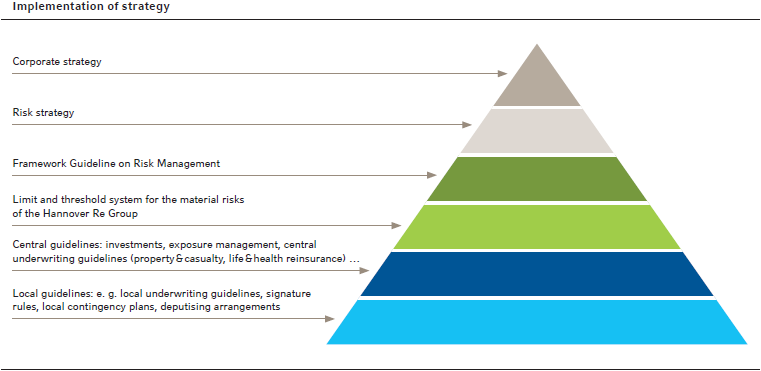

Strategy implementation

In the course of the last financial year we revised our corporate strategy. It encompasses ten fundamental strategic principles which safeguard the realisation of our vision “Long-term success in a competitive business” across the various divisions. For further information on the corporate strategy and the strategic principles in detail please see the section entitled “Our strategy”. The following principles of the corporate strategy constitute the key strategic points of departure for our Group-wide risk management:

- We manage risks actively.

- We maintain an adequate level of capitalisation.

- We are committed to sustainability, integrity and compliance.

The risk strategy is derived from our corporate strategy. It forms the core element in our handling of opportunities and risks. The risk strategy specifies more closely the goals of risk management and documents our understanding of risk. We have defined ten overriding principles within our risk strategy:

- We adhere to the risk appetite set by the Executive Board.

- We integrate risk management into value-based management.

- We promote an open risk culture and the transparency of our risk management system.

- We strive for the highest ERM rating and the approval of our internal model.

- We determine a materiality threshold for our risks.

- We make use of appropriate quantitative methods.

- We apply well-suited qualitative methods.

- We allocate our capital risk-based.

- We ensure the necessary separation of functions through our organisational structure.

- We assess the risk contribution from new business areas and new products.

The risk strategy is similarly specified with an increasing degree of detail on the various levels of the company.

The risk strategy and the major guidelines derived from it, such as the Framework Guideline on Risk Management and the central system of limits and thresholds, are reviewed at least once a year. In this way we ensure that our risk management system is kept up-to-date.

We manage our total enterprise risk such that we can expect to generate positive Group net income with a probability of 90 % p. a. and the likelihood of the complete loss of our economic capital and shareholders’ equity does not exceed 0,03 % p. a.These indicators are monitored using our internal capital model and the Executive Board is informed quarterly about adherence to these key parameters as part of regular reporting. The necessary equity resources are determined according to the requirements of our economic capital model, solvency regulations, the expectations of rating agencies with respect to our target rating and the expectations of our clients. Above and beyond that, we maintain a capital cushion in order to be able to act on new business opportunities at any time.

| Strategic targets for the risk position | ||

| Limit | 2014 | |

|---|---|---|

| Probability of positive Group net income | > 90% | 95.4% |

| Probability of complete loss of shareholders’ equity | < 0.03% | 0.01% |

| Probability of complete loss of economic capital | < 0.03% | < 0.01% |

More Information

Topic related links within the report:

Topic related links outside the report: