Analysis of the capital structure

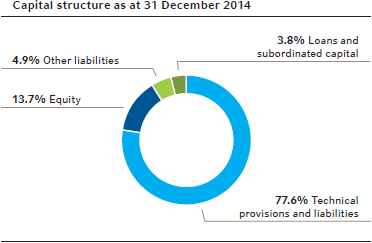

The capital structure and the composition of the liabilities of Hannover Re are shaped by our activity as a reinsurer. By far the largest share is attributable to technical provisions and liabilities. Further elements are equity and equity substitutes, which help to substantially strengthen our financial base and optimise our cost of capital. The following chart shows our capital structure as at 31 December 2014, split into equity, loans and subordinated capital, technical provisions and other liabilities, in each case as a percentage of the balance sheet total.

The technical provisions and liabilities shown above, which include funds withheld / contract deposits and reinsurance payable, make up 77.6% (78.4%) of the balance sheet total and are more than covered by our investments, (assets-side) funds withheld / contract deposits, accounts receivable and reinsurance recoverables.

The equity including non-controlling interests at 13.7% (12.1%) of the balance sheet total as well as the loans and – especially – subordinated capital at altogether 3.8% (4.6%) of the balance sheet total represent our most important sources of funds.

We ensure that our business is sufficiently capitalised at all times through continuous monitoring and by taking appropriate steering actions as necessary. For further information please see the following section “Management of policyholders’ surplus”.

More Information

Topic related links within the report: