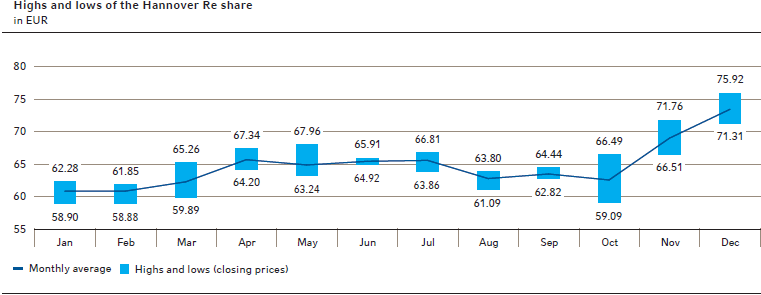

Hannover Re share reaches new all-time high of EUR 75.92

The Hannover Re share stood at EUR 62.38 as 2014 got underway. In the early weeks of the year the share moved lower, retreating to its lowest point of the year on 3 February 2014 at EUR 58.88. This slide was prompted by the challenging round of fiercely competitive renewals in property and casualty reinsurance and the associated rate erosion. The price rally that subsequently took hold was chiefly driven by a major loss experience that was significantly lower than expected overall as well as analyst expectations surrounding the sustained healthy profit outlook for Hannover Re. This latter assumption is based on the recognition that Hannover Re, thanks to its thoroughly comfortable capital resources and very conservatively calculated loss reserves, should be in a position to deliver good results even in a highly competitive market environment and despite reduced growth prospects. The company’s robust capitalisation also triggered debate among investors as to the possibility of a higher payout ratio or a share repurchase programme. Against this backdrop the share ultimately soared to its new record high of EUR 75.92 on 23 December. On the back of its price rally in the fourth quarter the Hannover Re share closed the financial year with a gain of 20.2% at EUR 74.97, thereby delivering a performance of 25.8% including reinvested dividends. Over the year the Hannover Re share thus clearly outperformed its benchmark indices, namely the DAX (+2.7%) and MDAX (+2.2%), and also beat the Global Reinsurance (Performance) Index (+24.4%).

In a three-year comparison the Hannover Re share delivered a performance (including reinvested dividends) of 125.2%. It therefore once again clearly outperformed the DAX (66.3%) and MDAX (90.2%) benchmark indices and the Global Reinsurance Index (94.3%).

Based on the year-end closing price of EUR 74.97, the market capitalisation of the Hannover Re Group totalled EUR 9.0 billion at the end of the 2014 financial year, an increase of EUR 1.5 billion or 20.2% compared to the previous year’s figure of EUR 7.5 billion. According to the rankings drawn up by Deutsche Börse AG, the company placed ninth in the MDAX at the end of December with a free float market capitalisation of EUR 4,396.4 million. Measured by trading volume over the past twelve months, the share came in at number 11 in the MDAX with a volume of EUR 3,311.7 million. All in all, the Hannover Re Group thus continues to rank among the 40 largest listed companies in Germany.

With a book value per share of EUR 62.61 the Hannover Re share showed a price-to-book (P / B) ratio of 1.2 at the end of the year under review; compared to the average MDAX P / B ratio of 2.17 as at year-end the share thus continues to be very moderately valued.

More Information

Topic related links within the report:

- Share data

- Figures

- Statement of changes in shareholders’ equity

- 8.5 Earnings per share and dividend proposal

Topic related links outside the report: