Property & Casualty reinsurance

| Key figures for Property & Casualty reinsurance | ||||||

|---|---|---|---|---|---|---|

| in EUR million | 2014 | +/- previous year |

2013 | 20121 | 2011 | 2010 |

| Gross written premium | 7,903.4 | +1.1% | 7,817.9 | 7,717.5 | 6,825.5 | 6,339.3 |

| Net premium earned | 7,011.3 | +2.1% | 6,866.3 | 6,854.0 | 5,960.8 | 5,393.9 |

| Underwriting result | 351.5 | +4.8% | 335.5 | 272.2 | (268.7) | 82.4 |

| Net investment income | 843.6 | +8.0% | 781.2 | 944.5 | 845.4 | 721.2 |

| Operating result (EBIT) | 1,190.8 | +12.2% | 1,061.0 | 1,091.4 | 599.3 | 879.6 |

| Group net income | 829.1 | +2.7% | 807.7 | 685.6 | 455.6 | 581.0 |

| Earnings per share in EUR | 6.88 | +2.7% | 6.70 | 5.68 | 3.78 | 4.82 |

| EBIT margin 2 | 17.0% | 15.5% | 15.9% | 10.1% | 16.3% | |

| Retention | 90.6% | 89.9% | 90.2% | 91.3% | 88.9% | |

| Combined ratio 3 | 94.7% | 94.9% | 95.8% | 104.3% | 98.2% | |

| 1 Adjusted pursuant to IAS 8 2 Operating result (EBIT) / net premium earned 3 Including expenses on funds withheld and contract deposits |

||||||

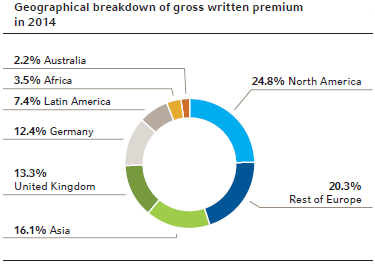

Accounting for 55% of our premium volume, Property & Casualty reinsurance is Hannover Re’s largest business group. Effective 1 September 2014 we reorganised the responsibilities in property and casualty reinsurance owing to a change on the Executive Board, as a result of which the composition of our Board areas of responsibility – “Target markets”, “Specialty lines worldwide” and “Global reinsurance” – differs somewhat from the previous year in terms of markets and regions.

In many property and casualty reinsurance markets competition intensified still further in the year under review. This was driven by the renewed absence of market-changing major losses as well as the tendency among ceding companies to carry more risks in their retention thanks to their healthy capital resources. As a further factor, additional capacities from the market for catastrophe bonds (ILS) and alternative capacities, especially in US natural catastrophe business, led to appreciable price erosion.

Hannover Re counters this fiercely competitive climate with a profit-oriented underwriting policy and is thus well placed to handle the challenging market conditions. In regions and lines where prices failed to satisfy our profitability requirements we systematically reduced our shares. In areas where margins were commensurate with the risks we expanded our business. This strategy of active cycle management enables us – despite soft market conditions – to preserve the high rate quality of our portfolio. Overall, Hannover Re again benefited from its enduring customer relationships as well as its position as one of the world’s leading and most financially robust reinsurance groups.

We are broadly satisfied with the outcome of the various rounds of treaty renewals during the year under review. The largest business volume was renewed on 1 January 2014, the date when almost two-thirds of our treaties in traditional reinsurance were renegotiated. Thanks to our underwriting discipline we were for the most part able to achieve adequate margins. Rate increases were booked above all under loss-impacted programmes: this was especially true of catastrophe covers in Germany and Canada as well as marine business, which had incurred significant losses in 2012 and 2013. We acted on opportunities for further growth in the markets of Asia, Latin America as well as Central and Eastern Europe. On the other hand, rate reductions had to be accepted for property catastrophe business in the United States and in the aviation line owing to very good underwriting results from the previous year. Although property and casualty reinsurance as a whole was overshadowed by soft market conditions and rate erosion, we nevertheless also discerned some positive signals in the second half of the year.

The total gross premium volume for our Property & Casualty reinsurance business group climbed in the year under review – not least thanks to new business opportunities – by a modest 1.1% to EUR 7.9 billion (previous year: EUR 7.8 billion); at constant exchange rates growth would have reached 1.2%. We had anticipated a broadly stable currency-adjusted premium volume. The level of retained premium rose to 90.6% (89.9%). Net premium earned increased by 2.1% to EUR 7.0 billion (EUR 6.9 billion); growth would have also been 2.1% at constant exchange rates.

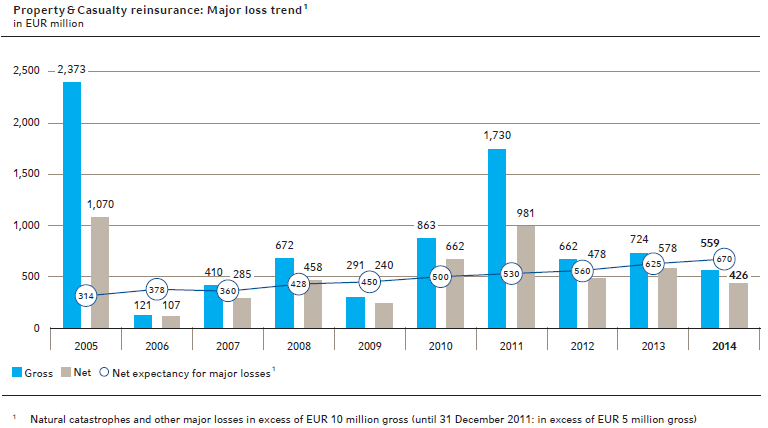

As in the previous year, the burden of major losses that we incurred in 2014 remained moderate. The year under review was, however, one of heavy losses for the aviation line. A number of crashes involving passenger aircraft cost hundreds of lives. In addition, several planes were destroyed on the ground at Tripoli airport.

Even though the hurricane season in North America and the Caribbean again passed off thoroughly innocuously, the year under review still saw a number of natural catastrophe events. In Western Europe the heaviest losses were caused by storm Ela, with a net strain of EUR 49.1 million for Hannover Re’s account. These and other major losses (see also page 88) resulted in net loss expenditure for our company totalling EUR 425.7 million (EUR 577.6 million), a figure well below our expected level of EUR 670 million.

We improved further on the good combined ratio of the previous year (94.9%) to post a figure of 94.7% in the year under review, once again comfortably beating the target mark of 96%. The underwriting result including administrative expenses also showed another modest improvement to reach EUR 351.5 million (EUR 335.5 million).

Investment income in the Property & Casualty reinsurance group climbed in the year under review by a very pleasing 8.0% to EUR 843.6 million (EUR 781.2 million). The operating profit (EBIT) increased by 12.2% to EUR 1,190.8 million, clearly demonstrating that profitability was maintained on a high level even in such a competitive environment. Group net income for the Property & Casualty reinsurance business group, which had been positively influenced by a tax effect in the previous year, improved again to EUR 829.1 million (EUR 807.7 million); this is the highest figure ever recorded. Earnings per share stood at EUR 6.88 (EUR 6.70) for this business group.

On the following pages we report in detail on developments in the individual markets and lines of our Property & Casualty reinsurance group, which is split into the three areas of Board responsibility referred to at the beginning of this section.

| Property & Casualty reinsurance: Key figures for individual markets and lines in 2014 | ||||||

|---|---|---|---|---|---|---|

| Gross

premium 2014 in EUR million | Change in gross premium relative to previous year | Gross

premium

2013 in EUR million | EBIT in | Combined ratio | Maximum tolerable combined ratio (MtCR) | |

| Target markets | 2,619.4 | -0.6% | 2,634.2 | 507.6 | 92.5% | 95.9% |

| North America | 1,213.4 | 3.1% | 1,177.3 | 258.2 | 91.8% | 95.1% |

| Continental Europe | 1,406.1 | -3.5% | 1,456.9 | 249.4 | 93.1% | 96.5% |

| Specialty lines worldwide | 2,575.6 | -5.2% | 2,716.8 | 169.4 | 100.2% | 95.9% |

| Marine | 280.6 | -4.1% | 292.7 | 85.7 | 67.2% | 94.2% |

| Aviation | 364.0 | -9.4% | 401.7 | (2.4) | 112.1% | 97.3% |

| Credit, surety and political risks | 531.4 | -10.3% | 592.5 | 87.2 | 92.2% | 96.0% |

| UK, Ireland, London market and direct business | 442.0 | -21.2% | 561.2 | (12.8) | 110.3% | 95.5% |

| Facultative reinsurance | 957.6 | 10.2% | 868.7 | 11.8 | 103.9% | 95.8% |

| Global reinsurance | 2,708.4 | 9.8% | 2,466.9 | 513.8 | 91.6% | 95.9% |

| Worldwide treaty reinsurance | 1,480.7 | 0.2% | 1,477.6 | 225.6 | 98.5% | 98.1% |

| Catastrophe XL (Cat XL) | 310.0 | -16.6% | 371.5 | 185.6 | 39.3% | 75.5% |

| Structured reinsurance and Insurance-linked securities | 917.7 | 48.6% | 617.8 | 102.6 | 94.1% | 99.4% |

Target markets

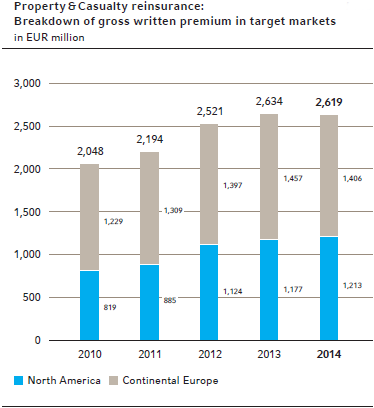

We classify North America and Continental Europe as target markets. The premium volume remained virtually unchanged at EUR 2,619.4 million (EUR 2,634.2 million). This puts us in line with our planning. The combined ratio improved to 92.5% (100.4%), as a consequence of which the operating profit (EBIT) rose very substantially to EUR 507.6 million (EUR 277.2 million).

North America

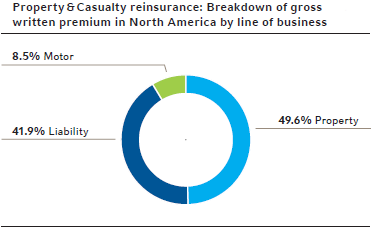

The North American (re)insurance market is the largest single market both worldwide and for Hannover Re. Our business is written through brokers.

After pausing for breath in the first half of 2014, the US economy picked up the pace of growth again as the year progressed, hence also pushing up the premium volume in the original market. Given the continued absence of significant natural catastrophe events in the United States, the combined ratio for the reinsurance market was once again better than that of the primary market.

The rate increases that have prevailed in the original market since 2011 flagged appreciably over the course of the year under review. In most lines, however, increases of 1% to 2% were still recorded. In some property insurance lines the trend turned negative. This was especially true of large programmes, whereas under small and mid-sized programmes the situation remained relatively stable. Casualty business in the original market continued to see rate increases, albeit at a declining pace. Conditions here for the most part remained unchanged. Sporadic rate increases were observed in Canada on the back of the flood losses in 2013, but overall rates here were flat or softened slightly.

Intense competition was the hallmark of the US property reinsurance market in the year under review. An absence of market-changing major losses coupled with reduced reinsurance cessions on the part of primary insurers led to further rate cuts, sometimes running into double-digit percentages. Only for loss-impacted programmes were modestly positive price adjustments recorded. Some softening in conditions could also be observed, for example in the form of longer hours clauses or poorer reinstatement conditions.

Rates in the US catastrophe XL market came under additional pressure due to the inflow of capital from alternative markets and the sustained decline in prices – a reflection of the favourable loss experience for US hurricanes.

The pressure on rates similarly intensified in US casualty business in the year under review. Under proportional programmes conditions also deteriorated for Reinsurers. This included instances of coverage extensions, more limits of liability or increased cost reimbursements.

Even though no particularly notable loss events occurred in the casualty sector, the greater awareness of cyber-risks – given the topicality of this issue – will trigger stronger demand in this area.

Hannover Re is very well positioned in the North American market and thanks to its excellent rating, its financial standing and its experience the company is a valued partner for its clients. This is especially important in long-tail liability business. Access to the entire market spectrum enables us to optimally diversify our portfolio: we write business in the United States and Canada with some 600 clients.

On the claims side North America experienced a number of smaller natural catastrophe events, which resulted in merely moderate losses for reinsurers. This was particularly the case with the hurricane season, which again passed off thoroughly benignly in the year under review. We incurred a loss from only one event. In addition, Hannover Re booked a major loss of EUR 15.8 million for net account from a fire loss.

Despite the competitive climate and our margin-oriented underwriting policy, the gross premium for our business in North America rose slightly to EUR 1,213.4 million (EUR 1,177.3 million). The combined ratio improved in the year under review to 91.8% (93.1%). The operating profit (EBIT) climbed to EUR 258.2 million (EUR 236.4 million), a performance with which we are highly satisfied.

Continental Europe

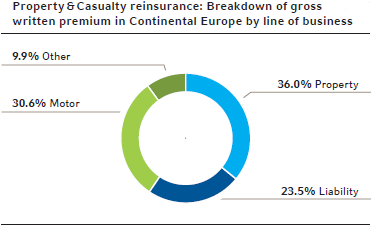

We group together the markets of Northern, Eastern and Central Europe as Continental Europe. The largest single market here is Germany. The premium volume for our business in Continental Europe in the year under review came in at EUR 1,406.1 million (EUR 1,456.9 million). The combined ratio stood at 93.1 % (106.1 %). The operating profit (EBIT) improved to EUR 249.4 million (EUR 40.7 million).

Germany

The German market – the second-largest in the world for property and casualty reinsurance – is served within the Hannover Re Group by our subsidiary E+S Rück. As the “dedicated reinsurer for Germany”, the company is a sought-after partner thanks to its very good rating and the continuity of its business relationships. E+S Rück is superbly positioned in its domestic market and a market leader in property and casualty reinsurance.

The state of property and casualty insurance in Germany revealed a clear dichotomy in the year under review: whereas the premium quality in retail lines improved, especially in motor and homeowners business, industrial lines – above all fire insurance – were fiercely competitive. A further factor is that loss ratios here have been rising steadily since 2010, yet underwriting profits have not been generated market-wide since 2011. Despite slight premium increases in industrial fire business in 2013 and 2014, it remained the case that in the year under review – with a combined ratio well in excess of 100% – the market showed no effects of the efforts made to restore business to profitability. Against this backdrop, we are adhering to a highly selective underwriting approach.

The impact of moves to rehabilitate the motor own damage line was curtailed in the face of heavy losses from storm Ela in June – which also left its mark on homeowners insurance – as well as belatedly reported claims from the storms of the previous year. Yet the line closed in the black for the first time since 2007. Given the increased frequency of extreme weather events in Germany and the associated higher loss expenditure, there is now greater awareness of the resulting risks. Using highly specialised analysis programmes, we assist our customers with the individual exposure mapping of their own damage portfolios and draw on these insights to develop bespoke reinsurance solutions.

Motor liability insurance continued to stabilise in the year under review on the back of tariff increases. Allowing for the run-off from previous years, the combined ratio for the year as a whole is likely to reach a level of 96% market-wide. General liability business in Germany will similarly see the technical income statement close in positive territory.

Once again we made personal accident business a special focus of our attention. In the year under review, for example, we successfully completed development work on our functional disability insurance product for children. Children aged four or older now have access to comprehensive accident and disability coverage encompassing an accident annuity, an annuity for diminished organ function, pension benefits due to the loss of one or more basic skills and pension benefits based on a need for long-term care from care level 1 or higher (LTC annuity). With the aid of the “EsmerIT” underwriting tool that we have developed in-house and make available to our ceding companies free of charge, quick and uncomplicated underwriting can be performed directly at the point of sale.

The loss situation in Germany was once again notable in the year under review for a number of extreme weather events. The largest such loss event was storm Ela in June 2014, which cost the German insurance industry some EUR 650 million.

Rest of Continental Europe

European markets are still intensely competitive; this is true not only of countries in Central and Eastern Europe but also of most mature markets such as France. Along with difficult economic conditions, surplus capacities put the insurance industry under strain; rate reductions and poorer conditions were therefore once again a feature of the French market, especially in the industrial lines. We nevertheless succeeded in maintaining our market share, in part by increasing our shares with selected cedants and also by writing additional business in less competitive lines. Hailstorm Ela caused sizeable losses in France and Belgium as well, both in the property lines and in motor own damage.

Despite a slow economic recovery in Spain and Portugal, the insurance industry is still suffering from a contraction in premium volume. With this in mind, the margins that can be generated are limited.

In Northern European countries the competition was less intense in retail lines than in large industrial programmes, where rates were under pressure. In terms of losses, the region was impacted by another series of extreme weather events in the year under review after experiencing several violent storms in 2013.

Developments in Central and Eastern Europe varied: compared to Western European primary markets, growth rates here are still better than average. Competition therefore remains intense and original rates in most markets are under pressure. On the reinsurance side, however, it was again possible to obtain riskappropriate rates and conditions in the year under review and hence we were able – as forecast – to enlarge our premium volume. On the claims side the region was impacted by numerous small and mid-sized events. In addition, more sizeable losses resulted from an explosion at a refinery in Russia, flooding in Southeast Europe and a hailstorm in Bulgaria.

Specialty lines worldwide

Under specialty lines we include marine and aviation reinsurance, credit and surety reinsurance, business written on the London Market as well as direct business and facultative reinsurance.

The premium volume for specialty lines contracted in the year under review from EUR 2,716.8 million to EUR 2,575.6 million. The combined ratio deteriorated from 93.0% to 100.2%. The operating profit (EBIT) for specialty lines fell to EUR 169.4 million (EUR 339.6 million).

Marine

After years of heavy expenditure on major losses such as the wrecked cruise ship “Costa Concordia” and Superstorm Sandy, which had led to marked rate increases, marine business now finds itself at the onset of a soft market phase. In the case of offshore energy risks, where the last significant major losses date back even further, the rate decline was consequently even more appreciable.

Unlike in other lines, alternative capital – originating for example from hedge funds – does not directly influence the price trend in the marine and offshore energy market. This is because the medium- to long-term nature of many products as well as the fact that loss amounts sometimes takes years to finalise diminish the appeal of this business for investors. To this extent, the additional capacity in the marine market derives from reinsurers who are looking for, among other things, greater diversification effects relative to their other property and casualty lines. Prices came under further pressure because large insurance groups are increasingly purchasing their reinsurance on a centralised basis, as a result of which the total ceded premium volume has contracted.

Surplus capacities were especially prevalent in the hull market in the year under review. Cargo covers, which had long been rather profitable for most ceding companies, proved less attractive in the financial year just ended. Declining profitability was evident in the energy offshore segment: after the low loss burdens and associated good results recorded in recent years, rates here saw marked decreases running into doubledigit percentages.

Hannover Re’s underwriting policy remains unswerving in its focus on selective diversification of the portfolio, both regionally and in terms of individual lines. We continue to take a restrictive approach to writing offshore energy risks in the Gulf of Mexico on account of the considerable potential for natural hazards exposure.

Gross premium for our marine portfolio contracted by 4.1% to EUR 280.6 million (EUR 292.7 million).

The loss situation in the year under review was dominated above all by the removal of the wreck of the “Costa Concordia”, which led to a significantly increased market loss of around EUR 1.5 billion. In view of this, we strengthened our reserves by an additional EUR 23 million to almost EUR 82 million in total. The loss expenditure for the wrecked container vessel “Rena” similarly came in higher than originally estimated.

The underwriting result for our marine business was a clear improvement on the previous year. The combined ratio decreased to 67.2% (78.3%). The operating profit (EBIT) reached a satisfactory level of EUR 85.7 million (EUR 66.0 million).

Aviation

Compared to previous years, the year under review was a very costly one for the international aviation (re)insurance industry. Several hundred people perished in crashes involving two passenger aircraft operated by Malaysia Airlines as well as two other passenger planes in Mali and Indonesia. Not only that, armed clashes in Libya caused considerable damage to Tripoli airport in the reporting period.

The sum total of airline losses far exceeded the corresponding annual premium. Despite this, the ensuing rate increases fell short of expectations owing to both existing and new capacities. Depending on the risk, original business in the airline segment presented a very mixed picture that ranged from stable premiums to significant rate increases. Nor could a single unambiguous trend be discerned in general aviation business, although further rate declines under existing business were largely avoided. Given recent loss events, expectations for price increases were especially high when it came to war covers. While we did observe premium increases in this segment, they did not match up to our expectations.

In terms of our underwriting strategy, we retained a clear focus on non-proportional business; we operate here as one of the market leaders, contrasting with the selective approach that we adopt in our underwriting of proportional business.

The premium volume for our total aviation portfolio contracted sharply to EUR 364.0 million (EUR 401.7 million).

The largest single loss for our company in the year under review – coming in at EUR 63.4 million for net account – was the event in Tripoli. Reflecting these loss expenditures, the underwriting result – after years of robust profitability – posted a marked decline in the year under review. The combined ratio slipped to 112.1% (78.8%). The operating result (EBIT) consequently deteriorated to -EUR 2.4 million (EUR 101.0 million).

Credit, surety and political risks

Hannover Re ranks among the market leaders in worldwide credit and surety reinsurance.

With the global economy showing tepid growth and faced with continued difficult economic conditions, the level of insolvencies remained consistently high. Only in a few countries, including Germany, did numbers come down. Despite this challenging overall situation, a disciplined underwriting policy made it possible to hold claims rates in credit insurance on a good level. This led into a growing risk appetite and hence reduced reinsurance cessions on the primary insurance side. All in all, moderate erosion in reinsurance rates could be observed.

Although the prevalence of mid-sized losses in the surety line was considerably diminished in the year under review compared to 2012 and 2013, the losses recorded in previous years failed to bring about a fundamental improvement in conditions owing to the intensely competitive climate. Under loss-free programmes conditions came under pressure, and a trend towards rising retentions was evident.

Despite greater risk awareness, the claims burden in the area of political risks remained minimal. Prices in this line consequently moved moderately lower.

Having substantially enlarged our credit and surety portfolio in 2009 and 2010, we see no reason – given the current capacity surplus and the associated diminished appeal of treaty conditions – to further expand our market share. We continued to follow through on our strategy of boosting the proportion of the total portfolio deriving from business with political risks.

Total gross premium income contracted by 10.3% in 2014 to EUR 531.4 million (EUR 592.5 million).

Our results in the area of credit, surety and political risks were satisfactory. We did not incur any major losses in 2014 and basic losses were also lower overall. The crisis in Ukraine only gave rise to relatively minor loss events in the year under review. The combined ratio improved to 92.2% (94.5%). The operating profit (EBIT) was boosted to EUR 87.2 million (EUR 64.6 million).

United Kingdom, London market and direct business

Traditional reinsurance

We are largely satisfied with the reinsurance business that we write in the United Kingdom and on the London market. While fierce competition raged in the primary sector with rate reductions running into double-digit percentages, especially in motor insurance, conditions on the reinsurance side were more favourable. In non-proportional motor business it was possible to push through further rate hikes in 2014 – building on appreciable increases in the previous year −, although these levelled off towards year-end. Rates in the other property lines broadly remained stable or slipped slightly lower. As planned, we expanded our portfolio in the United Kingdom.

Direct business

We also write direct business through our subsidiary in the United Kingdom, International Insurance Company of Hannover SE (Inter Hannover). This essentially involves tightly defined portfolios of niche or other non-standard business that complements our principal commercial activity as a reinsurer.

Compared to 2013, the economic climate in the United Kingdom once again failed to show any significant improvement. The brisk competition among insurers and reinsurers writing business in this market continued to intensify. Inevitably, this was reflected in a declining rate level in many lines. Most lines suffered under rate erosion, including not only motor insurance but also private homeowners insurance and commercial covers for small and mid-sized businesses. We responded by further trimming our exposures from agency acceptances in these areas in 2014.

Inter Hannover’s business written in Sweden again performed satisfactorily overall in 2014 despite a number of sizeable losses in the aviation sector. The development of business at the branches in Australia and Canada – markets which are highly competitive – was in line with expectations.

The gross premium booked from the United Kingdom, London market and direct business contracted from EUR 561.2 million to EUR 442.0 million. The combined ratio stood at 110.3% (105.9%). The operating result (EBIT) slipped into negative territory at -EUR 12.8 million (EUR 6.8 million).

Facultative reinsurance

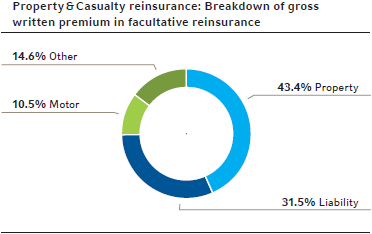

In contrast to obligatory reinsurance, a reinsurer underwrites primarily individual risks in facultative business. The general environment for both types of reinsurance in the various markets is, however, for the most part comparable.

In facultative reinsurance, too, the story was one of excess capacity and hence lively competition. This state of affairs was exacerbated by the fact that many reinsurance customers raised their retentions. Thanks to our very good rating, however, we were frequently able to stand up to this price war because many primary insurers and brokers prefer to cooperate with reinsurers who have proven their long-term reliability.

In the year under review we stepped up our involvement in Latin American markets and in Turkey. Driven also in part by increased acceptances in very new segments such as renewables, our premium volume consequently remained stable overall. Particularly long and solid partnerships proved advantageous in that we were able to preserve a large portion of the portfolio at viable prices.

Rate movements – while generally trending lower – varied from market to market. The spectrum ranged from moderate reductions of 5% to 10% to as much as 50% or more.

Price drops were most marked in property business, as in the case of fire and construction risks, and in the energy lines. Less significant decreases were recorded in liability business and in specialty lines such as personal accident and sports covers.

Despite the soft market, we are broadly satisfied with the development of our total facultative portfolio in the year under review: we grew and continued to diversify our business. Our premium volume increased to EUR 957.6 million (EUR 868.7 million). Virtually no major losses were recorded, but there was an accumulation of mid-sized losses – which also impacted our portfolio. As a result, the combined ratio climbed to 103.9% (94.7%). The operating profit (EBIT) fell well short of the previous year’s figure at EUR 11.8 million (EUR 101.1 million).

Global reinsurance

We combine all markets worldwide under global reinsurance with the exception of our target markets and specialty lines. This segment also encompasses global catastrophe business, the reinsurance of agricultural risks and Sharia-compliant retakaful business.

The premium volume increased in the year under review by 9,8% to EUR 2,708.4 million (EUR 2,466.9 million). This is in line with our forecast of continuous and stable growth. The combined ratio deteriorated slightly from 90.8% to 91.6%. The operating profit (EBIT) improved from EUR 444.3 million to EUR 513.8 million.

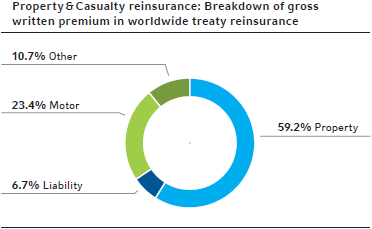

Worldwide treaty reinsurance

We were satisfied with the development of our worldwide treaty reinsurance portfolio. The gross premium volume nudged higher in line with our expectations to reach EUR 1,480.7 million (EUR 1,477.6 million). The combined ratio deteriorated from 95.0% to 98.5%. The operating profit (EBIT) increased to EUR 225.6 million (EUR 217.9 million).

Asia-Pacific region

The Asia-Pacific countries continue to be a growth region for Hannover Re, and with this in mind we further expanded our position in the year under review. Developments in the individual markets varied widely; the region was the scene of increasing competition on account of the available growth opportunities. Although the loss expenditure incurred in certain markets was striking, it can still be assessed as satisfactory overall.

In Japan, a key market for our company, continued market consolidation led to a contraction in ceded reinsurance premiums – a trend which also impacted Hannover Re. Thanks to our broadly diversified product range and our long-standing loyalty to our Japanese cedants, however, we successfully set ourselves apart from our competitors. Conditions came under pressure after the light losses incurred in both 2012 and 2013, but they are still adequate. Our premium volume was down slightly as planned.

Aside from one snowstorm, catastrophe covers – an important area of business for Japan – did not suffer any notable loss events in the year under review. We did, however, set aside an appreciable reserve for a pharmaceutical claim in the casualty line, which had been spared losses for many years. Against this backdrop we were satisfied with the performance of our Japanese portfolio.

The Chinese insurance market again delivered double-digit percentage growth in the year under review. Hannover Re, which is present in the country with a locally licensed branch, was able to successfully pursue the strategy that it had followed in previous years – namely consolidating its business relationships with selected clients. The development of our Chinese portfolio received a boost from discussions surrounding the adoption of a nuanced system of solvency requirements (C-ROSS), which will benefit local reinsurance placements going forward. All in all, the market remained highly competitive, as reflected not only in original business but also in conditions for reinsurance treaties. Our selective underwriting policy nevertheless enabled us to further enlarge the premium volume. Given the absence of sizeable losses, we are satisfied with the result in the year under review.

In South and Southeast Asia we were again able to significantly improve our market penetration. Almost all the primary markets in this region are growing disproportionately strongly compared to the more mature Asian markets. Key drivers here are, above all, the rising insurance density and urbanisation.

Our portfolio in many parts of this region consists predominantly of property, motor and accident business. We further scaled back the proportion of catastrophe-exposed business in the year under review because, in our assessment, the considerable capacity surplus on the reinsurance side had resulted in conditions that were no longer commensurate with the risks.

The service company established in India last year, which concentrates its efforts exclusively on the growing segment of microinsurance, has gained a good footing in the market. This segment already recorded growth in the year under review and will play an even greater role for us going forward.

Despite a number of loss events, we are thoroughly satisfied with the development and performance of our business in South and Southeast Asian markets. The result came under strain from floods in Pakistan and India as well as a cyclone that impacted India, typhoons in the Philippines and a large fire at a semiconductor factory in Thailand. The premium volume from this region once again surged vigorously in the year under review.

Other Asian markets such as Korea, Taiwan and Hong Kong delivered a pleasing result with stable or slightly lower premium income.

Australia and New Zealand looked set to close with a very good result as the year progressed, only for the Greater Brisbane area to be hit by a severe hailstorm in November. With primary insurers carrying higher retentions, however, this event led to a merely moderate strain for our company as a reinsurer. Other than that, the year passed off relatively benignly as far as natural catastrophes were concerned. In common with other market players, we were nevertheless compelled in the year under review to strengthen our IBNR reserve for the New Zealand earthquakes of 2010 and 2011. Based on our good market position, we were able to assert our status as the third-largest property and casualty reinsurer in Australia. Despite this, our premium volume declined slightly in the year under review – a reflection of the ongoing market consolidation, sustained pressure on conditions and our selective underwriting policy.

South Africa

Our business in South Africa is written through our subsidiary Hannover Reinsurance Africa Limited. This market is notable for what is still a relatively low insurance density; most vehicles on public roads, for example, are uninsured. While a large section of the population has not taken out any insurance for property damage or bodily injury, the situation with respect to commercial undertakings is nevertheless comparable with that of industrial nations.

The insurance market only grew in step with inflation in the year under review. Competition remains intense, thereby curtailing profitability. The underwriting result for the insurance market nevertheless closed in marginally positive territory in 2014. A number of major losses occurred in the reporting period, primarily impacting reinsurers – and hence also our subsidiary Hannover Re Africa. Yet the company was still able to generate a modestly positive business result thanks to its disciplined underwriting approach.

We also write direct business in South Africa. These activities are conducted through Compass Insurance Company Limited, a subsidiary for so-called agency business. Although primary insurers were certainly able to push through rate increases for existing business based on a higher level of retained premium, it cannot be assumed that general hardening of the market has set in. What is more, the industry suffered a number of substantial major losses in the year under review. Despite the difficult environment prevailing in the South African market overall, Compass Insurance Company Limited succeeded in delivering a positive result.

Latin America

Hannover Re is well positioned in Latin America and a market leader in some countries. The most important markets for our company are Brazil, where we are present with a representative office, as well as Mexico, Argentina, Colombia and Ecuador.

Most Latin American markets have enjoyed very vigorous growth in recent years and are still showing solid gains. The strong demand for reinsurance covers remains undiminished owing to the considerable exposure to natural catastrophe risks. Nevertheless, premium growth has been somewhat curbed in certain countries due to a number of different factors, including local market regulation, adverse exchange rate effects and higher retentions carried by primary insurers.

Movements in reinsurance rates varied; prices differed regionally from country to country and also by lines. Particularly in property business, larger Latin American markets experienced sometimes marked premium erosion of 10% to 15% under non-proportional treaties and an increase in commissions for proportional covers. We were nevertheless able to act on business opportunities that satisfied our margin requirements. In niche markets where we are market leader there was no decline in prices. In casualty business, where particularly great importance is attached to a reinsurer’s know-how and very good rating, we made the most of growth opportunities in all our markets and stepped up our acceptances.

We succeeded in preserving our market leadership in Argentina despite the restrictions placed on foreign reinsurers. In the English-speaking Caribbean we have been able to enlarge our market share in recent years, while staying firmly focused on the profitability of the business.

The losses and damage caused by natural disasters in the year under review were largely attributable to the earthquake in Chile and hurricane Odile, which swept across Mexico. The resulting strains for the (re)insurance industry were nevertheless moderate. Hannover Re recorded a net loss of EUR 18.8 million from the hurricane.

Overall, we are highly satisfied with the development of our business in Latin America.

Agricultural risks

Lower prices for corn, soya, wheat and other products in the year under review led to reduced sums insured and hence to a moderate premium decline for agricultural risks. Driven by rising demand for food and with extremes of weather becoming increasingly common, we nevertheless continue to see this area as a growth market. Index-linked products are taking on greater importance relative to traditional multi-risk insurance policies.

Rates and conditions remained broadly stable on the primary insurance side. Prices in reinsurance business came under pressure due to new market players; still, the influence of alternative capital on the US market fortunately remained limited.

Hannover Re continues to be one of the largest providers of agricultural covers and also plays an active role in product development. We entered into cooperative ventures with governments and international organisations in the year under review with a view to expanding protection for agricultural risks.

We were successful in our efforts to further diversify the portfolio mix in terms of both countries and lines of business; a contributory factor here, for example, was an enlarged proportion of microinsurance products.

We are satisfied with the development of our agricultural risks business. The losses incurred by Hannover Re were moderate overall: sizeable hail events occurred inter alia in Southeast Europe and the United States. In Turkey much of the apricot and hazelnut crop was destroyed by frost. In each case the resulting strains were in the low single-digit million euros. We did not incur any major losses.

Retakaful business

We write retakaful business, i. e. reinsurance transacted in accordance with Islamic law, both on the Arabian Peninsula and in Southeast Asia. We are present in Bahrain with a dedicated subsidiary for this business and also maintain a branch responsible for writing traditional reinsurance in the Arab world. All in all, we are satisfied with the development of our business.

The member states of the Gulf Cooperation Council (GCC) – namely Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates – posted further robust growth in the year under review. Investments in infrastructure projects are delivering substantial economic stimuli. These major construction projects are reliant primarily on government funding.

Bearing in mind that takaful and retakaful markets have become intensely competitive, brisker premium growth is offset by lower rates. New international providers on the reinsurance markets served to keep up the pressure on rates. On the other hand, the influence of alternative capital (ILS) in the region continues to be negligible.

Hannover Re has been present in Bahrain with its subsidiary since 2006 and is strongly positioned in retakaful business. The largest single market for our company is still Saudi Arabia, where we enjoyed further growth in the year under review. Our branch established in 2014 in Labuan, Malaysia, delivered additional growth impetus. Industrial fire business, where we similarly succeeded in expanding our portfolio, is the largest single line.

In view of the highly competitive state of the markets, we are not currently guided by any specific premium targets but focus instead on preserving the profitability of our portfolio. Nevertheless, we believe that the retakaful market will continue to generate dynamic growth rates going forward.

The largest loss event for our company in the year under review was a fire which caused extensive damage to a large bakery plant in Saudi Arabia.

Catastrophe XL (Cat XL)

We write the bulk of our catastrophe business out of Bermuda, which has established itself as a worldwide centre of competence. In the interest of diversifying the portfolio our subsidiary Hannover Re (Bermuda) Ltd. has also written some of the specialty lines since 2013.

As expected, catastrophe business became even more competitive in the year under review in most markets, and especially in the United States. The principal drivers here were the continued absence of major losses, additional capacities from the capital markets and reduced reinsurance cessions from ceding companies enjoying a healthy level of capitalisation. Overall, rates declined in almost all markets in the financial year just ended, albeit not always as sharply as they did in the United States. In markets where alternative capital is not a factor – such as Latin America – rates also slipped back, but on a more moderate scale. In regions that had been impacted by major losses, such as Europe and Canada, the price level was in large measure maintained in the treaty renewals as at 1 January 2014; indeed, improved rates were actually obtained under some programmes.

As in the previous years, losses were very much on the moderate side for both insurers and reinsurers; there were no major natural disasters resulting in heavy losses. Neither the storms in Europe and Canada nor the earthquake in Chile had any implications for pricing on account of the relatively slight market losses. The largest single loss incurred by our company from natural catastrophe business was the low pressure area known as Ela, which swept across France, Belgium and Germany causing net loss expenditure of EUR 49.1 million. The hurricane season in the United States and the Caribbean also passed off comparatively quietly in the year under review. Only hurricane Gonzalo, which primarily impacted Bermuda, resulted in loss expenditure for Hannover Re’s account.

Bearing in mind the enormous competition over property catastrophe covers, our subsidiary in Bermuda wrote business extremely selectively and reduced its premium volume. On the other hand, we booked growth in the liability and specialty lines, where more adequate prices could be obtained.

The gross premium volume for our global catastrophe business contracted by 16.6% in the year under review to EUR 310.0 million (EUR 371.5 million). The combined ratio improved to 39.3% (49.5%). The operating profit (EBIT) came in at EUR 185.6 million (EUR 188.2 million).

Structured reinsurance and Insurance-linked securities Structured reinsurance

Hannover Re is one of the largest providers in the world of structured reinsurance solutions. These products are designed, among other things, to optimise the cost of capital for our ceding companies.

As forecast, demand for bespoke alternative reinsurance solutions continued to grow in the year under review. This trend also extends to aggregate excess of loss covers, which protect the net retention of our clients against a large number of basic losses in lower layers.

Structured reinsurance is benefiting from growth impetus associated in particular with preparations for the adoption of Solvency II in the European Union as well as with the implementation of risk-based capital requirements in various other countries.

In keeping with our objective we pressed ahead with the enlargement of our customer base and further improved the regional diversification of our portfolio in the year under review. We also stepped up our involvement in the area of corporate captives. Quota share arrangements in motor business designed to provide solvency relief continued to enjoy brisk demand.

The premium volume for the area of Advanced Solutions / structured reinsurance increased in the year under review. Results were good and lived up to our expectations.

Insurance-linked securities (ILS)

Demand on the capital market for ILS products shows no signs of easing. Thus, for example, we were able to renew our “K cession” – a modelled quota share cession consisting of non-proportional reinsurance treaties in the property, catastrophe, aviation and marine (including offshore) lines that we have placed inter alia on the ILS market for 20 years now – on an unchanged level of roughly USD 320 million for 2014.

Yet in addition to using the capital market to protect our own property catastrophe risks, we also transfer risks to it in a structured and packaged form on behalf of our cedants. Not only that, we take the role of investor ourselves by investing in catastrophe bonds.

The year under review, in common with the two previous years, brought another strong inflow of cash into the ILS market. In the first place, investors value the low correlation with other financial assets and the associated diversification, while at the same time they also find the market for insurance risks relatively appealing in comparison with other investments. As a result, there has been no let-up in the lively demand for catastrophe bonds among investors. Prices for these bonds have consequently fallen considerably. At the same time, though, the issuance of catastrophe bonds has become a more attractive proposition. The volume of new issues in the market was once again higher at USD 8.7 billion (USD 7.7 billion).

The available funds currently exceed by far the opportunities for new investments in catastrophe bonds. This has prompted investors to look for other means of investing in the reinsurance sector. So-called collateralised reinsurance programmes again enjoyed particularly strong growth in the year under review and surpassed the volume of funds invested in catastrophe bonds. Under collateralised reinsurance business the investor assumes reinsurance risks that are normally collateralised in the amount of the limit of liability.

Hannover Re’s product range encompasses the entire spectrum of activities typically associated with the ILS market. We thereby offer investors optimised and customised access to the capital market. In the year under review, for example, we successfully transferred windstorm risks with a volume of USD 400 million to the capital market for the Texas Windstorm Insurance Association (TWIA) in the form of a catastrophe bond.

In the year under review we continued to expand our cooperation with selected managers of investor funds in the area of collateralised reinsurance business and thereby generated attractive margins. When it comes to investing in catastrophe bonds, on the other hand, we showed restraint on account of the sharp decline in prices.

More Information

Topic related links within the report:

Topic related links outside the report:

- Hannover Re issues additional hybrid capital

- Non-Life Reinsurance

- Major Losses External Quicklink PageID nicht vergeben: 300