Notes to the Financial Statements

-

1. Principal Activities, Organisation and Basis of Presentation

Principal activities

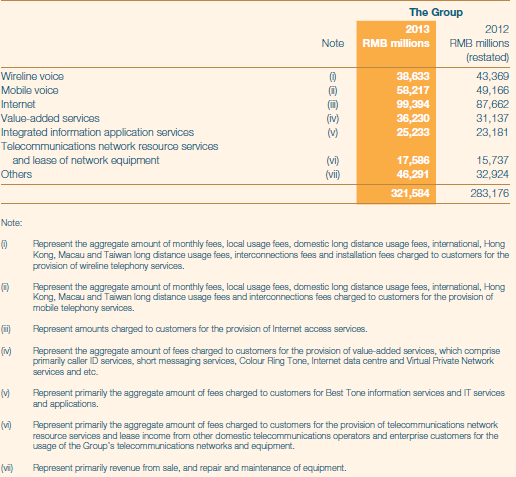

China Telecom Corporation Limited (the “Company”) and its subsidiaries (hereinafter, collectively referred to as the “Group”) offers a comprehensive range of wireline and mobile telecommunications services including wireline voice, mobile voice, Internet, telecommunication network resource services and lease of network equipment, value-added services, integrated information application services and other related services. The Group provides wireline telecommunications services and related services in Beijing Municipality, Shanghai Municipality, Guangdong Province, Jiangsu Province, Zhejiang Province, Anhui Province, Fujian Province, Jiangxi Province, Guangxi Zhuang Autonomous Region, Chongqing Municipality, Sichuan Province, Hubei Province, Hunan Province, Hainan Province, Guizhou Province, Yunnan Province, Shaanxi Province, Gansu Province, Qinghai Province, Ningxia Hui Autonomous Region and Xinjiang Uygur Autonomous Region of the People’s Republic of China (the “PRC”). Following the acquisition of Code Division Multiple Access (“CDMA”) mobile telecommunications business in October 2008, the Group also provides mobile telecommunications and related services in the mainland China and Macau Special Administrative Region (“Macau”) of the PRC. The Group also provides international telecommunications services, including lease of network equipment, International Internet access and transit, and Internet data centre service in certain countries of the Asia Pacific, Europe, South America and North America regions.

The operations of the Group in the mainland China are subject to the supervision and regulation by the PRC government. The Ministry of Industry and Information Technology of the PRC (the “MIIT”), pursuant to the authority delegated to it by the PRC State Council, is responsible for formulating the telecommunications industry policies and regulations, including the regulation and setting of tariff levels for basic telecommunications services, such as wireline and mobile local and long distance telephony services, lease of network equipment, roaming and interconnection arrangements.

Organisation

As part of the reorganisation (the “Restructuring”) of China Telecommunications Corporation, the Company was incorporated in the PRC on 10 September 2002. In connection with the Restructuring, China Telecommunications Corporation transferred to the Company the wireline telecommunications business and related operations in Shanghai Municipality, Guangdong Province, Jiangsu Province and Zhejiang Province together with the related assets and liabilities (the “Predecessor Operations”) in consideration for 68,317 million ordinary domestic shares of the Company. The shares issued to China Telecommunications Corporation have a par value of RMB1.00 each and represented the entire registered and issued share capital of the Company at that date.

On 31 December 2003, the Company acquired the entire equity interests in Anhui Telecom Company Limited, Fujian Telecom Company Limited, Jiangxi Telecom Company Limited, Guangxi Telecom Company Limited, Chongqing Telecom Company Limited and Sichuan Telecom Company Limited (collectively the “First Acquired Group”) and certain network management and research and development facilities from China Telecommunications Corporation for a total purchase price of RMB46,000 million (hereinafter, referred to as the “First Acquisition”).

On 30 June 2004, the Company acquired the entire equity interests in Hubei Telecom Company Limited, Hunan Telecom Company Limited, Hainan Telecom Company Limited, Guizhou Telecom Company Limited, Yunnan Telecom Company Limited, Shaanxi Telecom Company Limited, Gansu Telecom Company Limited, Qinghai Telecom Company Limited, Ningxia Telecom Company Limited and Xinjiang Telecom Company Limited (collectively the “Second Acquired Group”) from China Telecommunications Corporation for a total purchase price of RMB27,800 million (hereinafter, referred to as the “Second Acquisition”).

On 30 June 2007, the Company acquired the entire equity interests in China Telecom System Integration Co., Ltd. (“CTSI”), China Telecom Global Limited (“CT Global”) and China Telecom (Americas) Corporation (“CT Americas”) (collectively the “Third Acquired Group”) from China Telecommunications Corporation for a total purchase price of RMB1,408 million (hereinafter, referred to as the “Third Acquisition”).

On 30 June 2008, the Company acquired the entire equity interest in China Telecom Group Beijing Corporation (“Beijing Telecom” or the “Fourth Acquired Company”) from China Telecommunications Corporation for a total purchase price of RMB5,557 million (hereinafter, referred to as the “Fourth Acquisition”).

On 1 August 2011 and 1 December 2011, the subsidiaries of the Company, E-surfing Pay Co., Ltd and E-surfing Media Co., Ltd., acquired the e-commerce business and video media business (collectively the “Fifth Acquired Group”) from China Telecommunications Corporation and its subsidiaries for a total purchase price of RMB61 million (hereinafter, referred to as the “Fifth Acquisition”).

On 30 April 2012, the Company acquired the digital trunking business (the “Sixth Acquired Business”) from Besttone Holding Co., Ltd., a subsidiary of China Telecommunications Corporation, at a purchase price of RMB48 million (hereinafter, referred to as the “Sixth Acquisition”).

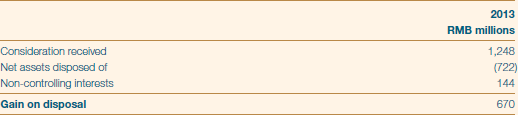

Pursuant to an agreement entered into by the Company and China Telecommunications Corporation on 26 April 2013, the Company disposed of an 80% equity interest in E-surfing Media Co., Ltd. (“E-surfing Media”), a subsidiary of the Company primarily engaged in the provision of video media services, to China Telecommunications Corporation. The initial consideration for the disposal of the equity interest in E-surfing Media was RMB1,195 million, which was concluded based on the valuation of the equity interests in E-surfing Media as at 31 December 2012 as filed for the state-owned assets appraisals. In addition, an adjustment was made to the initial consideration to arrive at the final consideration based on 80% of the change in the book value of the net assets of E-surfing Media during the period from 31 December 2012 to the completion date of the disposal. The risks and rewards of the ownership of the equity interest in E-surfing Media were transferred to China Telecommunications Corporation on 30 June 2013. The final consideration was arrived at RMB1,248 million and received by 31 December 2013.

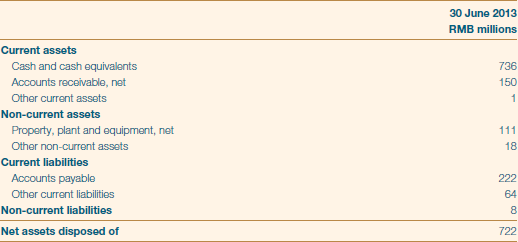

Analysis of assets and liabilities of the disposed subsidiary:

Gain on disposal of a subsidiary:

The gain on disposal of E-surfing Media has been included in investment income of the consolidated statement of comprehensive income.

Net cash inflow from disposal of a subsidiary:

Pursuant to an acquisition agreement entered into by CT Global and China Telecommunications Corporation on 16 December 2013, CT Global acquired 100% interest in China Telecom (Europe) Limited (“CT Europe” or the “Seventh Acquired Company”), a wholly owned subsidiary of China Telecommunications Corporation, from China Telecommunications Corporation (hereinafter, referred to as the “Seventh Acquisition”). The initial consideration for the Seventh Acquisition was RMB261 million. The initial consideration shall be adjusted for the difference between the net asset value on the completion date of the acquisition and the net asset value on the appraisal benchmark date of the acquisition, which was 30 June 2013 in order to arrive at the final consideration. The Seventh Acquisition was completed on 31 December 2013. The final consideration was RMB278 million. The initial consideration has been paid within 15 Business Days upon the completion of the acquisition.

Hereinafter, the First Acquired Group, the Second Acquired Group, the Third Acquired Group, the Fourth Acquired Company, the Fifth Acquired Group, the Sixth Acquired Business and the Seventh Acquired Company are collectively referred to as the “Acquired Groups”.

Basis of presentation

Since the Group and the Acquired Groups are under common control of China Telecommunications Corporation, the Group’s acquisitions of the Acquired Groups have been accounted for as a combination of entities under common control in a manner similar to a pooling-of-interests. Accordingly, the assets and liabilities of these entities have been accounted for at historical amounts and the consolidated financial statements of the Group prior to the acquisitions are combined with the financial statements of the Acquired Groups. The considerations for the acquisition of the Acquired Groups are accounted for as an equity transaction in the consolidated statement of changes in equity.

The consolidated results of operations for the year ended 31 December 2012 and the consolidated financial position as at 31 December 2012 as previously reported by the Group and the combined amounts presented in the consolidated financial statements of the Group to reflect the acquisition of the Seventh Acquired Company are set out below:

For the periods presented, all significant transactions and balances between the Group and the Seventh Acquired Company have been eliminated on combination.

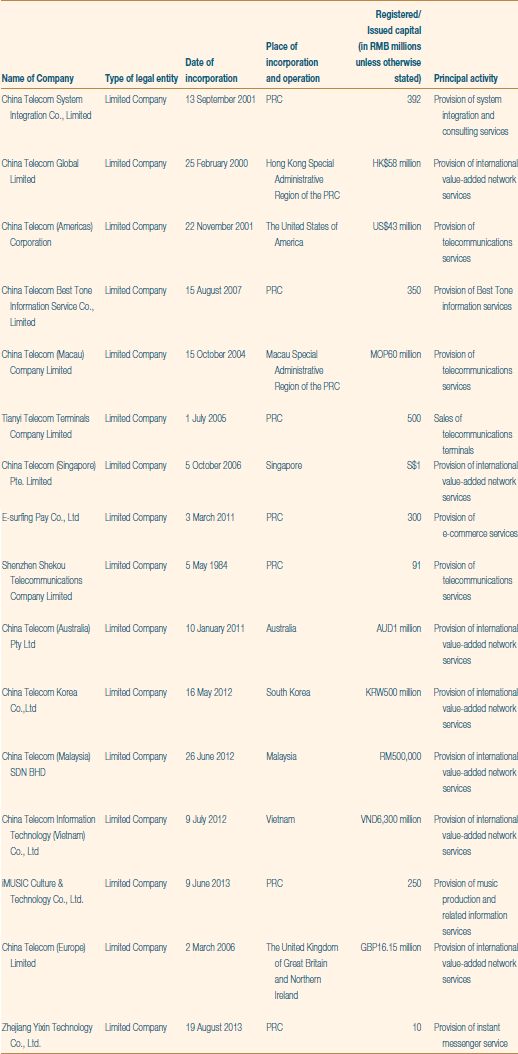

Set up of subsidiaries

On 9 June 2013, the Group set up a subsidiary, iMUSIC Culture & Technology Co., Ltd., which engages in the provision of music production and related information services.

On 19 August 2013, the Group set up a subsidiary, Zhejiang Yixin Technology Co., Ltd., which engages in the provision of instant messenger service.

Merger with subsidiaries

Pursuant to the resolution passed by the Company’s shareholders at an Extraordinary General Meeting held on 25 February 2008, the Company entered into merger agreements with each of the following subsidiaries: Shanghai Telecom Company Limited, Guangdong Telecom Company Limited, Jiangsu Telecom Company Limited, Zhejiang Telecom Company Limited, Anhui Telecom Company Limited, Fujian Telecom Company Limited, Jiangxi Telecom Company Limited, Guangxi Telecom Company Limited, Chongqing Telecom Company Limited, Sichuan Telecom Company Limited, Hubei Telecom Company Limited, Hunan Telecom Company Limited, Hainan Telecom Company Limited, Guizhou Telecom Company Limited, Yunnan Telecom Company Limited, Shaanxi Telecom Company Limited, Gansu Telecom Company Limited, Qinghai Telecom Company Limited, Ningxia Telecom Company Limited and Xinjiang Telecom Company Limited. In addition, the Company entered into merger agreements with Beijing Telecom on 1 July 2008. Pursuant to these merger agreements, the Company merged with these subsidiaries and the assets, liabilities and business operations of these subsidiaries were transferred to the Company’s branches in the respective regions.

-

2. Significant Accounting Policies

(a) Basis of preparation

The accompanying financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). These financial statements also comply with the disclosure requirements of the Hong Kong Companies Ordinance and the applicable disclosure provisions of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

These financial statements are prepared on the historical cost basis as modified by the revaluation of certain available-for-sale equity securities (Note 2(m)).

The preparation of financial statements in conformity with IFRS requires management to make judgements, estimates and assumptions that affect the application of policies and the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The estimates and associated assumptions are based on historical experience and various other factors that management believes are reasonable under the circumstances, the results of which form the basis of making the judgments about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from those estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects both current and future periods.

Judgements made by management in the application of IFRS that have significant effect on the financial statements and major sources of estimation uncertainty are discussed in Note 40.

(b) Basis of consolidation

The consolidated financial statements comprise the Company and its subsidiaries and the Group’s interests in associates.

A subsidiary is an entity controlled by the Company. When fulfilling the following conditions, the Company has control over an entity: (a) has power over an investee, (b) has exposure, or rights, to variable returns from its involvement with the investee, and (c) has the ability to use its power over the investee to affect the amount of the investor’s returns.

When assessing whether the Company has power, only substantive rights (held by the Company and other parties) are considered.

The financial results of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases, and the profit attributable to non-controlling interests is separately presented on the face of the consolidated statement of comprehensive income as an allocation of the profit or loss for the year between the non-controlling interests and the equity holders of the Company. Non-controlling interests represent the equity in subsidiaries not attributable directly or indirectly to the Company. For each business combination, the Group measures the non-controlling interests at fair value of the subsidiary’s net identifiable assets. Non-controlling interests at the end of the reporting period are presented in the consolidated statement of financial position within equity and consolidated statement of changes in equity, separately from the equity of the Company’s equity holders. Changes in the Group’s interests in a subsidiary that do not result in a loss of control are accounted for as equity transactions, whereby adjustments are made to the amounts of controlling and non-controlling interests within consolidated equity to reflect the change in relative interests, but no adjustments are made to goodwill and no gain or loss is recognised. When the Group loses control of a subsidiary, it is accounted for as a disposal of the entire interest in that subsidiary, with a resulting gain or loss being recognised in profit or loss. Any interest retained in that former subsidiary at the date when control is lost is recognised at fair value and this amount is regarded as the fair value on initial recognition of a financial asset or, when appropriate, the cost on initial recognition of an investment in an associate or a joint venture.

An associate is an entity, not being a subsidiary, in which the Group exercises significant influence, but not control, over its management. Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control over those policies.

An investment in an associate is accounted for in the consolidated financial statements under the equity method and is initially recorded at cost, adjusted for any excess of the Group’s share of the acquisitiondate fair values of the investee’s net identifiable assets over the cost of the investment (if any). Thereafter, the investment is adjusted for the Group’s equity share of the post-acquisition changes in the associate’s net assets and any impairment loss relating to the investment. When the Group ceases to have significant influence over an associate, it is accounted for as a disposal of the entire interest in that investee, with a resulting gain or loss being recognised in profit or loss. Any interest retained in that former investee at the date when significant influence is lost is recognised at fair value and this amount is regarded as the fair value on initial recognition of a financial asset.

All significant intercompany balances and transactions and unrealised gains arising from intercompany transactions are eliminated on consolidation. Unrealised gains arising from transactions with associates are eliminated to the extent of the Group’s interest in the entity. Unrealised losses are eliminated in the same way as unrealised gains, but only to the extent that there is no evidence of impairment.

(c) Foreign currencies

The accompanying consolidated financial statements are presented in Renminbi (“RMB”). The functional currency of the Company and its subsidiaries in mainland China is RMB. The functional currency of the Group’s foreign operations is the currency of the primary economic environment in which the foreign operations operate. Transactions denominated in currencies other than the functional currency during the year are translated into the functional currency at the applicable rates of exchange prevailing on the transaction dates. Foreign currency monetary assets and liabilities are translated into the functional currency using the applicable exchange rates at the end of the reporting period. The resulting exchange differences, other than those capitalised as construction in progress (Note 2(i)), are recognised as income or expense in profit or loss. For the periods presented, no exchange differences were capitalised.

When preparing the Group’s consolidated financial statements, the results of operations of the Group’s foreign operations are translated into RMB at average rate prevailing during the year. Assets and liabilities of the Group’s foreign operations are translated into RMB at the foreign exchange rates ruling at the end of the reporting period. The resulting exchange differences are recognised in other comprehensive income and accumulated separately in equity in the exchange reserve.

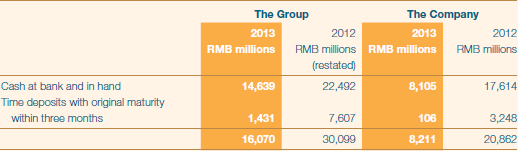

(d) Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and time deposits with original maturities of three months or less when purchased. Cash equivalents are stated at cost, which approximates fair value. None of the Group’s cash and cash equivalents is restricted as to withdrawal.

(e) Accounts and other receivables

Accounts and other receivables are initially recognised at fair value and thereafter stated at amortised cost using the effective interest method, less allowance for doubtful debts (Note 2(o)) unless the effect of discounting would be immaterial, in which case they are stated at cost less allowance for doubtful debts.

(f) Inventories

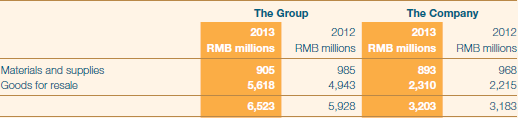

Inventories consist of materials and supplies used in maintaining the telecommunications network and goods for resale. Inventories are valued at cost using the specific identification method or the weighted average cost method, less a provision for obsolescence.

Inventories that are held for resale are stated at the lower of cost or net realisable value. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion, the estimated costs to make the sale and the related tax expenses.

(g) Property, plant and equipment

Property, plant and equipment are initially recorded at cost, less subsequent accumulated depreciation and impairment losses (Note 2(o)). The cost of an asset comprises its purchase price, any directly attributable costs of bringing the asset to working condition and location for its intended use and the cost of borrowed funds used during the periods of construction. Expenditure incurred after the asset has been put into operation, including cost of replacing part of such an item, is capitalised only when it increases the future economic benefits embodied in the item of property, plant and equipment and the cost can be measured reliably. All other expenditure is expensed as it is incurred.

Assets acquired under leasing agreements which effectively transfer substantially all the risks and benefits incidental to ownership from the lessor to the lessee are classified as assets under finance leases. Assets held under finance leases are initially recorded at amounts equivalent to the lower of the fair value of the leased assets at the inception of the lease or the present value of the minimum lease payments (computed using the rate of interest implicit in the lease). The net present value of the future minimum lease payments is recorded correspondingly as a finance lease obligation. Assets held under finance leases are amortised over their estimated useful lives on a straight-line basis. As at 31 December 2013, the carrying amount of assets held under finance leases was RMB28 million (2012: RMB3 million).

Gains or losses arising from retirement or disposal of property, plant and equipment are determined as the difference between the net disposal proceeds and the carrying amount of the asset and are recognised as income or expense in the profit or loss on the date of disposal.

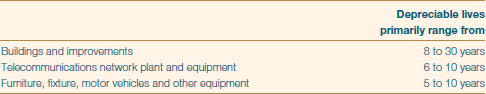

Depreciation is provided to write off the cost of each asset over its estimated useful life on a straight-line basis, after taking into account its estimated residual value, as follows:

Where parts of an item of property, plant and equipment have different useful lives, the cost of the item is allocated on a reasonable basis between the parts and each part is depreciated separately. Both the useful life of an asset and its residual value are reviewed annually.

(h) Lease prepayments

Lease prepayments represent land use rights paid. Land use rights are initially carried at cost or deemed cost and then charged to profit or loss on a straight-line basis over the respective periods of the rights which range from 20 years to 70 years.

(i) Construction in progress

Construction in progress represents buildings, telecommunications network plant and equipment and other equipment and intangible assets under construction and pending installation, and is stated at cost less impairment losses (Note 2(o)). The cost of an item comprises direct costs of construction, capitalisation of interest charge, and foreign exchange differences on related borrowed funds to the extent that they are regarded as an adjustment to interest charges during the periods of construction. Capitalisation of these costs ceases and the construction in progress is transferred to property, plant and equipment and intangible assets when the asset is substantially ready for its intended use.

No depreciation is provided in respect of construction in progress.

(j) Goodwill

Goodwill represents the excess of the cost over the Group’s interest in the fair value of the net assets acquired in the CDMA business (as defined in Note 6) acquisition.

Goodwill is stated at cost less any accumulated impairment losses. Goodwill is allocated to cash-generating units and is tested annually for impairment (Note 2(o)). On disposal of a cash generating unit during the year, any attributable amount of the goodwill is included in the calculation of the profit or loss on disposal.

(k) Intangible assets

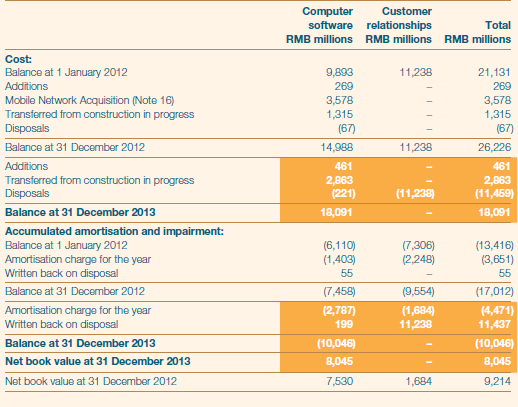

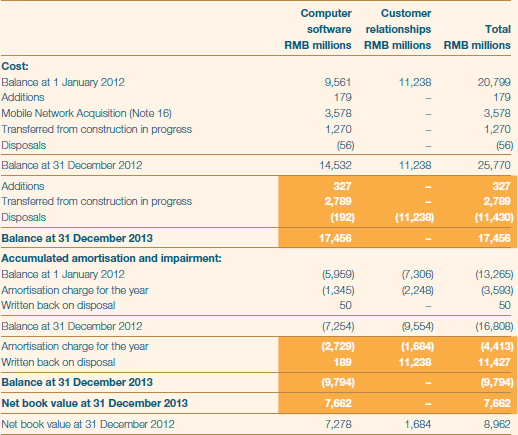

The Group’s intangible assets comprise computer software and customer relationships acquired in the CDMA business acquisition (Note 7).

Computer software that is not an integral part of any tangible assets, is recorded at cost less subsequent accumulated amortisation and impairment losses (Note 2(o)). Amortisation of computer software is calculated on a straight-line basis over the estimated useful lives, which mainly range from three to five years.

The customer relationships acquired in the CDMA business acquisition are recorded at the acquisitiondate fair value and amortised on a straight-line basis over the expected customer relationship of five years. By the end of the expected customer relationship period, fully amortised customer relationships were written off.

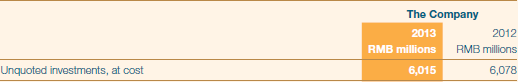

(l) Investments in subsidiaries

In the Company’s stand-alone statement of financial position, investments in subsidiaries are stated at cost less impairment losses (Note 2(o)).

(m) Investments

Investments in available-for-sale equity securities are carried at fair value with any change in fair value being recognised in other comprehensive income and accumulated separately in equity. For investments in available-for-sale equity securities, a significant or prolonged decline in the fair value of that investment below its cost is considered to be objective evidence of impairment. When these investments are derecognised or impaired, the cumulative gain or loss previously recognised in other comprehensive income is recognised in profit or loss. Investments in equity securities that do not have a quoted market price in an active market and whose fair value cannot be reliably measured are stated at cost less impairment losses (Note 2(o)).

(n) Operating lease charges

Where the Group has the use of assets held under operating leases, payments made under the leases are charged to profit or loss in equal installments over the accounting periods covered by the lease term, except where an alternative basis is more representative of the pattern of benefits to be derived from the leased asset. Lease incentives received are recognised in profit or loss as an integral part of the aggregate net lease payments made. Contingent rentals are charged to profit or loss in the accounting period in which they are incurred.

(o) Impairment

(i) Impairment of accounts and other receivables and investments in equity securities carried at cost

Accounts and other receivables and investments in equity securities carried at cost are reviewed at the end of each reporting period to determine whether there is objective evidence of impairment. Objective evidence of impairment includes observable data that comes to the attention of the Group about one or more of the following loss events:

- significant financial difficulty of the debtor;

- a breach of contract, such as a default or delinquency in interest or principal payments;

- it becoming probable that the debtor will enter bankruptcy or other financial reorganisation; and

- significant changes in the technological, market, economic or legal environment that have an adverse effect on the debtor.

The impairment loss for accounts and other receivables is measured as the difference between the asset’s carrying amount and the estimated future cash flows, discounted at the financial asset’s original effective interest rate where the effect of discounting is material, and is recognised as an expense in profit or loss.

The impairment loss for investments in equity securities carried at cost is measured as the difference between the asset’s carrying amount and the estimated future cash flows, discounted at the current market rate of return for a similar financial asset where the effect of discounting is material, and is recognised as an expense in profit or loss.

Impairment losses for accounts and other receivables are reversed through profit or loss if in a subsequent period the amount of the impairment losses decreases. Impairment losses for equity securities carried at cost are not reversed.

(ii) Impairment of long-lived assets

The carrying amounts of the Group’s long-lived assets, including property, plant and equipment, intangible assets and construction in progress are reviewed periodically to determine whether there is any indication of impairment. These assets are tested for impairment whenever events or changes in circumstances indicate that their recorded carrying amounts may not be recoverable. For goodwill, the impairment testing is performed annually at each year end.

The recoverable amount of an asset or cash-generating unit is the greater of its fair value less costs of disposal and value in use. When an asset does not generate cash flows largely independent of those from other assets, the recoverable amount is determined for the smallest group of assets that generates cash inflows independently (i.e. a cash-generating unit). In determining the value in use, expected future cash flows generated by the assets are discounted to their present value using a pre-tax discount rate that reflects current market assessments of time value of money and the risks specific to the asset. The goodwill arising from a business combination, for the purpose of impairment testing, is allocated to cash-generating units that are expected to benefit from the synergies of the combination.

An impairment loss is recognised if the carrying amount of an asset or its cash-generating unit exceeds its estimated recoverable amount. Impairment loss is recognised as an expense in profit or loss. Impairment loss recognised in respect of cash-generating units is allocated first to reduce the carrying amount of any goodwill allocated to the units and then to reduce the carrying amounts of the other assets in the unit (group of units) on a pro rata basis.

The Group assesses at the end of each reporting period whether there is any indication that an impairment loss recognised for an asset in prior years may no longer exist. An impairment loss is reversed if there has been a favourable change in the estimates used to determine the recoverable amount. A subsequent increase in the recoverable amount of an asset, when the circumstances and events that led to the write-down cease to exist, is recognised as an income in profit or loss. The reversal is reduced by the amount that would have been recognised as depreciation and amortisation had the write-down not occurred. An impairment loss in respect of goodwill is not reversed. For the years presented, no reversal of impairment loss was recognised in profit or loss.

(p) Revenue recognition

The revenue recognition methods of the Group are as follows:

(i)

Revenue derived from local, domestic long distance and international, Hong Kong, Macau and Taiwan long distance usage are recognised as the services are provided.

(ii)

Fees received for wireline installation charges for periods prior to 1 January 2012 are deferred and recognised over the expected customer relationship period. The direct costs associated with the installation of wireline services are deferred to the extent of the installation fees and amortised over the same expected customer relationship period. In 2012, since the amounts of fees received and the associated direct costs incurred are insignificant, the fees and associated direct costs are not deferred, and are recognized in profit or loss when received or incurred.

(iii)

Monthly service fees are recognised in the month during which the services are provided to customers.

(iv)

Revenue from sale of prepaid calling cards are recognised as the cards are used by customers.

(v)

Revenue derived from value-added services are recognised when the services are provided to customers.

Revenue from value-added services in which no third party service providers are involved, such as caller display and Internet data center services, are presented on a gross basis. Revenues from all other value-added services are presented on either gross or net basis based on the assessment of each individual arrangement with third parties. The following factors indicate that the Group is acting as principal in the arrangements with third parties:

i) The Group is responsible for providing the applications or services desired by customers, and takes responsibility for fulfillment of ordered applications or services, including the acceptability of the applications or services ordered or purchased by customers;

ii) The Group takes title of the inventory of the applications before they are ordered by customers;

iii) The Group has risks and rewards of ownership, such as risks of loss for collection from customers after applications or services are provided to customers;

iv) The Group establishes selling prices with customers;

v) The Group can modify the applications or perform part of the services;

vi) The Group has discretion in selecting suppliers used to fulfill an order; and

vii) The Group determines the nature, type, characteristics, or specifications of the applications or services.

If majority of the indicators of risks and responsibilities exist in the arrangements with third parties, the Group is acting as a principal and have exposure to the significant risks and rewards associated with the rendering of services or the sale of applications, and revenues for these services are recognised on gross basis. If majority of the indicators of risks and responsibilities do not exist in the arrangements with third parties, the Group is acting as an agent, and revenues for these services are recognised on a net basis.

(vi)

Revenue from the provision of Internet and telecommunications network resource services is recognised when the services are provided to customers.

(vii)

Interconnection fees from domestic and foreign telecommunications operators are recognised when the services are rendered as measured by the minutes of traffic processed.

(viii)

Lease income from operating leases is recognised over the term of the lease.

(ix)

Revenue derived from integrated information application services is recognised when the services are provided to customers.

(x)

Sale of equipment is recognised on delivery of the equipment to customers and when the significant risks and rewards of ownership and title have been transferred to the customers. Revenue from repair and maintenance of equipment is recognised when the service is provided to customers.

The Group offers promotional packages, which involve the bundled sales of terminal equipment (mobile handsets) and telecommunications services, to customers. The total contract consideration of a promotional package is allocated to revenues generated from the provision of telecommunications services and the sales of terminal equipment using the residual method. Under the residual method, the total contract consideration of the arrangement is allocated as follows: The undelivered component, which is the provision of telecommunications services, is measured at fair value, and the remainder of the contract consideration is allocated to the delivered component, which is the sales of terminal equipment. The Group recognises revenues generated from the delivery and sales of the terminal equipment when the title of the terminal equipment is passed to the customers whereas revenues generated from the provision of telecommunications services are recognised based upon the actual usage of such services. During each of the years in the two-year period ended 31 December 2013, a substantial portion of the total contract consideration is allocated to the provision of telecommunications services since the terminal equipment is typically provided free of charge or at a nominal amount to promote the Group’s core business of the provision of telecommunications services, and the fair value of the telecommunication services approximates the total contract consideration. The Group believes that the residual method of accounting for promotional packages provides the most relevant and reliable presentation method of the delivery and sales of the terminal equipment and telecommunication services since it reflects the economic substance of the arrangement.

(q) Advertising and promotion expense

The costs for advertising and promoting the Group’s telecommunications services are expensed as incurred. Advertising and promotion expense, which is included in selling, general and administrative expenses, was RMB36,490 million for the year ended 31 December 2013 (2012: RMB34,905 million), among which, the costs of terminal equipment offered as part of a promotional package to our customers for free or at a nominal amount to promote the Group’s telecommunication service amounted to RMB22,795 million for the year ended 31 December 2013 (2012: RMB21,754 million).

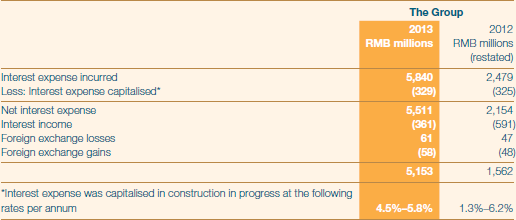

(r) Net finance costs

Net finance costs comprise interest income on bank deposits, interest costs on borrowings, and foreign exchange gains and losses. Interest income from bank deposits is recognised as it accrues using the effective interest method.

Interest costs incurred in connection with borrowings are calculated using the effective interest method and are expensed as incurred, except to the extent that they are capitalised as being directly attributable to the construction of an asset which necessarily takes a substantial period of time to get ready for its intended use.

(s) Research and development expense

Research and development expenditure is expensed as incurred. For the year ended 31 December 2013, research and development expense was RMB630 million (2012: RMB608 million).

(t) Employee benefits

The Group’s contributions to defined contribution retirement plans administered by the PRC government and defined contribution retirement plans administered by independent external parties are recognised in profit or loss as incurred. Further information is set out in Note 38.

Compensation expense in respect of the stock appreciation rights granted is accrued as a charge to the profit or loss over the applicable vesting period based on the fair value of the stock appreciation rights. The liability of the accrued compensation expense is re-measured to fair value at the end of each reporting period with the effect of changes in the fair value of the liability charged or credited to profit or loss. Further details of the Group’s stock appreciation rights scheme are set out in Note 39.

(u) Interest-bearing borrowings

Interest-bearing borrowings are recognised initially at fair value less attributable transaction costs. Subsequent to initial recognition, interest-bearing borrowings are stated at amortised cost with any difference between the amount initially recognised and the redemption value recognised in profit or loss over the period of the borrowings, together with any interest, using the effective interest method.

(v) Accounts and other payables

Accounts and other payables are initially recognised at fair value and thereafter stated at amortised cost unless the effect of discounting would be immaterial, in which case they are stated at cost.

(w) Provisions and contingent liabilities

A provision is recognised in the consolidated statement of financial position when the Group has a legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation. Where the time value of money is material, provisions are stated at the present value of the expenditure expected to settle the obligation.

Where it is not probable that an outflow of economic benefits will be required, or the amount cannot be estimated reliably, the obligation is disclosed as a contingent liability, unless the probability of outflow of economic benefits is remote. Possible obligations, whose existence will only be confirmed by the occurrence or non-occurrence of one or more future events, are also disclosed as contingent liabilities unless the probability of outflow of economic benefits is remote.

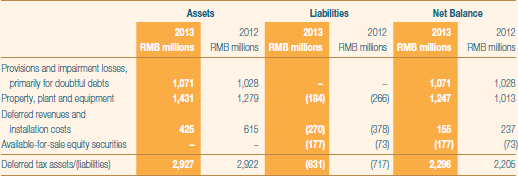

(x) Income tax

Income tax for the year comprises current tax and movement in deferred tax assets and liabilities. Income tax is recognised in profit or loss except to the extent that it relates to items recognised in other comprehensive income, or directly in equity, in which case the relevant amounts of tax are recognised in other comprehensive income or directly in equity respectively. Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the end of the reporting period, and any adjustment to tax payable in respect of previous years. Deferred tax is provided using the balance sheet liability method, providing for all temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and their tax bases. The amount of deferred tax is calculated on the basis of the enacted or substantively enacted tax rates that are expected to apply in the period when the asset is realised or the liability is settled. The effect on deferred tax of any changes in tax rates is charged or credited to profit or loss, except for the effect of a change in tax rate on the carrying amount of deferred tax assets and liabilities which were previously recognised in other comprehensive income, in such case the effect of a change in tax rate is also recognised in other comprehensive income.

A deferred tax asset is recognised only to the extent that it is probable that future taxable income will be available against which the asset can be utilised. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit will be realised.

Deferred tax liabilities are generally recognised for all taxable temporary differences. Deferred tax liabilities are recognised for taxable temporary differences associated with investments in subsidiaries and associates, except where the Group is able to control the reversal of the temporary difference and it is probable that the temporary difference will not reverse in the foreseeable future.

(y) Dividends

Dividends are recognised as a liability in the period in which they are declared.

(z) Related parties

(a)

A person, or a close member of that person’s family, is related to the Group if that person:

(i)

has control or joint control over the Group;

(ii)

has significant influence over the Group; or

(iii)

is a member of the key management personnel of the Group or the Group’s parent.

(b)

An entity is related to the Group if any of the following conditions applies:

(i)

The entity and the Group are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others);

(ii)

The entity is an associate or joint venture of the Group (or an associate or joint venture of a member of a group of which the Group is a member); or the Group is an associate or joint venture of the entity (or an associate or joint venture of a member of a group of which the entity is a member);

(iii)

The entity and the Group are joint ventures of the same third party;

(iv)

The entity is a joint venture of a third entity and the Group is an associate of the third entity; or the Group is a joint venture of a third entity and the entity is an associate of the third entity;

(v)

The entity is controlled or jointly controlled by a person identified in (a);

(vi)

A person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity).

Close members of the family of a person are those family members who may be expected to influence, or be influenced by, that person in their dealings with the entity.

(aa) Segmental reporting

An operating segment is a component of an entity that engages in business activities from which revenues are earned and expenses are incurred, and is identified on the basis of the internal financial reports that are regularly reviewed by the chief operating decision maker in order to allocate resource and assess performance of the segment. For the periods presented, management has determined that the Group has one operating segment as the Group is only engaged in the integrated telecommunications business. The Group’s assets located outside mainland China and operating revenues derived from activities outside mainland China are less than 10% of the Group’s assets and operating revenues, respectively. No geographical area information has been presented as such amount is immaterial. No single external customer accounts for 10 percent or more of the Group’s operating revenues.

-

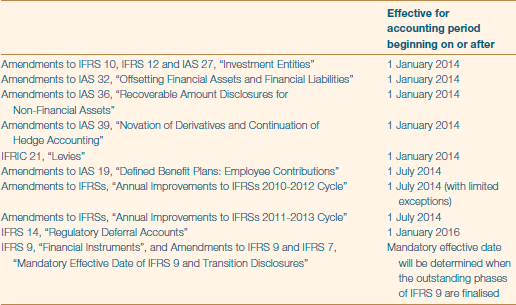

3. Application of New and Revised International Financial Reporting Standards

The IASB has issued a number of new and revised IFRSs that are effective for accounting period beginning on or after 1 January 2013. The Group applied the following new or revised IFRSs that are effective for the current year:

- Amendments to IAS 1, “Presentation of Financial Statements – Presentation of Items of Other Comprehensive Income”

- IFRS 10, “Consolidated Financial Statements”

- IFRS 12, “Disclosure of Interests in Other Entities”

- IFRS 13, “Fair Value Measurement”

- Amendments to IFRS 7,” Financial Instruments: Disclosures – Offsetting Financial Assets and Financial Liabilities”

- Revised IAS 19, “Employee Benefits”

The Group has not yet applied any new and revised standard or interpretation that is not yet effective for the current accounting period (Note 41).

Amendments to IAS 1, “Presentation of Financial Statements – Presentation of Items of Other Comprehensive Income”

The amendments introduced new terminology for the statement of comprehensive income and income statement. Under the amendments to IAS 1, “statement of comprehensive income” is renamed as “statement of profit or loss and other comprehensive income” and “income statement” is renamed as “statement of profit or loss”. However, the amendments to IAS 1 allow an entity to use titles for these statements other than those used in the amendments to IAS 1. The Group has not made any changes to the titles for these statements.

In addition, the amendments to IAS 1 require items of other comprehensive income to be grouped into two categories to disclose: (a) items that will not be reclassified subsequently to profit or loss; and (b) items that may be reclassified subsequently to profit or loss when specific conditions are met. Income tax on items of other comprehensive income is required to be allocated on the same basis – the amendments do not change the option to present items of other comprehensive income either before tax or net of tax.

The application of the amendments has no significant impact on the presentation of items of other comprehensive income of the Group.

IFRS 10, “Consolidated Financial Statements”

IFRS 10 replaces the parts of IAS 27, “Consolidated and Separate Financial Statements” that deal with consolidated financial statements and SIC 12, “Consolidation – Special Purpose Entities”. Under IFRS 10, there is only one basis for consolidation, that is, control. In addition, IFRS 10 includes a new definition of control that contains three elements: (a) has power over an investee, (b) has exposure, or rights, to variable returns from its involvement with the investee, and (c) has the ability to use its power over the investee to affect the amount of the investor’s returns. Extensive guidance has been added in IFRS 10 to deal with complex scenarios.

The application of IFRS 10 has no significant impact on the Group’s financial statements.

IFRS 12, “Disclosure of Interests in Other Entities”

IFRS 12 is a disclosure standard and brings together into a single standard all disclosure requirements applicable to entities’ interests in subsidiaries, joint arrangements, associates and unconsolidated structured entities. In general, the disclosure requirements in IFRS 12 are more extensive than those previously required by the respective standards.

The application of IFRS 12 has no significant impact on the Group’s financial statements.

IFRS 13, “Fair Value Measurement”

IFRS 13 establishes a single source of guidance for fair value measurements. The standard defines fair value, establishes a framework for measuring fair value, and requires disclosures about fair value measurements.

The scope of IFRS 13 is broad, and applies to both financial instrument items and non-financial instrument items for which other IFRSs require or permit fair value measurements and disclosures about fair value measurements, subject to a few exceptions.

The application of IFRS 13 has no significant impact on the Group’s financial statements.

Amendments to IFRS 7, “Financial Instruments: Disclosures – Offsetting Financial Assets and Financial Liabilities”

The amendments require entities to disclose information about rights of offset and related arrangements for financial instruments under an enforceable master netting agreement or similar arrangement.

The application of the amendments has no significant impact on the Group’s financial statements.

Revised IAS 19, “Employee Benefits”

Revised IAS 19, “Employee Benefits” mainly changes the accounting for defined benefit plans. This standard eliminates the “corridor approach” permitted under the previous version of IAS 19 and no longer permits the recognition of actuarial gains and losses to be deferred and recognised in profit or loss. All actuarial gains and losses should be recognised immediately through other comprehensive income.

The application of Revised IAS 19. “Employee Benefits” has no significant impact on the Group’s financial statements.

-

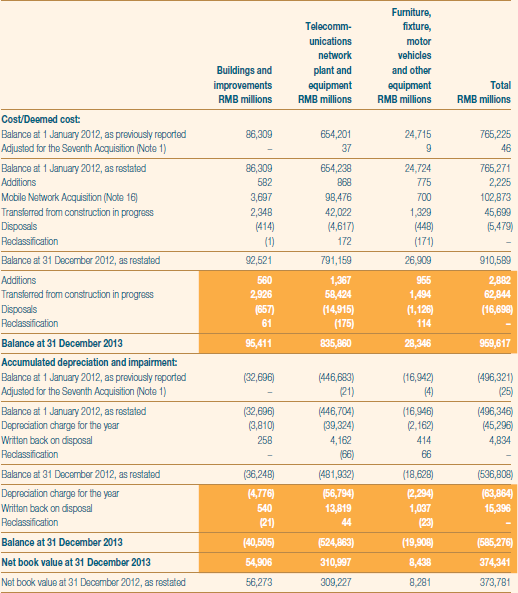

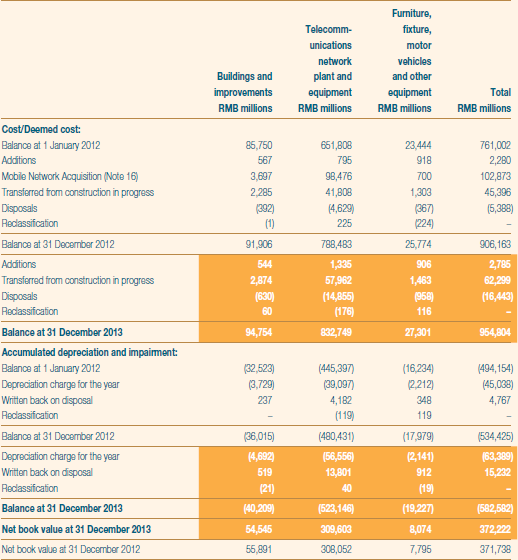

4. Property, Plant and Equipment, Net

-

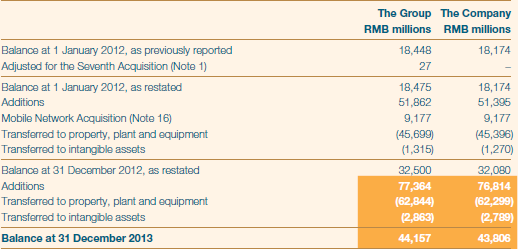

5. Construction in Progress

-

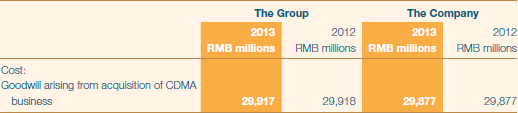

6. Goodwill

On 1 October 2008, the Group acquired the CDMA mobile communication business and related assets and liabilities, which also included the entire equity interests of China Unicom (Macau) Company Limited (currently known as China Telecom (Macau) Company Limited) and 99.5% equity interests of Unicom Huasheng Telecommunications Technology Company Limited (currently known as Tianyi Telecom Terminals Company Limited) (collectively the “CDMA business”) from China Unicom. The purchase price of the business combination was RMB43,800 million, which was fully settled as at 31 December 2010. In addition, pursuant to the acquisition agreement, the Group acquired the customer-related assets and assumed the customer-related liabilities of CDMA business for a net settlement amount of RMB3,471 million due from China Unicom. This amount was subsequently settled by China Unicom in 2009. The business combination was accounted for using the purchase method.

The goodwill recognised in the business combination is attributable to the skills and technical talent of the acquired business’s workforce, and the synergies expected to be achieved from integrating and combining the CDMA mobile communication business into the Group’s telecommunications business.

For the purpose of goodwill impairment testing, the goodwill arising from the acquisition of CDMA business was allocated to the appropriate cash-generating unit of the Group, which is the Group’s telecommunications business. The recoverable amount of the Group’s telecommunications business is estimated based on the value in use model, which considers the Group’s financial budgets covering a five-year period and a pre-tax discount rate of 10.6% (2012: 10.2%). Cash flows beyond the five-year period are projected to perpetuity at annual growth rate of 1.5%. Management performed impairment tests for the goodwill and determined that goodwill was not impaired. Management believes any reasonably possible change in the key assumptions on which the recoverable amount is based would not cause its recoverable amount to be less than carrying amount.

Key assumptions used for the value in use calculation model are the number of subscribers, average revenue per subscriber and gross margin. Management determined the number of subscribers, average revenue per subscriber and gross margin based on historical trends and financial information and operational data.

-

7. Intangible Assets

-

8. Investments in Subsidiaries

Details of the Company’s subsidiaries which principally affected the results, assets and liabilities of the Group at 31 December 2013 are as follows:

Except for Shenzhen Shekou Telecommunications Company Limited which is 51% owned by the Company and Zhejiang Yixin Technology Co., Ltd. which is 73% owned by the Company, all of the above subsidiaries are directly or indirectly wholly-owned by the Company. No subsidiaries of the Group have material non-controlling interest.

-

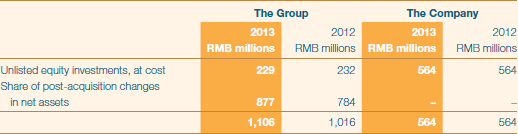

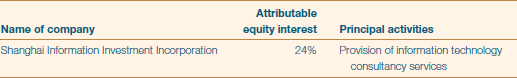

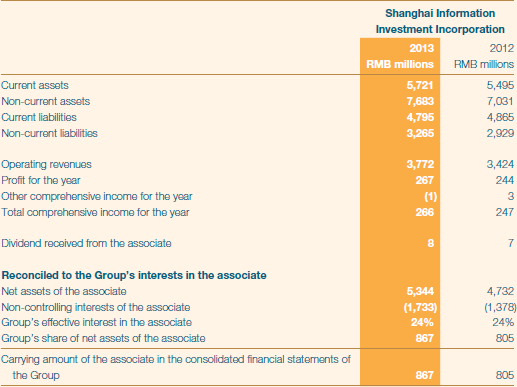

9. Interests in Associates

The Group’s and the Company’s interests in associates are accounted for under the equity method and the cost method, respectively, and are individually and in aggregate not material to the Group’s financial position or results of operations for all periods presented. Details of the Group’s principal associate are as follows:

The above associate is established in the PRC and is not traded on any stock exchange.

Summarised financial information of the Group’s principal associate and reconciled to the carrying amounts in the Group’s consolidated financial statements are disclosed below:

-

10. Investments

-

11. Deferred Tax Assets and Liabilities

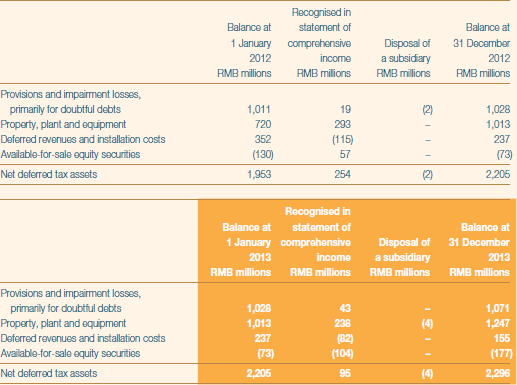

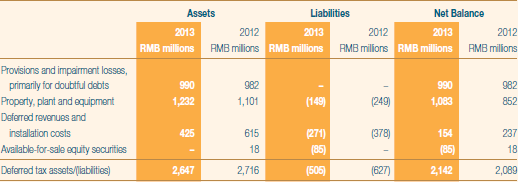

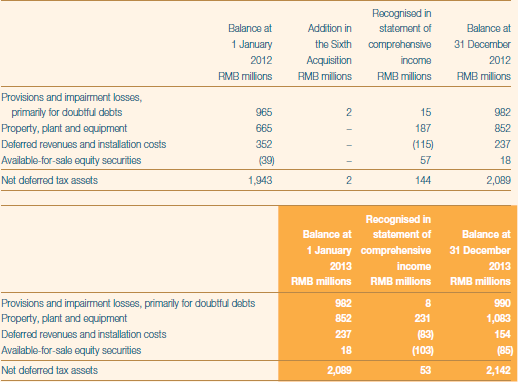

-

12. Inventories

-

13. Accounts Receivable, Net

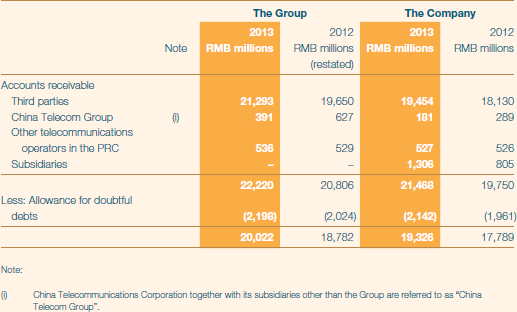

Accounts receivable, net, are analysed as follows:

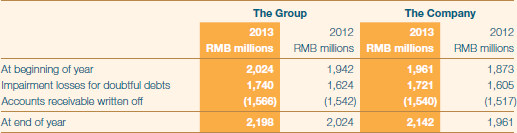

The following table summarises the changes in allowance for doubtful debts:

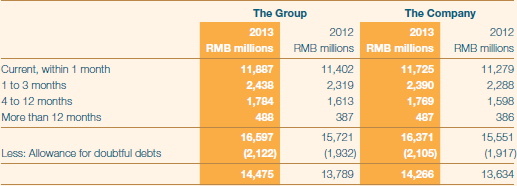

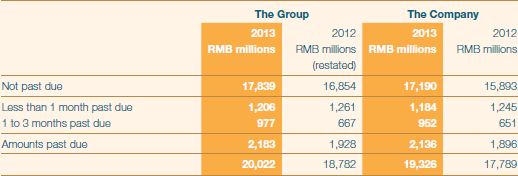

Ageing analysis of accounts receivable from telephone and Internet subscribers is as follows:

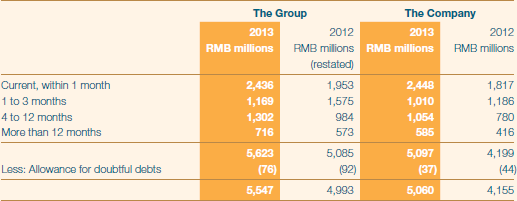

Ageing analysis of accounts receivable from other telecommunications operators and enterprise customers is as follows:

Ageing analysis of accounts receivable that are not impaired is as follows:

Amounts due from the provision of telecommunications services to customers are generally due within 30 days from the date of billing.

-

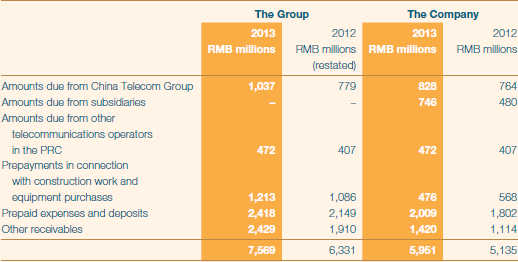

14. Prepayments and Other Current Assets

-

15. Cash and Cash Equivalents

-

16. Short-term and Long-term Debt and Payable

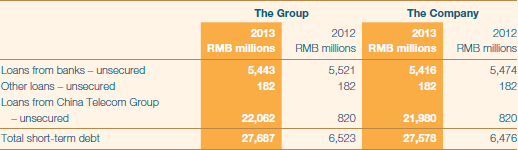

Short-term debt comprises:

The weighted average interest rate of the Group’s and the Company’s total short-term debt as at 31 December 2013 was 4.7% (2012: 5.5%) and 4.7% (2012: 5.5%) respectively. As at 31 December 2013, the loans from banks and other loans bear interest at rates ranging from 4.5% to 6.0% (2012: 4.5% to 6.7%) per annum and are repayable within one year; the loans from China Telecom Group bear interest at rate of 4.5% (2012: 4.5% to 4.7%) per annum and are repayable within one year.

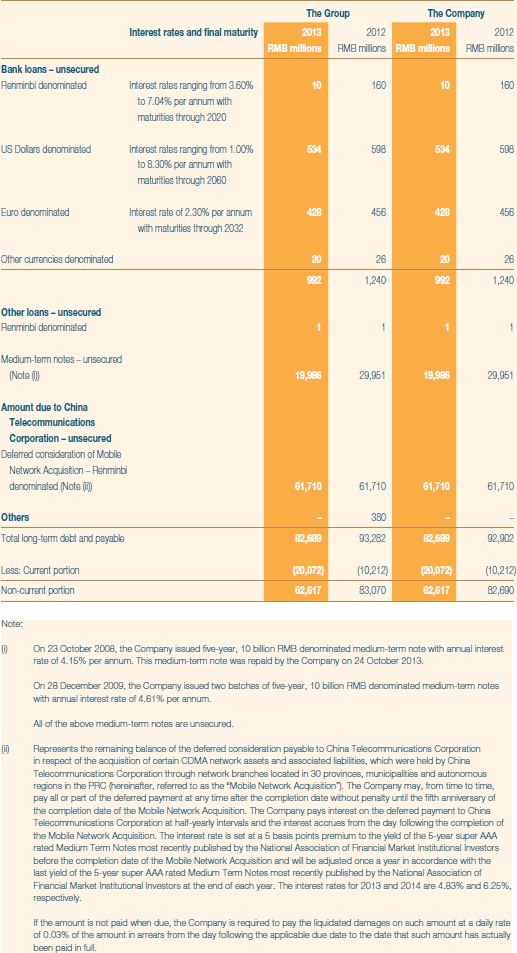

Long-term debt and payable comprises:

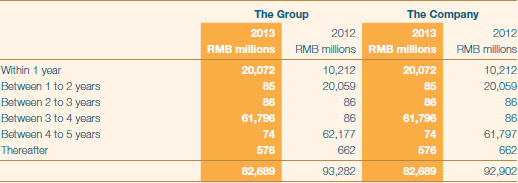

The aggregate maturities of the Group’s and the Company’s long-term debt and payable subsequent to 31 December 2013 are as follows:

The Group’s short-term and long-term debt and payable do not contain any financial covenants. As at 31 December 2013, the Group and the Company have unutilised committed credit facilities amounting to RMB157,694 million (2012: RMB163,130 million) and RMB157,694 million (2012: RMB163,127 million) respectively.

-

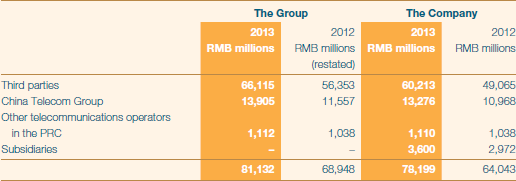

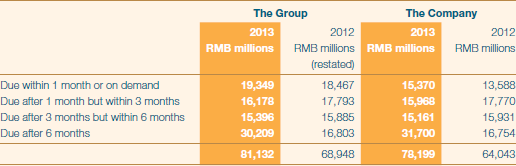

17. Accounts Payable

-

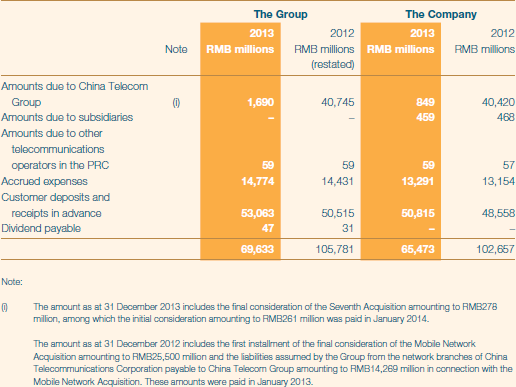

18. Accrued Expenses and Other Payables

-

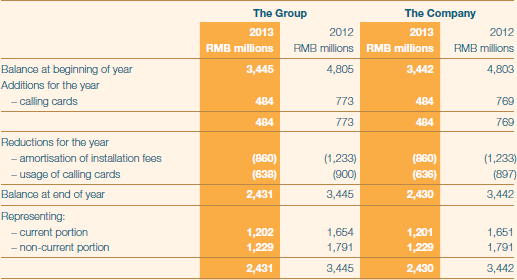

19. Deferred Revenues

Deferred revenues represent the unearned portion of installation fees for wireline services received from customers and the unused portion of calling cards.

Included in other assets are primarily capitalised direct costs associated with the installation of wireline services. As at 31 December 2013, the unamortised portion of these costs was RMB1,172 million (2012: RMB1,687 million).

-

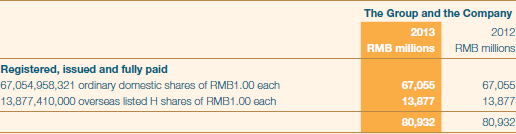

20. Share Capital

-

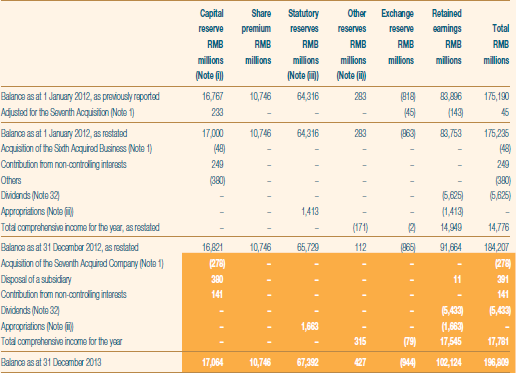

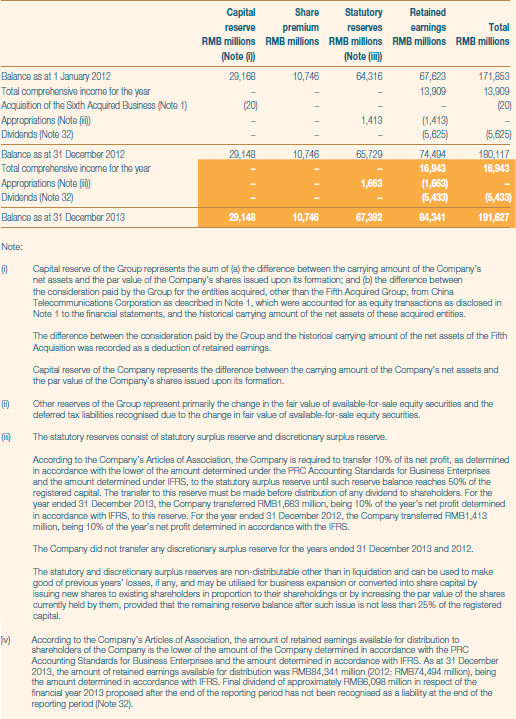

21. Reserves

-

22. Operating Revenues

-

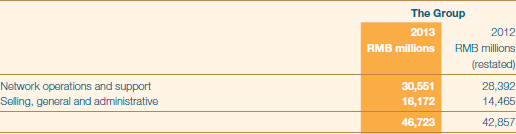

23. Network Operations and Support Expenses

-

24. Personnel Expenses

-

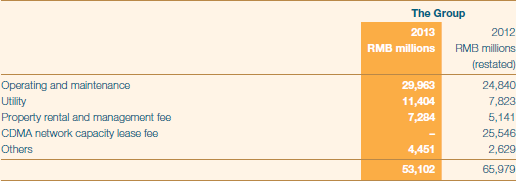

25. Other Operating Expenses

-

26. Total Operating Expenses

Total operating expenses for the year ended 31 December 2013 were RMB294,116 million (2012: RMB261,968 million) which include auditor’s remuneration in relation to audit and non-audit services are RMB60 million and RMB1 million respectively (2012: RMB90 million and RMB6 million).

-

27. Net Finance Costs

-

28. Income Tax

-

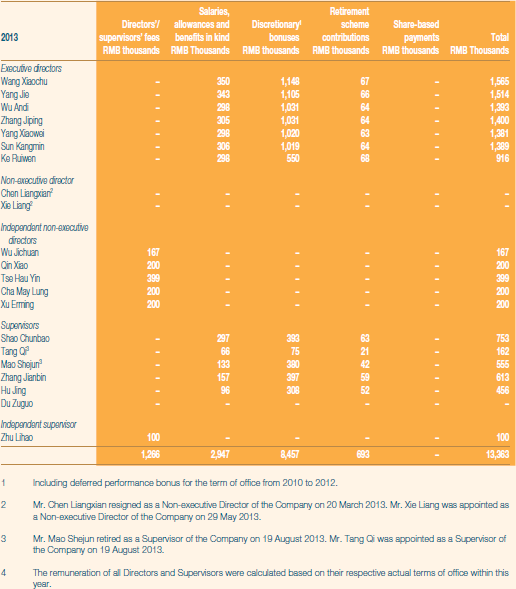

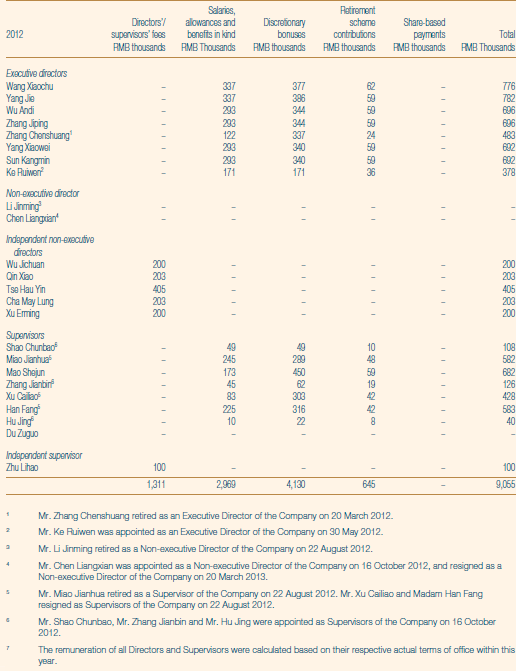

29. Directors’ and Supervisors’ Remuneration

-

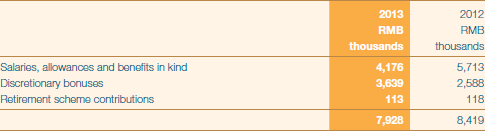

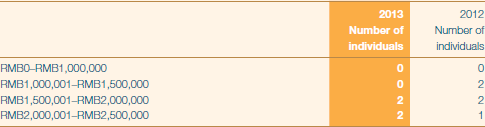

30. Individuals With Highest Emoluments and Senior Management Remuneration

(a) Five highest paid individuals

Of the five highest paid individuals of the Group for the year ended 31 December 2013, one of them was director of the Company and whose remuneration was disclosed in Note 29. None of the five highest paid individuals of the Group for the year ended 31 December 2012 were directors of the Company.

The aggregate of the emoluments in respect of the four (2012: five) individuals (non-directors) are as follows:

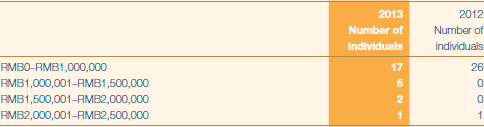

The emoluments of the four (2012: five) individuals (non-directors) with the highest emoluments are within the following bands:

None of these employees received any inducements or compensation for loss of office, or waived any emoluments during the periods presented.

(b) Senior management remuneration

The emoluments of the Group’s senior management are within the following bands:

-

31. Profit Attributable to Equity Holders of the Company

For the year ended 31 December 2013, the consolidated profit attributable to equity holders of the Company includes a profit of RMB16,633 million which has been dealt with in the stand-alone financial statements of the Company.

For the year ended 31 December 2012, the consolidated profit attributable to equity holders of the Company includes a profit of RMB14,134 million which has been dealt with in the stand-alone financial statements of the Company.

-

32. Dividends

Pursuant to a resolution passed at the Directors’ meeting on 19 March 2014, a final dividend of equivalent to HK$0.095 per share totaling approximately RMB6,098 million for the year ended 31 December 2013 was proposed for shareholders’ approval at the Annual General Meeting. The dividend has not been provided for in the consolidated financial statements for the year ended 31 December 2013.

Pursuant to the shareholders’ approval at the Annual General Meeting held on 29 May 2013, a final dividend of RMB0.067135 (equivalent to HK$0.085) per share totaling RMB5,433 million in respect of the year ended 31 December 2012 was declared and paid on 19 July 2013.

Pursuant to the shareholders’ approval at the Annual General Meeting held on 30 May 2012, a final dividend of RMB0.069506 (equivalent to HK$0.085) per share totaling RMB5,625 million in respect of the year ended 31 December 2011 was declared of which RMB5,235 million was paid on 20 July 2012. The remaining amounts were paid by December 2012.

-

33. Basic Earnings Per Share

The calculation of basic earnings per share for the years ended 31 December 2013 and 2012 is based on the profit attributable to equity holders of the Company of RMB17,545 million and RMB14,949 million respectively, divided by 80,932,368,321 shares.

The amount of diluted earnings per share is not presented as there were no dilutive potential ordinary shares in existence for the periods presented.

-

34. Commitments and Contingencies

Operating lease commitments

The Group leases business premises and equipment through non-cancellable operating leases. These operating leases do not contain provisions for contingent lease rentals. None of the rental agreements contain escalation provisions that may require higher future rental payments nor impose restrictions on dividends, additional debt and/or further leasing.

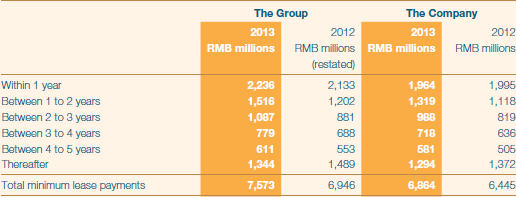

As at 31 December 2013 and 2012, the Group’s and the Company’s future minimum lease payments under non-cancellable operating leases are as follows:

Total rental expense in respect of operating leases charged to profit or loss for the year ended 31 December 2013 was RMB6,057 million (2012: RMB29,434 million).

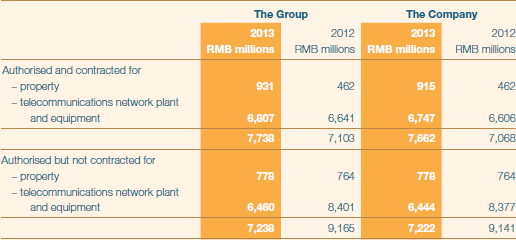

Capital commitments

As at 31 December 2013 and 2012, the Group and the Company had capital commitments as follows:

Contingent liabilities

(a)

The Company and the Group were advised by their PRC lawyers that, no material contingent liabilities were assumed by the Company or the Group.

(b)

As at 31 December 2013 and 2012, the Group did not have contingent liabilities in respect of guarantees given to banks in respect of banking facilities granted to other parties, or other forms of contingent liabilities.

As at 31 December 2013 and 2012, the Company did not have contingent liabilities in respect of guarantees given to banks in respect of banking facilities granted to subsidiaries.

Legal contingencies

The Group is a defendant in certain lawsuits as well as the named party in other proceedings arising in the ordinary course of business. Management has assessed the likelihood of an unfavourable outcome of such contingencies, lawsuits or other proceedings and based on such assessment, believes that any resulting liabilities will not have a material adverse effect on the financial position, operating results or cash flows of the Group.

-

35. Financial Instruments

Financial assets of the Group and the Company include cash and cash equivalents, time deposits, investments, accounts receivable, advances and other receivables. Financial liabilities of the Group and the Company include short-term and long-term debts and payable, accounts payable, accrued expenses and other payables. The Group and the Company do not hold nor issue financial instruments for trading purposes.

(a) Fair Value Measurements

Based on IFRS 13, Fair Value Measurement, the fair value of each financial instrument is categorised in its entirety based on the lowest level of input that is significant to that fair value measurement. The levels are defined as follows:

- Level 1: fair values measured using quoted prices (unadjusted) in active markets for identical financial instruments

- Level 2: fair values measured using quoted prices in active markets for similar financial instruments, or using valuation techniques in which all significant inputs are directly or indirectly based on observable market data

- Level 3: fair values measured using valuation techniques in which any significant input is not based on observable market data

The fair values of the Group and the Company’s financial instruments (other than long-term debt and payable and available-for-sale equity investment securities) approximate their carrying amounts due to the short-term maturity of these instruments.

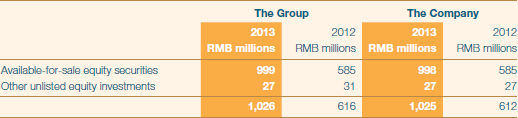

The Group and the Company’s available-for-sale equity investment securities are categorised as level 1 financial instruments. As at 31 December 2013, the fair value of the Group and the Company’s available-for-sale equity investment securities are RMB999 million (2012: RMB585 million) and RMB998 million (2012: RMB585 million), respectively, based on quoted market price on a PRC stock exchange. The Group and the Company’s long-term investments, other than the available-for-sale equity investment securities, are unlisted equity interests for which no quoted market prices exist in the PRC and accordingly, a reasonable estimate of their fair values could not be made without incurring excessive costs.

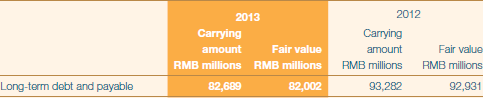

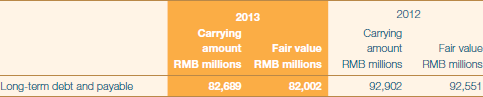

The fair values of long-term indebtedness are estimated by discounting future cash flows using current market interest rates offered to the Group and the Company for debt with substantially the same characteristics and maturities. The fair value measurement of long-term indebtedness is categorized as level 2. The interest rates used by the Group and the Company in estimating the fair values of long-term debt and payable, having considered the foreign currency denomination of the debt, ranged from 1.0% to 6.8% (2012: 1.0% to 6.8%). As at 31 December 2013 and 2012, the carrying amounts and fair values of the Group and the Company’s long-term debt and payable were as follows:

The Group

The Company

During the year, there were no transfers among instruments in level 1, level 2 or level 3.

(b) Risks

The Group and the Company’s financial instruments are exposed to three main types of risks, namely, credit risk, liquidity risk and market risk (which comprises of interest rate risk and foreign currency exchange rate risk). The Group and the Company’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Group and the Company’s financial performance. Risk management is carried out under policies approved by the Board of Directors. The Board provides principles for overall risk management, as well as policies covering specific areas, such as liquidity risk, credit risk, and market risk. The Board regularly reviews these policies and authorises changes if necessary based on operating and market conditions and other relevant risks. The following summarises the qualitative and quantitative disclosures for each of the three main types of risks:

(i) Credit risk

Credit risk refers to the risk that a counterparty will be unable to pay amounts in full when due. For the Group and the Company, this arises mainly from deposits it maintains at financial institutions and credit it provides to customers for the provision of telecommunications services. To limit exposure to credit risk relating to deposits, the Group and the Company primarily place cash deposits only with large state-owned financial institutions in the PRC with acceptable credit ratings. For accounts receivable, management performs ongoing credit evaluations of its customers’ financial condition and generally does not require collateral on accounts receivable. Furthermore, the Group and the Company has a diversified base of customers with no single customer contributing more than 10% of revenues for the periods presented. Further details of the Group and the Company’s credit policy and quantitative disclosures in respect of the Group and the Company’s exposure on credit risk for accounts receivable are set out in Note 13.

(ii) Liquidity risk

Liquidity risk refers to the risk that funds will not be available to meet liabilities as they fall due, and results from timing and amount mismatches of cash inflow and outflow. The Group and the Company manages liquidity risk by maintaining sufficient cash balances and adequate amount of committed banking facilities to meet its funding needs, including working capital, principal and interest payments on debts, dividend payments, capital expenditures and new investments for a set minimum period of between 3 to 6 months.

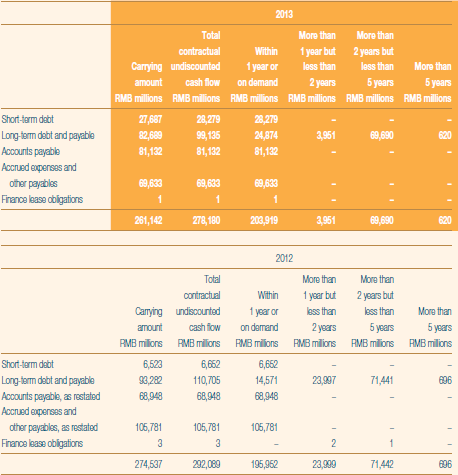

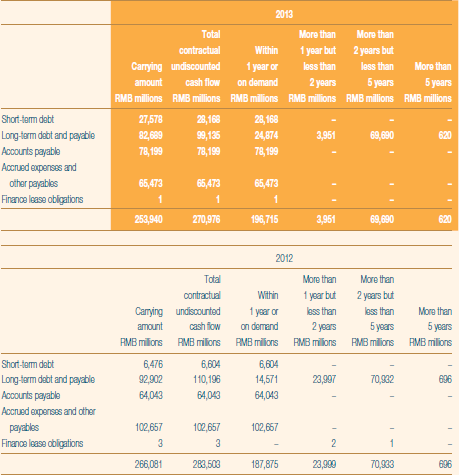

The following table sets out the remaining contractual maturities at the end of the reporting period of the Group and the Company’s financial liabilities, which are based on contractual undiscounted cash flows (including interest payments computed using contractual rates or, if floating, based on prevailing rates at the end of the reporting period) and the earliest date the Group and the Company would be required to repay:

The Group

The Company

Management believes that the Group and the Company’s current cash on hand, expected cash flows from operations and available credit facilities from banks (Note 16) will be sufficient to meet the Group and the Company’s working capital requirements and repay its borrowings and obligations when they become due.

(iii) Interest rate risk

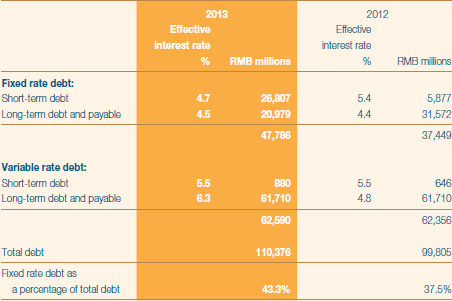

The Group and the Company’s interest rate risk exposure arises primarily from its short-term debts and long-term debts and payable. Debts carrying interest at variable rates and at fixed rates expose the Group and the Company to cash flow interest rate risk and fair value interest rate risk, respectively. The Group and the Company manages its exposure to interest rate risk by closely monitoring the change in the market interest rate.

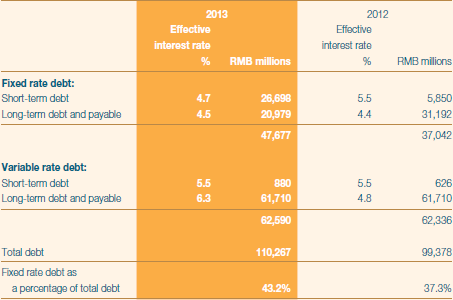

The following table sets out the interest rate profile of the Group and the Company’s debt at the end of the reporting period:

The Group

The Company

As at 31 December 2013, it is estimated that an increase of 100 basis points in interest rate, with all other variables held constant, would decrease the Group and the Company’s net profit for the year and retained earnings by approximately RMB469 million (2012: RMB468 million).

The above sensitivity analysis has been prepared on the assumptions that the change of interest rate was applied to the Group and the Company’s debt in existence at the end of the reporting period with exposure to cash flow interest rate risk. The analysis is prepared on the same basis for 2012.

(iv) Foreign currency exchange rate risk

Foreign currency exchange rate risk arises on financial instruments that are denominated in a currency other than the functional currency in which they are measured. The Group and the Company’s foreign currency risk exposure relates to bank deposits and borrowings denominated primarily in US dollars, Euros and Hong Kong dollars.

Management does not expect the appreciation or depreciation of the Renminbi against foreign currencies will materially affect the Group and the Company’s financial position and result of operations because 94.3% (2012: 97.2%) of the Group and 99.2% (2012: 99.2%) of the Company’s cash and cash equivalents and 99.1% (2012: 98.9%) and of the Group and the Company’s short-term and long-term debt and payable as at 31 December 2013 are denominated in Renminbi. Details of bank loans denominated in other currencies are set out in Note 16.

-

36. Capital Management

The Group’s primary objectives when managing capital are to safeguard the Group’s ability to continue as a going concern, so that it can continue to provide investment returns for shareholders and benefits for other stakeholders, by pricing products and services commensurately with the level of risk and by securing access to finance at a reasonable cost.

Management regularly reviews and manages its capital structure to maintain a balance between the higher shareholder returns that might be possible with higher levels of borrowings and the advantages and security afforded by a sound capital position, and makes adjustments to the capital structure in light of changes in economic conditions.

Management monitors its capital structure on the basis of total debt-to-total assets ratio. For this purpose the Group defines total debt as the sum of short-term debt, long-term debt and payable, and finance lease obligations. As at 31 December 2013, the Group’s total debt-to-total assets ratio was 20.3% (2012: 18.3%), which is within the range of management’s expectation.

Neither the Company nor any of its subsidiaries are subject to externally imposed capital requirements.

-

37. Related Party Transactions

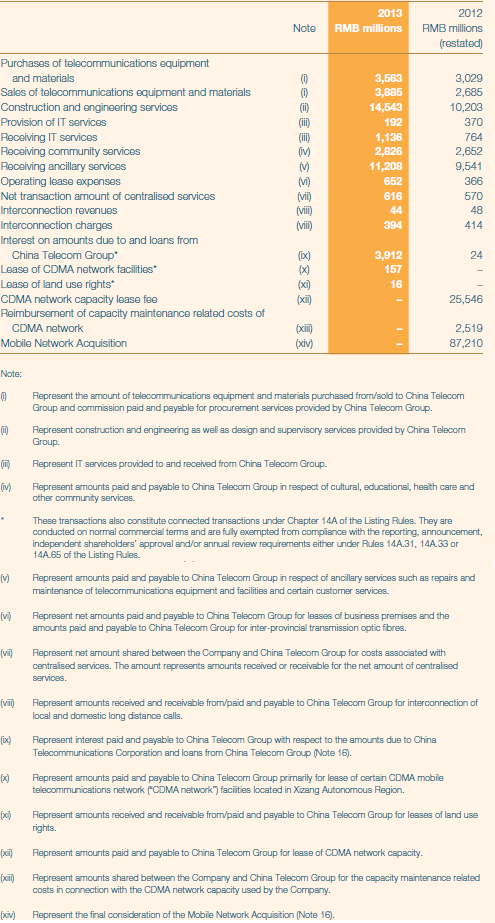

(a) Transactions with China Telecom Group

The Group is a part of companies under China Telecommunications Corporation, a company owned by the PRC government, and has significant transactions and business relationships with members of China Telecom Group.

The principal transactions with China Telecom Group are as follows. The majority of these transactions also constitute continuing connected transactions under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and have complied with the disclosure requirements under Chapter 14A of the Listing Rules. Further details of these continuing connected transactions are disclosed under the paragraph “Connected Transactions” in the report of directors.

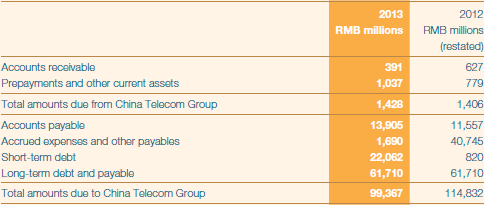

Amounts due from/to China Telecom Group are summarised as follows:

Amounts due from/to China Telecom Group, other than short-term debt and long-term debt and payable, bear no interest, are unsecured and are repayable in accordance with contractual terms which are similar to those terms offered by third parties. The terms and conditions associated with short-term debt and long-term debt and payable due to China Telecom Group are set out in Note 16.

As at 31 December 2013 and 2012, no material allowance for doubtful debts was recognised in respect of amounts due from China Telecom Group.

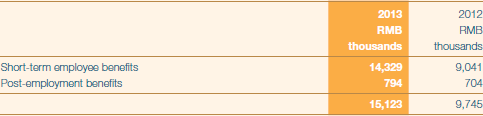

(b) Key management personnel compensation

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Group, directly or indirectly, including directors and supervisors of the Group.

Key management personnel compensation of the Group is summarised as follows:

The above remuneration is included in personnel expenses.

(c) Contributions to post-employment benefit plans

The Group participates in various defined contribution post-employment benefit plans organised by municipal, autonomous regional and provincial governments for its employees. Further details of the Group’s post-employment benefit plans are disclosed in Note 38.

(d) Transactions with other government-related entities in the PRC

The Group is a government-related enterprise and operates in an economic regime currently dominated by entities directly or indirectly controlled by the People’s Republic of China through government authorities, agencies, affiliations and other organisations (collectively referred to as “government-related entities”).

Apart from transactions with parent company and its fellow subsidiaries (Note 37(a)), the Group has, collectively but not individually, significant transactions with other government-related entities, which include but not limited to the following:

- rendering and receiving services, including but not limited to telecommunications services

- sales and purchases of goods, properties and other assets

- lease of assets

- depositing and borrowing

- use of public utilities

These transactions are conducted in the ordinary course of the Group’s business on terms comparable to the terms of transactions with other entities that are not government-related. The Group prices its telecommunications services and products based on government-regulated tariff rates, where applicable, or based on commercial negotiations. The Group has also established procurement policies and approval processes for purchases of products and services, which do not depend on whether the counterparties are government-related entities or not.

The directors believe the above information provides appropriate disclosure of related party transactions.

-

38. Post-Employment Benefits Plans

As stipulated by the regulations of the PRC, the Group participates in various defined contribution retirement plans organised by municipal, autonomous regional and provincial governments for its employees. The Group is required to make contributions to the retirement plans at rates ranging from 18% to 20% of the salaries, bonuses and certain allowances of the employees. A member of the plan is entitled to a pension equal to a fixed proportion of the salary prevailing at the member’s retirement date. Other than the above, the Group also participates in supplementary defined contribution retirement plans managed by independent external parties whereby the Group is required to make contributions to the retirement plans at fixed rates of the employees’ salaries, bonuses and certain allowances. The Group has no other material obligation for the payment of pension benefits associated with these plans beyond the annual contributions described above.

The Group’s contributions for the above plans for the year ended 31 December 2013 were RMB5,682 million (2012: RMB5,049 million).

The amount payable for contributions to the above defined contribution retirement plans as at 31 December 2013 was RMB707 million (2012: RMB617 million).

-

39. Stock Appreciation Rights

The Group implemented a stock appreciation rights plan for members of its management to provide incentives to these employees. Under this plan, stock appreciation rights are granted in units with each unit representing one H share. No shares will be issued under the stock appreciation rights plan. Upon exercise of the stock appreciation rights, a recipient will receive, subject to any applicable withholding tax, a cash payment in RMB, translated from the Hong Kong dollar amount equal to the product of the number of stock appreciation rights exercised and the difference between the exercise price and market price of the Company’s H shares at the date of exercise based on the applicable exchange rate between RMB and Hong Kong dollar at the date of the exercise. The Company recognises compensation expense of the stock appreciation rights over the applicable vesting period.

In 2012, the Company approved the granting of 916.7 million stock appreciation right units to eligible employees. Under the terms of this grant, all stock appreciation rights had a contractual life of five years from date of grant and an exercise price of HK$4.76 per unit. A recipient of stock appreciation rights may exercise the rights in stages commencing November 2013. As at each of the third, fourth and fifth anniversary of the date of grant, the total number of stock appreciation rights exercisable may not in aggregate exceed 33.3%, 66.7% and 100%, respectively, of the total stock appreciation rights granted to such person.

During the year ended 31 December 2013 and 2012, no stock appreciation right units were exercised. For the year ended 31 December 2013, compensation expense of RMB39 million was reversed by the Group in respect of stock appreciation rights as a result of decline in share price of the Company. For the year ended 31 December 2012, compensation expense of RMB163 million was recognised by the Group in respect of stock appreciation rights.

As at 31 December 2013, the carrying amount of the liability arising from stock appreciation rights was RMB124 million (2012: RMB163 million). As at 31 December 2013, 305 million stock appreciation right units vested but were not exercised. The carrying amount of the corresponding liability was RMB41 million. As at 31 December 2012, no stock appreciation right units were vested.

-

40. Accounting Estimates and Judgements