zhang Jiping 2/4 N/A N/A 0/1 Yang Xiaowei 3/4 N/A N/A 1/1 Sun Kangmin 4/4 N/A N/A 0/1 Ke Ruiwen 2/4 N/A N/A 1/1 Non-Executive Directors Chen Liangxian* N/A N/A N/A N/A Xie Liang* 2/2 N/A N/A N/A Independent Non-Executive Directors Wu Jichuan 3/4 3/4 1/1 1/1 Qin Xiao 3/4 3/4 N/A 1/1 Tse Hau Yin, Aloysius 4/4 4/4 1/1 1/1 Cha May Lung, Laura 4/4 N/A 1/1 0/1 Xu Erming 4/4 3/4 1/1 1/1 Note: Certain Executive Directors and Independent Non-executive Directors did not attend the Annual General Meeting and some of the meetings of the Board and the Committees due to other business commitments or being overseas.

* Mr. Chen Liangxian resigned as the Non-executive Director of the Company due to change in work arrangement on 20 March 2013. The appointment of Mr. Xie Liang as the Non-executive Director of the Company was approved at the Annual General Meeting held on 29 May 2013.Supervisory Committee

The Company’s Supervisory Committee comprises six Supervisors, with one External Independent Supervisor and two Employee Representative Supervisors. On 19 August 2013, Mr. Mao Shejun retired as the Employee Representative Supervisor due to his age. On the same date, Mr. Tang Qi has been elected by the employees of the Company democratically as an Employee Representative Supervisor.

The principal duties of the Supervisory Committee include supervising, in accordance with the law, the Company’s financials and performance of its Directors, managers and other senior management so as to prevent them from abusing their powers. The Supervisory Committee is a standing supervisory organisation within the Company, which is accountable to and reports to all shareholders. The Supervisory Committee holds meetings at least once or twice a year.

The number of attendance/meetings of members of the Supervisory Committee in year 2013

Number of Supervisors

Number of meetings in 20136

2Supervisors Number of

Attendance/MeetingsShao Chunbao (Chairman of the Supervisory Committee) 2/2 Zhu Lihao (Independent Supervisor) 2/2 Mao Shejun (Employee Representative Supervisor, retired on 19 August 2013) 2/2 Tang Qi (Employee Representative Supervisor, appointed on 19 August 2013) N/A Zhang Jianbin (Employee Representative Supervisor) 2/2 Hu Jing 2/2 Du Zuguo 2/2 External Auditors

The international and domestic auditors of the Company are Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP, respectively. In order to maintain their independence, the non-audit services provided by the external auditors did not contravene the requirements of the US Sarbanes- Oxley Act of 2002.

A breakdown of the remuneration received by the external auditors for audit and non-audit services provided to the Company for the year ended 31 December 2013 is as follows:

Service item Fee

(RMB millions)Audit services 59.8 Non-audit services (mainly include internal control advisory and other advisory services) 1.4 Total 61.2 The Directors of the Company are responsible for the preparation of consolidated financial statements that give a true and fair view in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board and the disclosure requirements of the Hong Kong Companies Ordinance, and for such internal control as the Directors determine is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

The statements by the external auditors of the Company, Deloitte Touche Tohmatsu, regarding their reporting responsibilities on the financial statements of the Company is set out in the Independent Auditors’ Report.

The service term of KPMG and KPMG Huazhen (Special General Partnership), the international and domestic auditors of the Company for 2012, expired at the Annual General Meeting for 2012 (29 May 2013). The appointment of Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP as the international and domestic auditors for the financial year 2013 has been approved at the Annual General Meeting for year 2012. The Audit Committee and the Board have resolved to re-appoint Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP as the international and domestic auditors for the financial year 2014, subject to the approval at the 2013 Annual General Meeting.

-

Internal Control

Internal Control System

The Board attaches great importance to the construction and perfection of the internal control system, and takes effective approaches to supervise the implementation of related control measures, whilst enhancing operation efficiency and effectiveness, and enhancing corporate governance, risk assessment, risk management and internal control so as to protect shareholders’ investment and ensure the safety of the Company’s assets. In this way, the Company can achieve long-term development goals. The Company’s management is responsible for the construction, optimisation and implementation of the internal control system. The internal control system of the Company is built on clear organisational structure and management duties, an effective delegation and accountability system, definite targets, policies and procedures, comprehensive risk assessment and management, a sound financial accounting system, and continuing analysis and supervision of operational performance. It covers all services and transactions of the Company. The Company has formulated a code of conduct for the senior management and employees which ensures their ethical value and competency. The Company has formulated its internal reporting system, which encourages anonymous reporting of situations where employees, especially Directors and senior management personnel, breach the rules.

Since the year 2003, based on the requirements of the U.S. securities regulatory authorities and the COSO Internal Control Framework (1992), and with the assistance of KPMG Advisory (China) Limited (Beijing office) and other advisory institutions, the Company has formulated manuals, implementation rules and related rules in relation to internal control, and has developed the Policies on Internal Control Management and Internal Control Accountability Management to ensure the effective implementation of the above systems. Over more than ten years, the Company has continuously revised and improved the manuals and implementation rules in view of the ever changing internal and external operation environment as well as the requirements of business development. In particular, the Company has further strengthened the control over key business processes based on the distinguishing features of mobile services since the commencement of the full services operation. While continuing to improve the internal control related policies, the Company has also been strengthening its IT internal control capabilities, which has improved the efficiency and effectiveness of internal control, enhancing the safety of the Company’s information system so that the integrity, timeliness and reliability of data and information are maintained.

In 2013, the Group further enhanced the construction of its internal control system, made additional efforts in its implementation, and strengthened risk control in key areas. With a focus on supporting the development of emerging services and pursuing ways to promptly address market needs and solve new problems arising in the course of innovations in business, operations and cooperation, the Company made revisions to the internal control manuals during the year. We also established and enhanced our internal control on the three emerging services, namely data traffic, Internet applications and ICT, and regulated the business processes in e-Surfing broadband WIFI management, e-channels management, “Best Pay” service management and IDC business management. Internal control for key businesses and key scopes of risks were strengthened, while the risk control on certain key aspects such as business cooperation, agency management and supplies procurement was reinforced. At the same time, critical control points were further refined and internal control processes were optimised to improve the operational efficiency of the Company. We also organised the implementation of a project for setting up an internal support system, which would become the Group’s first efficiently-centralised system under its MSS project, and achieved a unified platform for the provincial branches’ internal control supporting system, the physical centralisation of system hardware and centralisation of the work processes, and further strengthened and regulated the internal control system construction. We supported the establishment and enhancement of the implementation rules for internal control applicable to new business units, organised the review of implementation rules for internal control in respect of new business units, thoroughly organised and reviewed the risk areas in respect of emerging businesses, conducted annual assessment of the internal control of newly-established companies, and supervised the timely rectifications of problems that had been identified, thereby effectively guarding ourselves against operational risks.

-

Comprehensive Risk Management

The Company views comprehensive risk management as an important task within the Company’s daily operation. Pursuant to regulatory requirements in capital markets of the United States and Hong Kong, the Company has formulated a unique five-step risk management approach based on risk management theory and practice, including risk identification, risk assessment, key risk analysis, risk reaction and risk management assessment. The Company has also designed a risk management template, established and refined the centralised risk directories and case studies database of the Company, continued to strengthen the level of risk management informatisation, and solidified a standardised risk management procedure so that risk management terminology is unified across all levels of the Company and the effectiveness of risk management was improved. Following the efforts made over the past years, China Telecom has established a comprehensive risk management system and has gradually perfected its comprehensive risk monitoring and prevention mechanism.

In 2013, pursuant to the requirement of provision C2 of the Corporate Governance Code promulgated by The Stock Exchange of Hong Kong Limited, the Company further incorporated comprehensive risk management into its daily operation. The Company continued to strengthen the level-oriented, category-oriented and centralised risk management, with resources concentrated on the prevention of two types of major potential risks, including the external environment risk and operational risk, and has achieved satisfactory results. In 2013, the Company was not confronted with any major risk event.

After rigorous risk identification, assessment and analysis, the Company has conducted a preliminary assessment of potential major risks to the Company in 2014, such as the external environmental risk and operational risk, and has put forward detailed response plans. Through strict and appropriate risk management procedures, the Company will ensure the impact from the above risks to the Company are limited to and within an expected range.

Annual Internal Control Evaluation

The Company has been continuously improving its internal control system. In order to meet the regulatory requirements of its places of listing, including the United States and Hong Kong, and strengthen its internal control while guarding against operational risk, the Company’s internal audit department is responsible for coordinating the supervision and assessment of internal control.

The Company has adopted the COSO Internal Control Framework (1992) as the standard for the internal control assessment. With the management’s internal control testing guidelines and the Audit Standard No. 5 that were issued by PCAOB as its directives, the Company’s internal control assessment is composed of the self-assessment conducted by the persons responsible for internal control together with the independent assessment conducted by the internal audit department. In order to evaluate the nature of internal control deficiencies and reach a conclusion as to the effectiveness of the internal control system, the Company adopts the following four major steps of assessment: (1) analyse and identify areas which require assessment, (2) assess the effectiveness of the design of internal control, (3) assess the effectiveness of the execution of internal control, (4) analyse the impact of deficiencies in internal control. At the same time, the Company rectifies any deficiencies found during the assessment. By formulating “Interim Measures for the Internal Control Assessment”, “Manual for the Self-Assessment of Internal Control”, “Manual for the Independent Assessment of Internal Control” and other documents, the Company has ensured the assessment procedures are in compliance with related rules and regulations.

In 2013, the Company’s internal audit department initiated and coordinated the assessment of internal control at the Company level, and reported the results to the Audit Committee and the Board.

Self-assessment of internal control adopts a top-down approach which reinforces assessment in respect of control points at the Company level and control points corresponding to major accounting items. The Company insisted on risk-oriented principles and, on the basis of comprehensive assessment, identified key control areas and control points for major assessment through risk analysis. In 2013, the Company, on the basis of a comprehensive self-evaluation, launched a special self-assessment work organised and led by the operational department and conducted specific self-assessment based on two selected hot issues in relation to risk management which have certain impact on the operation of the Company. Meanwhile, we further enhanced the function of the internal control seminars and emphasised on solving the difficult issues on the cross-departmental and cross-processing internal control. The above measures effectively promoted the participation by various departments and units and ensured the self-assessment work covering 100% of the Company, while timely detected and rectified internal control deficiencies so as to effectively control and eliminate potential risks. The Company also worked towards perfecting the systems and deepening its governance measures, while continuously improving the quality and effectiveness of its internal control self-assessment.

Under the risk-guided independent assessment of the Company’s internal control, we consolidated audit resources, worked around key areas and major business processes and conducted assessments. At the same time, we focused on new services and new units including mobile Internet to select two units upon which we embarked upon our internal control construction. Thorough assessment was conducted to help guard us against risks associated with the new business areas. In 2013, in accordance with the Company’s assessment principles and arrangements, all units launched a proactive independent assessment, timely identified potential risks and oversaw the process to rectify the problems. This achieved positive results. Through independent assessment, the Company not only grasped the overall situation of internal control, but also developed key tests for its high-risk processes. In addition, the Company inspected the related units in respect of their rectification of internal control deficiencies and focused on the key issues in order to ensure the depth and quality of assessment.

Furthermore, the Company organised the internal control assessment team and other relevant departments to closely coordinate with the external auditors’ internal control audit related to financial statements. The internal control audit covered the Company and all its subsidiaries as well as the key processes and control points in relation to major accounting items. The external auditors regularly communicated with the management in respect of the audit results.

All levels of the Company have been attaching great importance to rectifying internal control deficiencies. The Company pushes all units to carry out rectification in relation to deficiencies identified through self-assessment, independent assessment and the internal control audit. The Company also highlighted the participation of professional departments whilst exploring the establishment of an internal control mechanism with long-term efficiency. To ensure effective rectification, the Company also strengthened the verification and supervision of the rectification of internal control deficiencies. Pursuant to requests from the Company, all provincial branches launched rectification on any deficiencies identified from the assessment (including the internal control audit) in a positive manner.

Through self-assessments and independent assessments conducted by branches at different levels, the Company carried out multi-layered and full-dimensional reviews of its internal control system, and put its utmost efforts into rectifying the problems which were identified. Through this method, the Company was able to ensure the effectiveness of its internal control and successfully passed the year-end attestation undertaken by the external auditors.

The Board, through the Audit Committee, reviewed the internal control system of the Company and its subsidiaries for the financial year ended 31 December 2013, which covered its controls on financial reporting, operation and compliance, as well as its risk management functions. The Board is of the view that the Company’s internal control system is solid, well-established and effective. The annual review also considers the adequacy of resources relating to the Company’s accounting and financial reporting functions, the sufficiency of the qualifications and experience of staff, together with the adequacy of the staff’s training programmes and the relevant budget.

-

Investor Relations and Transparent Information Disclosure Mechanism

The Company establishes an Investor Relations Department which is responsible for providing shareholders and investors with the necessary information, data and services in a timely manner. It also maintains proactive communications with shareholders, investors and other capital market participants so as to allow them to fully understand the operation and development of the Company. The Company’s senior management presents the annual results and interim results in Hong Kong every year. Through various activities such as analyst meetings, press conferences, global investor telephone conferences and investors road shows, the senior management provides the capital markets and the media with important information and responds to key questions which are of prime concerns to the investors. This has helped reinforce the understanding of the Company’s business and the overall development of the telecommunications industry in China. Since 2004, the Company has been holding the Annual General Meetings in Hong Kong to provide convenience and encourage its shareholders, especially public shareholders, to actively participate in the Company’s Annual General Meetings and to promote the direct communication and exchange of ideas between the Board and shareholders.

With an aim of strengthening communications with the capital market and enhancing the transparency of information disclosure, the Company has provided the quarterly disclosure of revenue, operating expenses, EBITDA, net profit figures and other key operational data, and the monthly announcements of the number of access lines in service, mobile subscribers (including 3G subscribers) and wireline broadband subscribers. The Company attaches great importance to maintaining daily communication with shareholders, investors and analysts. In 2013, the Company has participated in a number of investors conferences held by a number of major international investment banks in order to maintain active communication with institutional investors.

In 2013, the Company attended the following investors conferences held by major international investment banks:

Date Name of Conference January 2013 Deutsche Bank Access China Conference 2013 January 2013 UBS Greater China Conference 2013 March 2013 Credit Suisse Asian Investment Conference 2013 May 2013 Macquarie Greater China Conference 2013 May 2013 CLSA China Forum 2013 May 2013 Morgan Stanley Hong Kong Investor Summit 2013 May 2013 BNP Paribas Asia Pacific TMT Conference 2013 May 2013 Deutsche Bank Access Asia Conference 2013 May 2013 Goldman Sachs Telecom & Internet Corporate Day 2013 June 2013 J.P. Morgan China Summit 2013 June 2013 Societe Generale/Ji Asia London Conference 2013 June 2013 Bank of America Merrill Lynch Global Telecom & Media Conference 2013 June 2013 CIMB 11th Annual Asia Pacific Leaders' Conference June 2013 Nomura Asia Equity Forum 2013 July 2013 Macquarie Non-Deal Roadshow (Australia) 2013 September 2013 CICC 1st London Conference September 2013 CLSA Hong Kong Investors' Forum 2013 September 2013 UOB Kay Hian Non-Deal Roadshow (Taiwan) 2013 October 2013 Macquarie China Corporate Day 2013 & Non-Deal Roadshow (Europe) November 2013 Credit Suisse China Investment Conference 2013 November 2013 Goldman Sachs Greater China Summit 2013 November 2013 Bank of America Merrill Lynch China Conference 2013 November 2013 Citi Greater China Investor Conference 2013 November 2013 Morgan Stanley Asia Pacific Summit 2013 November 2013 HSBC Asia Investor Forum 2013 & Non-Deal Roadshow (US) November 2013 J.P. Morgan Global TMT Conference 2013 November 2013 Daiwa Investment Conference Hong Kong 2013 December 2013 CICC Investment Forum 2013 December 2013 Barclays Asia TMT Conference 2013 December 2013 Societe Generale/Ji Asia Pan Asian Conference 2013 December 2013 BOCI Mobile Internet Outlook 2014 Corporate Day The Company’s investor relations website (www.chinatelecom-h.com) not only serves as an important channel for the Company to disseminate press releases and corporate information to investors and the capital market, but also plays a significant role in the Company’s valuation and our compliance with regulatory requirements for information disclosure. The Company’s website is equipped with a number of useful functions including interactive stock quote, interactive KPI, interactive FAQs, auto email alerts to investors, downloading to excel, RSS Feeds, self-selected items in investors briefcase, html version annual report, financial highlights, investor toolbar, website information which other users are also interested in, etc. In 2013, the Company has revamped the website using a leading technology, HTML 5 and a number of new functions and contents were added to further enhance the functions of the website and the level of transparency of the Company’s information disclosure, so as to meet the international best practices. In addition, a mobile version of the Company’s website was also offered, which allows the investors, shareholders, media and the general public to easily and promptly browse the updated information on the Company’s website through mobile devices at any time and any place. The Company’s website was accredited a number of awards in IR Global Rankings, W3, iNova, Euromoney, indicating that the Company’s website is highly recognised by professionals. The Company also actively seeks recommendations on how to improve the Company’s annual report from shareholders through survey, and in accordance with its shareholders’ recommendations prepared and distributed the annual report in a more environmentally friendly and cost-saving manner. The shareholders can ascertain their choice of receiving the annual reports and communications by electronic means, or receiving English version only, Chinese version only or both English and Chinese versions.

The Company has always maintained a good information disclosure mechanism. While keeping highly transparent communications with media, analysts and investors, we attach great importance to the handling of inside information. In general, the authorised speaker only makes clarification and explanation on the data available on the market, and avoid providing or divulging any unpublished inside information either by an individual or by a team. Before conducting any external interview, if the authorised speaker has any doubt about the data to be disclosed, he/she would seek verification from the relevant person or the person-in-charge of the relevant department, so as to determine if such data is accurate. In addition, discussions on the Company’s key financial data or other financial indicators are avoided during the black-out period.

Shareholder Rights

According to the Articles of Association, shareholders who request for the convening of an extraordinary general meeting or a class meeting shall comply with the following procedures:

Two or more shareholders holding in aggregate 10% or more of the shares carrying the right to vote at the meeting sought to be held shall sign one or more written requisitions in the same format and with the same content, stating the proposed matters to be discussed at the meeting, and requiring the Board to convene a shareholders’ extraordinary general meeting or a class meeting thereof. If the board of directors fails to issue a notice of such a meeting within 30 days from the date of receipt of the requisitions, the shareholders who make the requisitions May themselves convene such a meeting (in a manner as similar as possible to the manner in which shareholders’ meetings are convened by the board of directors) within four months from the date of receipt of the requisitions by the board of directors.

When the Company convenes an annual general meeting, shareholders holding 5% or more of the total voting shares of the Company shall have the right to propose new motions in writing, and the Company shall place such proposed motions on the agenda for such Annual General Meeting if they are matters falling within the functions and powers of shareholders in general meetings.

Process of forwarding shareholders’ enquiries to the Board:

Shareholders May at any time send their enquiries and concerns to the Board in writing through the Company Secretary and the Investor Relations Department. The contact details of the Company Secretary are as follows:

The Company Secretary

China Telecom Corporation Limited

38th Floor, Dah Sing Financial Center

108 Gloucester Road, Wanchai

Hong Kong

Email: ir@chinatelecom-h.com

Tel No.: (852) 2877 9777

Fax No.: (852) 2877 0988A dedicated “Investor” section is available on the Company’s website (www.chinatelecom-h.com). There is a FAQ function in the “Investor” section designated to enable timely, effective and interactive communication between the Company, shareholders and investors. Company Secretary and the Investor Relations Department of the Company handle both telephone and written enquiries from shareholders of the Company from time to time. Shareholders’ enquiries and concerns will be forwarded to the Board and/or the relevant Board Committees of the Company, where appropriate, to answer the shareholders’ questions. Information on the Company’s website is updated regularly.

Significant Differences Between the Corporate Governance Practices followed by the Company and those followed by NYSE-Listed U.S. Companies

The Company was established in the PRC and is currently listed on The Stock Exchange of Hong Kong Limited and the New York Stock Exchange (“NYSE”). As a foreign private issuer in respect of its listing on the NYSE, the Company is not required to comply with all the corporate governance rules of Section 303A of the NYSE Listed Company Manual. However, the Company is required to disclose the significant differences between the Corporate Governance Practices followed by the Company and the listing standards followed by NYSE-listed U.S. companies.

Pursuant to the requirements of the NYSE Listed Company Manual, the board of directors of all NYSE-listed U.S. companies must be made up by a majority of independent directors. Under currently applicable PRC and Hong Kong laws and regulations, the Board of the Company is not required to be formed with a majority of independent directors. As a listed company on The Stock Exchange of Hong Kong Limited, the Company needs to comply with the Listing Rules. These rules require that at least one-third of the board of directors of a listed company in Hong Kong be independent non-executive directors. The Board of the Company currently comprises 13 Directors, of which 5 are Independent Directors, making the number of Independent Directors exceed one-third of the total number of Directors on the Board, in compliance with the requirements of the Corporate Governance Code of the Listing Rules. These Independent Directors also satisfy the requirements on “independence” under the Listing Rules. However, the related standard set out in the Listing Rules is different from the requirements in Section 303A.02 of the NYSE Listed Company Manual.

Pursuant to the requirements of the NYSE Listed Company Manual, companies shall formulate separate corporate governance rules. Under the currently applicable PRC and Hong Kong laws and regulations, the Company is not required to formulate any rules for corporate governance; therefore, the Company has not formulated any separate corporate governance rules. However, the Company has implemented the code provisions under the Corporate Governance Code as set out in Appendix 14 of the Listing Rules for the financial year ended 31 December 2013.

Continuous Evolution of Corporate Governance

The Company continuously analyses the corporate governance development of international advanced enterprises and the investors’ desires, constantly examines and strengthens the corporate governance measures and practice, and improves the current practices at the appropriate time; we strongly believe that by adhering to good corporate governance principles, and improving the transparency, independence and the establishment of the effective accountability system, we can ensure the long-term stable development of the Company and to seek sustainable returns for the shareholders and investors.